Test Scenario 1 Includes the Following Forms Schedule EIC 2021

Understanding IRS Form 8812

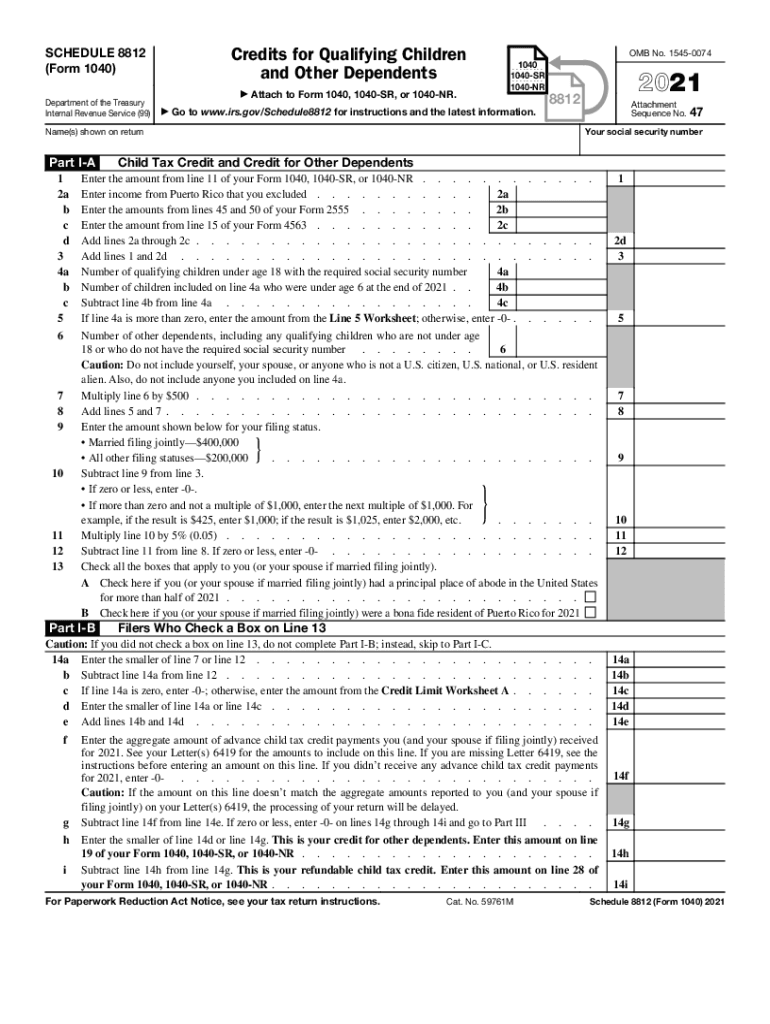

IRS Form 8812, also known as the Schedule 8812, is used to calculate the Additional Child Tax Credit (ACTC). This form allows eligible taxpayers to claim a refundable credit for qualifying children under the age of 17. The ACTC is particularly beneficial for those who may not have enough tax liability to claim the full Child Tax Credit. Understanding how to fill out this form accurately is essential for maximizing your tax benefits.

Eligibility Criteria for Form 8812

To qualify for the Additional Child Tax Credit, certain criteria must be met:

- The taxpayer must have at least one qualifying child under the age of 17.

- The child must be a dependent and meet specific residency requirements.

- The taxpayer must have earned income above a certain threshold.

- Taxpayers must file a tax return to claim the credit, even if they do not owe any tax.

Reviewing these eligibility requirements ensures that you can benefit from the credits available to you.

Steps to Complete IRS Form 8812

Completing Form 8812 involves several steps that require careful attention:

- Gather necessary documents, including your tax return and information about your qualifying children.

- Complete the main sections of the form, including details about your qualifying children and your income.

- Calculate the amount of the Additional Child Tax Credit based on the instructions provided.

- Transfer the calculated credit to your tax return.

Following these steps helps ensure that you accurately complete the form and claim the credits you are entitled to.

IRS Guidelines for Form 8812

The IRS provides specific guidelines for completing Form 8812. These guidelines include:

- Instructions on how to determine if a child qualifies for the credit.

- Income thresholds that affect the amount of credit you can claim.

- Information on how to handle multiple qualifying children.

Familiarizing yourself with these guidelines can prevent errors and ensure compliance with IRS regulations.

Filing Deadlines for Form 8812

Form 8812 must be filed along with your annual tax return. The typical deadline for filing your tax return is April 15. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods

You can submit Form 8812 in several ways:

- Electronically through tax preparation software that supports e-filing.

- By mail, sending the completed form along with your tax return to the appropriate IRS address.

- In-person at designated IRS locations, although this option may be less common.

Choosing the right submission method can streamline your filing process and ensure timely processing by the IRS.

Quick guide on how to complete test scenario 1 includes the following forms schedule eic

Effortlessly prepare Test Scenario 1 Includes The Following Forms Schedule EIC on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Test Scenario 1 Includes The Following Forms Schedule EIC on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

The easiest way to modify and eSign Test Scenario 1 Includes The Following Forms Schedule EIC with ease

- Find Test Scenario 1 Includes The Following Forms Schedule EIC and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers for this specific need.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries over lost or misplaced documents, lengthy form searches, or errors necessitating new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any chosen device. Modify and eSign Test Scenario 1 Includes The Following Forms Schedule EIC to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct test scenario 1 includes the following forms schedule eic

Create this form in 5 minutes!

How to create an eSignature for the test scenario 1 includes the following forms schedule eic

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is Form 8812 and how is it used?

Form 8812, also known as the Additional Child Tax Credit, is a tax form used to calculate additional credits for qualifying individuals. It's particularly useful for families who didn't receive the full Child Tax Credit amount. With airSlate SignNow, you can easily eSign and manage your Form 8812 electronically, streamlining the preparation process and ensuring timely submissions.

-

What features does airSlate SignNow offer for Form 8812?

airSlate SignNow provides features such as document templates, real-time collaboration, and automated workflows for Form 8812. These tools help users efficiently fill out, eSign, and manage their Form 8812 without the need for physical paperwork. Our user-friendly interface simplifies the process, making tax preparation less stressful.

-

How does airSlate SignNow ensure the security of Form 8812?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure access controls to protect your Form 8812 and other sensitive documents. Additionally, every eSignature is legally binding and can be tracked for audit purposes, providing peace of mind.

-

What are the pricing options for airSlate SignNow when using Form 8812?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of individuals and businesses. Whether you're a freelancer needing occasional access to Form 8812 or a large organization requiring bulk document management, our pricing options cater to various budgets, ensuring affordability and value.

-

Can I integrate airSlate SignNow with other software for handling Form 8812?

Yes, airSlate SignNow supports various integrations with popular software like Google Drive, Dropbox, and CRM systems. This compatibility allows users to seamlessly import and export Form 8812 documents, enhancing efficiency and collaboration across your existing tools.

-

How can airSlate SignNow help me complete Form 8812 quickly?

With user-friendly templates and guided workflows, airSlate SignNow simplifies the process of completing Form 8812 quickly and accurately. You can pre-fill information, save preferences, and easily access previous submissions, which cuts down on the time spent on tax preparation.

-

Is it easy to share Form 8812 with others using airSlate SignNow?

Absolutely! airSlate SignNow makes it easy to share your Form 8812 with collaborators or tax professionals. You can send requests for signatures or edits via email, ensuring that everyone involved can contribute and finalize the document efficiently.

Get more for Test Scenario 1 Includes The Following Forms Schedule EIC

- Delaware limited liability form

- Living trust for husband and wife with no children delaware form

- Living trust for individual who is single divorced or widow or widower with no children delaware form

- Living trust for individual who is single divorced or widow or widower with children delaware form

- Living trust for husband and wife with one child delaware form

- Living trust for husband and wife with minor and or adult children delaware form

- Amendment to living trust delaware form

- Living trust property record delaware form

Find out other Test Scenario 1 Includes The Following Forms Schedule EIC

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form