Ssa Form Ssa 44 for 2014-2026

What makes the form ssa 7163 03 2014 social security segurosocial legal?

Completing all the fields in a sample isn't enough to have a legally-binding paper. There are still a couple of additional requirements that need to be achieved for the form ssa 7163 03 2014 social security segurosocial to be recognized as legally-binding.

Before you start completing blank spaces, double-check if you have an up-to-date form. Obsolete documents won't work with independent government agencies or departments.

Give accurate details. Filing fake information only leads to your form becoming invalid (at best) or even a criminal case (at worst).

Make use of an identifiable signature. Advanced solutions like airSlate SignNow make it easier to create legally-binding electronic signatures. For important records, simple placing a photograph of your autograph is considered the same as a doodle on a piece of paper.

Follow the three simple recommendations mentioned and you'll save money and time typically wasted on unnecessary document administration.

How to protect your form ssa 7163 03 2014 social security segurosocial when completing it online

There’s no magic pill to get protected from each and every possible danger, but you can combine a couple of techniques and considerably improve your security. Check out the tips below to learn to protect your form ssa 7163 03 2014 social security segurosocial info while dealing with web solutions:

- Look at the platform's encryption. Probably, it's difficult for you to evaluate all the encryption features by yourself. Nevertheless, nearly all the services that store your data in ciphered sort tell you about it.

- Learn more about compliance. The service's compliance with global data security requirements makes certain that you can rely on it.

- Make use of a reputable platform. Benefit from airSlate SignNow – a reliable solution for creating eSignatures. Economic and healthcare agencies around the world already use our platform.

- Stay aware. Follow general cybersecurity guidelines. The safety of your data starts with you.

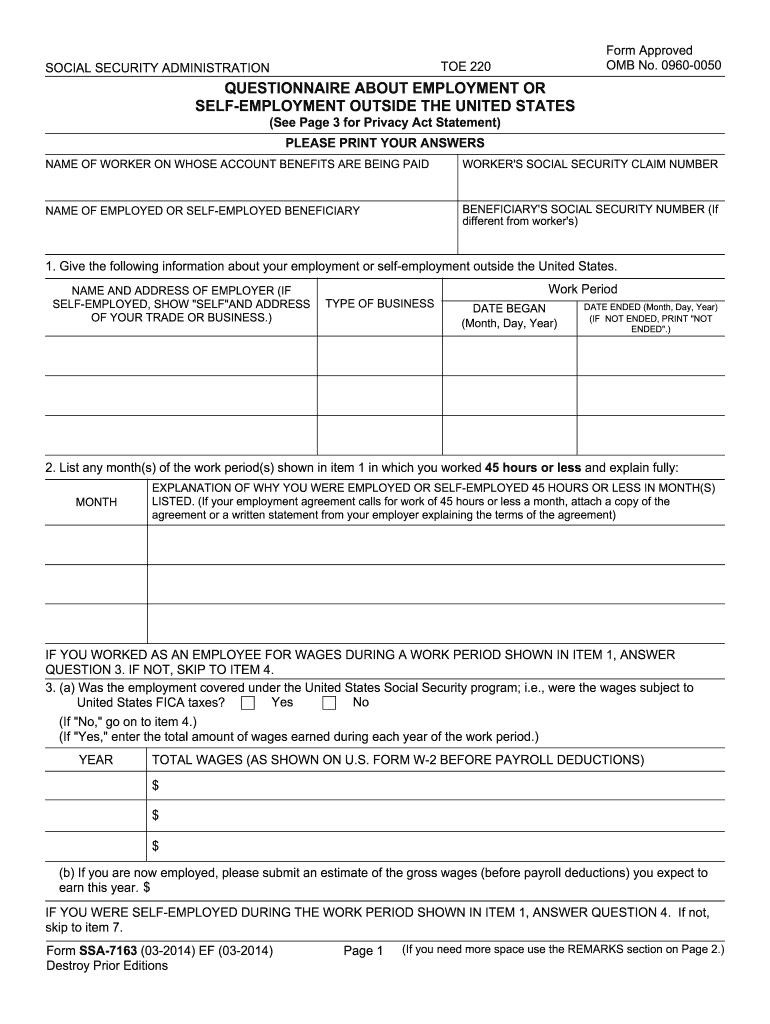

Quick guide on how to complete form ssa 7163 03 2014 social security segurosocial

A simple guide on how to prepare Ssa Form Ssa 44 For

Submitting digital documents has shown to be more effective and reliable than conventional pen-and-paper approaches. Unlike manually writing on paper, correcting a typo or entering information in the wrong place is straightforward. Such errors can be a signNow disadvantage when you prepare applications and requests. Consider utilizing airSlate SignNow for completing your Ssa Form Ssa 44 For. Our robust, intuitive, and compliant eSignature solution will streamline this procedure for you.

Follow our instructions on how to quickly complete and sign your Ssa Form Ssa 44 For with airSlate SignNow:

- Confirm the purpose of your chosen document to ensure it meets your needs, and click Get Form if it is acceptable.

- Find your template uploaded to our editor and explore what our tool provides for form customization.

- Populate blank fields with your information and select options using Check or Cross marks.

- Incorporate Text boxes, replace existing content, and insert Images as needed.

- Utilize the Highlight feature to underscore what you want to focus on, and conceal irrelevant information for your recipient using the Blackout option.

- On the right-side panel, create additional fillable fields designated for specific parties if necessary.

- Secure your document with watermarks or establish a password once you complete the editing.

- Insert Date, click Sign → Add signature and choose your signing preference.

- Draw, type, upload, or generate your legally binding eSignature using a QR code or the camera on your device.

- Review your responses and click Done to conclude editing and proceed with document sharing.

Utilize airSlate SignNow to complete your Ssa Form Ssa 44 For and work on other professional fillable templates securely and efficiently. Sign up today!

Create this form in 5 minutes or less

Find and fill out the correct form ssa 7163 03 2014 social security segurosocial

FAQs

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

I am retired and living in the Czech Republic. My social security check is transferred to a local bank. They asked me to fill out a form W-9. I am not working, not having business or any kind of additional income. Do l need to file it?

Under FATCA, the Czech government has signed a treaty with the U.S. government where they agree to have financial institutions document whether or not U.S. citizens are account holders (and therefore, they pretty much have to document all account holders). So, if you do not fill out the W-9, the bank will have to close your account as you will not have provided sufficient evidence to document whether or not you are a U.S. citizen. Countries have been signing the treaties and starting to implement over the last couple of years - portions of the Czech treaty become effective in 2014.

-

Is it legal for doctors offices to charge special fees for filling out residual function forms and other questionnaires specifically used by lawyers and judges to determine a Social Security disability action?

I’m answering as though to a lawyer.Doctors are private professionals governed by their medical association ethical standards and state law, not social security law. They can charge. I’ve had doctors say their charges would be anywhere from $200 to $500. Then you have to make the decision whether to foot the bill. When I have done that my clients have not reimbursed me, with the exception of 1 or 2.On the other hand, if you are at the federal court level, you can pay and if you win, the Court will order expenses paid under EAJA. To set up for this, ask in writing for the ALJ to pay the cost of the opinion. State that it is necessary development and identify the undeveloped part of the record that could be completed with admission of the doctor’s opinion.On appeal, one of the issues is: was failure to develop error and - was it harmful error? To show harmful error, you submit the doctor’s opinion that you have now paid for, and argue this is what would have been in the record, had the ALJ properly developed the record as specifically requested by you, the lawyer.

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

Social Security is funded by money taken out of every paycheck for American's in the form of Federal withholding. So how can Mitch McConnell say Social Security is to expensive and needs to be cut when the government doesn't fund it the people do?

Social security benefits are funded both by payroll tax deductions and by the the Social Security Trust fund. When more money comes in through taxes than is paid out in benefits, the Fund grows. The Trust Fund (the combined OASDI Trust Funds total reserve is $2.89 trillion at the end of the year 2017) is invested in US Government securities that pay interest, a lot of interest. Social Security ran a surplus of $35 billion in 2017 and projects a surplus of $44 billion this year, 2018; however, long term projections based on the number of workers and the number of people signNowing retirement age, are that the surplus will turn to a deficit, relatively soon.If this drain went unchecked, eventually the Trust Fund would go to zero and there wouldn’t be enough money to pay social security benefits. SSA currently projects that depletion of the fund will occur in 2034.[1]Several small adjustments can be made now to fix the problem, such as raising the ceiling on income that is taxable, increasing the tax rate, lowering the social security cost of living adjustments, and raising the retirement age.The important thing in this discussion is that today the fix is easy because the Trust Fund is huge and earns lots of interest. If the Fund is starts to be depleted, that interest goes away and the amount of money to make up is vastly greater.Footnotes[1] Summary: Actuarial Status of the Social Security Trust Funds

-

When filling out an online job application, a question asks you to provide your social security number as part of the background investigation. Do you provide this number or how do you proceed?

My question exactly. Other similar posts overwhelmingly answer 'do NOT give out that number' until you are hired. Yet the majority of firms ask for it from the get-go nowadays. I think it should be illegal to seek your number. Companies can say 'we only use it for ....' but apparently they can verify when and where you worked, your wage, etc. There is a lot of 'fudging' going on out there but companies seem to hold all the card in my opinion.HR will always say they are doing everything by the book but of course they can do whatever they want to.

Create this form in 5 minutes!

How to create an eSignature for the form ssa 7163 03 2014 social security segurosocial

How to generate an electronic signature for your Form Ssa 7163 03 2014 Social Security Segurosocial online

How to generate an electronic signature for the Form Ssa 7163 03 2014 Social Security Segurosocial in Chrome

How to create an eSignature for putting it on the Form Ssa 7163 03 2014 Social Security Segurosocial in Gmail

How to make an eSignature for the Form Ssa 7163 03 2014 Social Security Segurosocial from your smartphone

How to generate an eSignature for the Form Ssa 7163 03 2014 Social Security Segurosocial on iOS

How to create an electronic signature for the Form Ssa 7163 03 2014 Social Security Segurosocial on Android devices

Get more for Ssa Form Ssa 44 For

Find out other Ssa Form Ssa 44 For

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile