SCHEDULE J Form 990 Department of the Treasury Internal 2021

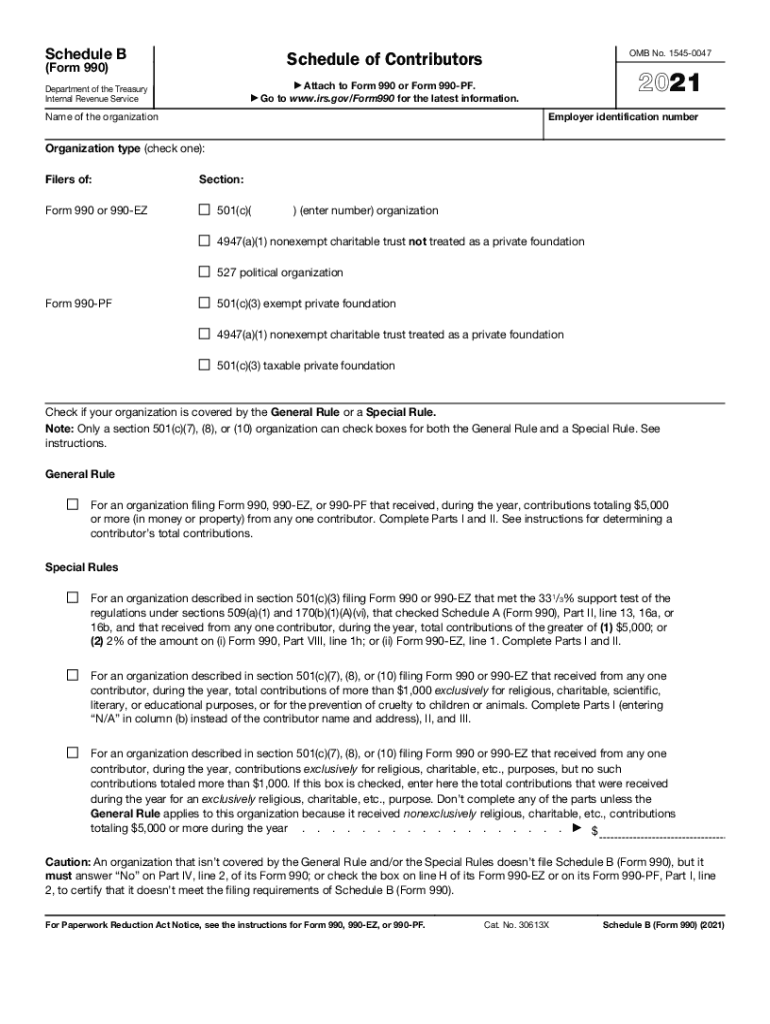

Understanding the 2021 Form Schedule B

The 2021 Form Schedule B is a critical document used by organizations to report certain types of contributions and grants. This form is part of the IRS Form 990 series, which non-profit organizations must file annually. Schedule B specifically details the sources of significant contributions, ensuring transparency and compliance with federal regulations. Organizations must accurately complete this form to maintain their tax-exempt status and provide the IRS with necessary financial information.

Steps to Complete the 2021 Form Schedule B

Completing the 2021 Form Schedule B involves several key steps:

- Gather necessary information about contributions received during the tax year.

- Identify and list all donors who contributed over a specified threshold, typically $5,000.

- Provide details about each donor, including their name, address, and the amount contributed.

- Ensure all entries are accurate and complete, as errors can lead to compliance issues.

- Review the form for any additional requirements specific to your organization type.

IRS Guidelines for Schedule B

The IRS has established specific guidelines for completing Schedule B. Organizations must adhere to these guidelines to ensure compliance. Key aspects include:

- Identifying all contributions that meet the reporting threshold.

- Providing complete and accurate donor information.

- Understanding the implications of not reporting certain contributions, which can affect tax-exempt status.

Filing Deadlines for Schedule B

Organizations must file the 2021 Form Schedule B along with their Form 990 by the due date of the return. Typically, this deadline is the fifteenth day of the fifth month after the end of the organization's fiscal year. For most organizations operating on a calendar year, the deadline would be May 15. It is crucial to file on time to avoid penalties and maintain compliance with IRS regulations.

Penalties for Non-Compliance with Schedule B

Failure to comply with the filing requirements for the 2021 Form Schedule B can result in significant penalties. Organizations may face fines for late submissions or inaccuracies in reporting. Additionally, non-compliance can lead to increased scrutiny from the IRS, which may affect the organization’s tax-exempt status. It is essential for organizations to ensure all forms are completed accurately and submitted on time.

Digital vs. Paper Version of Schedule B

Organizations have the option to file the 2021 Form Schedule B either digitally or via paper submission. Filing electronically is often recommended as it can streamline the process and reduce the risk of errors. Digital submissions are typically processed faster, allowing organizations to receive confirmation of filing more quickly. However, some organizations may prefer paper forms for record-keeping purposes. Regardless of the method chosen, ensuring accuracy in the information reported remains paramount.

Quick guide on how to complete schedule j form 990 department of the treasury internal

Effortlessly Prepare SCHEDULE J Form 990 Department Of The Treasury Internal on Any Device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any delays. Manage SCHEDULE J Form 990 Department Of The Treasury Internal on any platform using the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

The Easiest Way to Edit and eSign SCHEDULE J Form 990 Department Of The Treasury Internal with Ease

- Locate SCHEDULE J Form 990 Department Of The Treasury Internal and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to submit your form: by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign SCHEDULE J Form 990 Department Of The Treasury Internal to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule j form 990 department of the treasury internal

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 990 department of the treasury internal

How to create an e-signature for your PDF file in the online mode

How to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

What is the 2021 form schedule b and why do I need it?

The 2021 form schedule b is a crucial tax document that reports interest and dividend income from your investments. If you have earned more than a certain amount, you must include this form when filing your taxes. Using airSlate SignNow makes it easy to sign and submit this form securely online.

-

How can airSlate SignNow help me with the 2021 form schedule b?

AirSlate SignNow offers an efficient way to eSign your 2021 form schedule b, ensuring that your documents are completed quickly and securely. Our platform simplifies the process of preparing and submitting tax documents, making it easier to stay compliant. You can also streamline the approval process within your organization.

-

Is there a cost associated with using airSlate SignNow for the 2021 form schedule b?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that works for you, whether you're a freelancer needing to submit the 2021 form schedule b or a larger organization requiring multiple user access. Pricing is designed to be cost-effective for every budget.

-

What features does airSlate SignNow provide for document signing?

AirSlate SignNow provides features such as secure eSigning, document templates, and real-time tracking for your documents, including the 2021 form schedule b. The user-friendly interface allows you to easily prepare various documents and obtain signatures in just a few clicks. This streamlines the process, saving you time and effort.

-

Can airSlate SignNow integrate with other software for handling the 2021 form schedule b?

Absolutely! AirSlate SignNow integrates seamlessly with numerous applications, including CRMs and document management systems, which can help manage your 2021 form schedule b more efficiently. This integration allows you to automate workflows and ensures your data is always organized and easily accessible.

-

What are the benefits of using airSlate SignNow for tax documents like the 2021 form schedule b?

Using airSlate SignNow for tax documents like the 2021 form schedule b can greatly enhance your productivity. With electronic signatures, you no longer need to print, sign, and scan documents manually. Additionally, you can track the status of your documents, ensuring timely submission and minimizing errors.

-

Is airSlate SignNow secure for signing the 2021 form schedule b?

Yes, airSlate SignNow prioritizes security and compliance, particularly for sensitive documents like the 2021 form schedule b. Our platform uses advanced encryption and authentication processes to protect your data during the entire signing process. You can trust us to keep your information safe and confidential.

Get more for SCHEDULE J Form 990 Department Of The Treasury Internal

Find out other SCHEDULE J Form 990 Department Of The Treasury Internal

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter