Www Irs Govpubirs Pdf2021 Form 5695 Internal Revenue Service 2021

What is the IRS Form 5695?

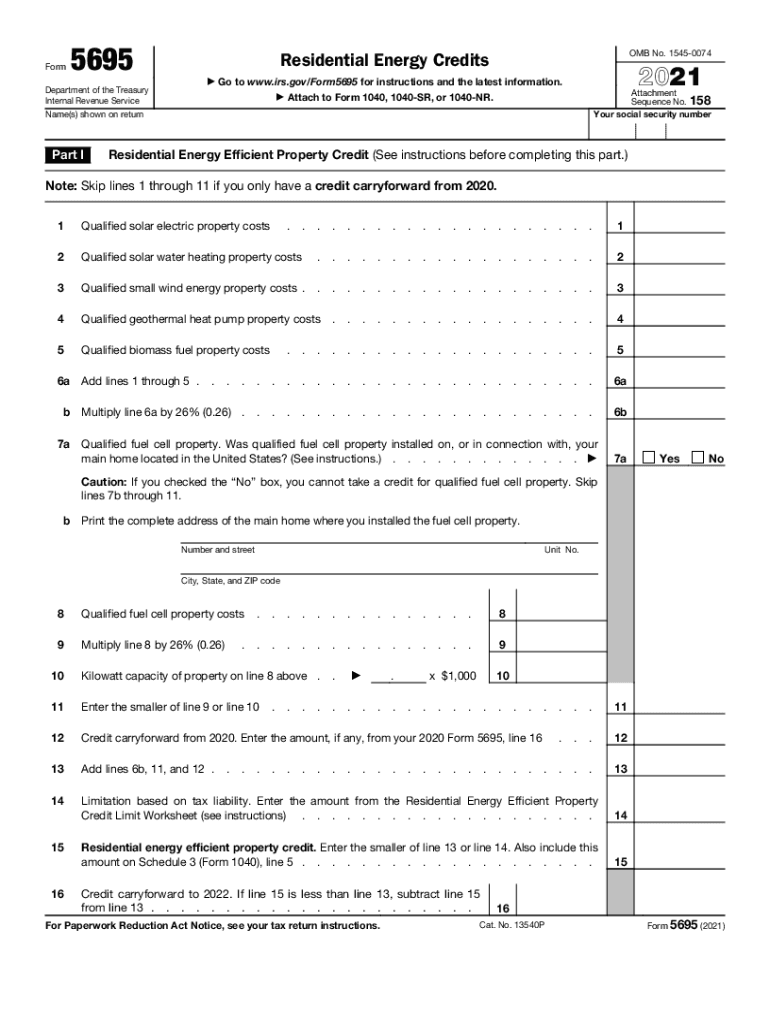

The IRS Form 5695 is a tax form used by individuals to claim residential energy credits. This form allows taxpayers to report the costs associated with energy-efficient improvements made to their homes. The credits can help reduce tax liability, making it an essential document for homeowners who have invested in energy-saving installations. Understanding the purpose and requirements of Form 5695 is crucial for maximizing potential tax benefits.

Steps to Complete the IRS Form 5695

Completing the IRS Form 5695 involves several steps to ensure accuracy and compliance. Begin by gathering necessary documentation, such as receipts for energy-efficient improvements. Next, fill out the form by providing personal information and detailing the qualifying expenses. It's important to follow the instructions carefully to avoid errors that could delay processing. Once completed, review the form for accuracy before submitting it with your tax return.

Eligibility Criteria for IRS Form 5695

To be eligible for the credits claimed on IRS Form 5695, taxpayers must meet specific criteria. The improvements must be made to a primary residence located in the United States. Additionally, the upgrades must meet certain energy efficiency standards set by the IRS. Homeowners should verify that their improvements qualify under the current tax year guidelines to ensure they can claim the credits successfully.

Legal Use of IRS Form 5695

The legal use of IRS Form 5695 requires adherence to federal tax regulations. The form must be completed accurately and submitted in accordance with IRS guidelines. Misrepresentation or errors can lead to penalties or disqualification from receiving credits. Utilizing a reliable eSignature platform can enhance the legal validity of the form, ensuring that all signatures and submissions comply with electronic signature laws.

Filing Deadlines for IRS Form 5695

Filing deadlines for IRS Form 5695 align with the standard tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following tax year. If additional time is needed, taxpayers may file for an extension, but it's important to ensure that Form 5695 is included in the final submission to avoid missing out on potential credits.

Form Submission Methods for IRS Form 5695

IRS Form 5695 can be submitted through various methods, including online filing, mail, or in-person submission. Many taxpayers choose to file electronically using tax software, which simplifies the process and reduces the risk of errors. For those who prefer traditional methods, mailing the completed form to the appropriate IRS address is also an option. It's essential to keep a copy of the submitted form for personal records.

Key Elements of IRS Form 5695

Key elements of IRS Form 5695 include sections that detail the type of energy improvements made, associated costs, and the calculation of credits. The form requires taxpayers to provide specific information about their home and the energy-efficient upgrades. Understanding these elements is vital for accurately completing the form and maximizing potential tax benefits.

Quick guide on how to complete wwwirsgovpubirs pdf2021 form 5695 internal revenue service

Complete Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service effortlessly on any device

Digital document management has become a favored choice for businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly and without hassle. Handle Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based task today.

The best approach to adjust and eSign Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service effortlessly

- Obtain Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 form 5695 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 form 5695 internal revenue service

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how can it help with IRS documentation?

airSlate SignNow is a comprehensive eSignature solution that allows businesses to send and eSign documents effortlessly. It streamlines the process of managing IRS documents, ensuring compliance and reducing the time spent on paperwork. By using airSlate SignNow, you can easily capture signatures for tax-related filings, making your interactions with the IRS more efficient.

-

How does airSlate SignNow handle IRS forms securely?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive IRS forms. The platform employs advanced encryption methods to protect your data and ensure that all documents remain confidential. With airtight security protocols, you can confidently manage and submit your IRS documentation without worry.

-

What features does airSlate SignNow offer for IRS form management?

airSlate SignNow offers several features tailored for effective IRS form management, including customizable templates and bulk sending options. Automated reminders and status tracking help you stay on top of deadlines for IRS submissions. These features increase your productivity while minimizing errors and delays with IRS paperwork.

-

Is airSlate SignNow cost-effective for small businesses dealing with IRS tasks?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage IRS tasks. With flexible pricing plans, you can choose an option that fits your budget while gaining access to essential eSigning features. This affordability ensures that managing IRS documents doesn’t become a financial burden for your business.

-

Can I integrate airSlate SignNow with accounting software for IRS reporting?

Absolutely! airSlate SignNow easily integrates with various accounting software solutions, enhancing your ability to manage IRS reporting. These integrations allow for seamless workflows where you can send, sign, and store IRS-related documents directly from your accounting platform. This ensures that your documentation processes are streamlined and organized.

-

How can airSlate SignNow improve the efficiency of IRS filings?

Using airSlate SignNow improves the efficiency of IRS filings by automating manual processes and reducing the turnaround time for document signing. With real-time tracking and notifications, you can manage the entire lifecycle of your IRS forms from anywhere. This efficiency not only speeds up your submissions but also helps avoid potential penalties for late filings.

-

What support does airSlate SignNow provide for IRS-related inquiries?

airSlate SignNow offers comprehensive customer support for IRS-related inquiries, ensuring that users have access to assistance when needed. Whether it’s through live chat, email, or phone support, the team is ready to help you navigate any challenges associated with IRS documentation. This dedicated support fosters a smoother experience when dealing with tax obligations.

Get more for Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service

- Warranty deed from individual to husband and wife florida form

- Enhanced life estate deed florida form

- Quitclaim deed from corporation to husband and wife florida form

- Warranty deed grantor 497302666 form

- Enhanced life estate or lady bird deed husband and wife to two individuals florida form

- Marital trust form

- Quitclaim deed from corporation to individual florida form

- Warranty form

Find out other Www irs govpubirs pdf2021 Form 5695 Internal Revenue Service

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy