Www Irs Govpubirs Pdf2020 Instructions for Form 1120 PC Internal Revenue Service 2021

IRS Guidelines for Form 1120 PC

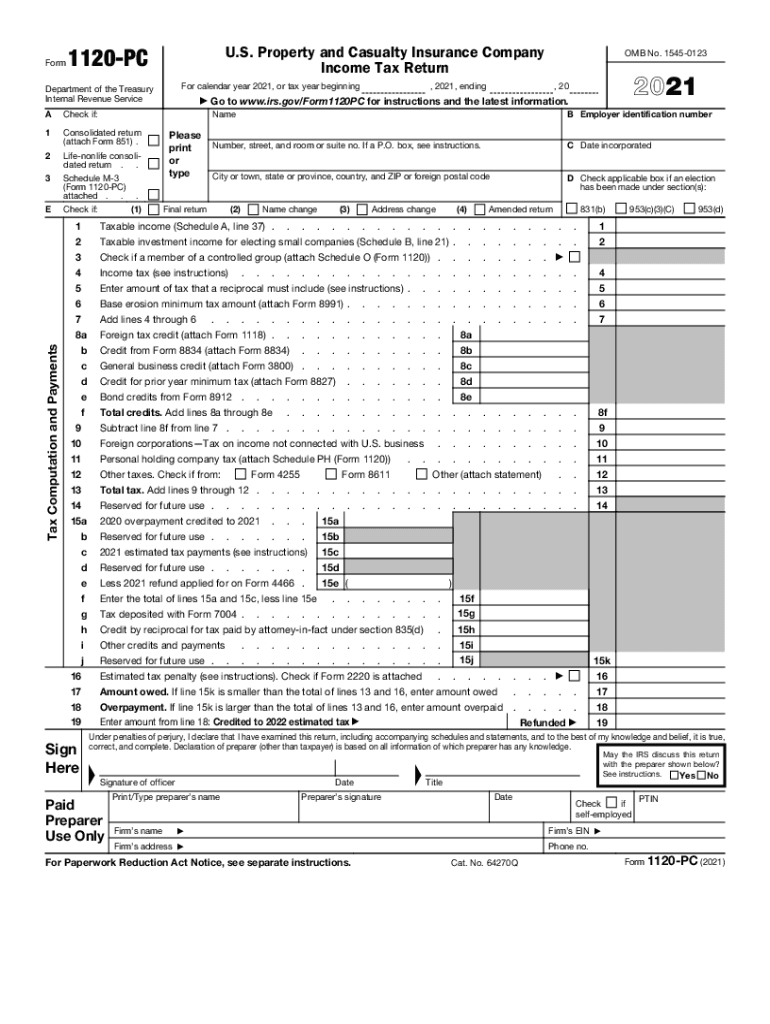

The IRS provides specific guidelines for completing Form 1120 PC, which is essential for businesses seeking to claim a property tax refund in Minnesota. These guidelines ensure that all necessary information is accurately reported, which is crucial for the approval of your refund request. Familiarizing yourself with these guidelines can help streamline the filing process and enhance your chances of receiving your refund in a timely manner.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the mn property tax refund for 2020. Typically, the deadline for submitting Form 1120 PC is aligned with the tax year’s filing deadline, which is usually April 15 of the following year. However, if you are filing for a refund, ensure that you check for any specific state extensions or changes that may apply, as these can vary from year to year.

Required Documents for Filing

When preparing to file Form 1120 PC for a property tax refund, certain documents are necessary to support your claim. This includes proof of property ownership, previous tax statements, and any relevant receipts that demonstrate your eligibility for the refund. Having these documents organized and ready will facilitate the filing process and help avoid delays in processing your refund.

Eligibility Criteria for the Refund

To qualify for the mn property tax refund for 2020, applicants must meet specific eligibility criteria set forth by the state. Generally, these criteria include factors such as income level, property type, and residency status. Understanding these requirements can help you determine whether you are eligible for a refund and guide you in completing the necessary forms accurately.

Application Process & Approval Time

The application process for the mn property tax refund involves submitting Form 1120 PC along with all required documentation. Once submitted, the approval time can vary based on factors such as the completeness of your application and the volume of claims being processed by the state. Typically, applicants can expect to receive a response within a few weeks to several months, depending on these variables.

Form Submission Methods

Form 1120 PC can be submitted through various methods, including online filing, mail, or in-person submission at designated state offices. Each method has its advantages, such as the convenience of online filing or the personal touch of in-person submission. It is important to choose the method that best suits your needs and ensures that your application is received in a timely manner.

Digital vs. Paper Version of the Form

Choosing between a digital or paper version of Form 1120 PC can impact your filing experience. The digital version allows for easier completion and submission, often with built-in checks for errors. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the choice, ensure that the form is filled out completely and accurately to avoid any processing delays.

Quick guide on how to complete wwwirsgovpubirs pdf2020 instructions for form 1120 pc internal revenue service

Complete Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files swiftly without delays. Manage Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service with ease

- Obtain Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2020 instructions for form 1120 pc internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2020 instructions for form 1120 pc internal revenue service

How to create an e-signature for your PDF online

How to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What is the mn property tax refund 2020 and how does it work?

The mn property tax refund 2020 is a program that allows eligible homeowners in Minnesota to receive a refund on their property taxes. This program is designed to ease the financial burden of property taxes by providing a refund based on the homeowner's income and property taxes paid. To apply, homeowners must complete the appropriate forms and may need to submit documentation of their income and tax payments.

-

How can I apply for the mn property tax refund 2020?

To apply for the mn property tax refund 2020, you must fill out the Minnesota Property Tax Refund Form. This form can be submitted online or via mail. Ensure you have your property tax statement and income documents ready to expedite the process, as these will be essential for the application.

-

What are the eligibility requirements for the mn property tax refund 2020?

Eligibility for the mn property tax refund 2020 primarily depends on your income, your property taxes paid, and your housing costs. Homeowners and renters may qualify, but exact requirements can vary. It’s important to check the Minnesota Department of Revenue’s guidelines to see if you meet the criteria for this program.

-

What is the deadline for applying for the mn property tax refund 2020?

The deadline for applying for the mn property tax refund 2020 typically falls on August 15th of the year following the tax year in question. For the 2020 refund, applications must be submitted by August 15, 2021. Make sure to submit on time to ensure you receive your refund.

-

How much can I expect to receive from the mn property tax refund 2020?

The amount you can receive from the mn property tax refund 2020 varies based on your household income and the amount of property taxes paid. Generally, refunds can range from a modest sum to several thousand dollars, depending on these factors. A thorough calculation using the provided form will give you a clearer estimate.

-

Can I track the status of my mn property tax refund 2020 application?

Yes, you can track the status of your mn property tax refund 2020 application through the Minnesota Department of Revenue's website. There, you can find updates on the processing of your refund. It's important to have your application details ready to check your status accurately.

-

Is the mn property tax refund 2020 considered taxable income?

The mn property tax refund 2020 is generally not considered taxable income on your federal tax return. However, this can depend on your specific financial situation and tax circumstances. Consultation with a tax professional is recommended to clarify any individual tax implications regarding the refund.

Get more for Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service

- Electrical contract for contractor florida form

- Florida contractor pdf 497302623 form

- Flooring contract for contractor florida form

- Florida deed form

- Notice of intent to enforce forfeiture provisions of contact for deed florida form

- Final notice of forfeiture and request to vacate property under contract for deed florida form

- Buyers request for accounting from seller under contract for deed florida form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed florida form

Find out other Www irs govpubirs pdf2020 Instructions For Form 1120 PC Internal Revenue Service

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement