IL 2220 Computation of Penalties for Businesses Form

What is the IL 2220 Computation Of Penalties For Businesses

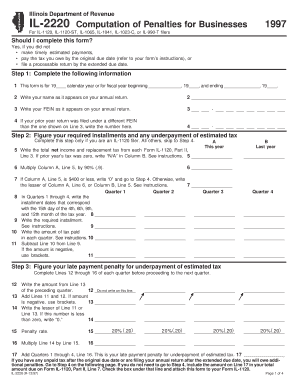

The IL 2220 Computation Of Penalties For Businesses is a specific form used by businesses in Illinois to calculate penalties related to underpayment of estimated taxes. This form is essential for ensuring compliance with state tax regulations and helps businesses determine their liability when they do not meet their estimated tax obligations. Understanding this form is crucial for businesses to avoid unnecessary penalties and maintain good standing with the Illinois Department of Revenue.

Steps to complete the IL 2220 Computation Of Penalties For Businesses

Completing the IL 2220 involves several key steps that ensure accurate reporting and calculation of penalties. First, businesses should gather relevant financial information, including total income and estimated tax payments made throughout the year. Next, they should calculate the total tax liability for the year and compare it to the estimated payments. If there is a shortfall, the business must determine the penalty amount based on the state's guidelines. Finally, the completed form must be submitted to the Illinois Department of Revenue by the specified deadline.

Legal use of the IL 2220 Computation Of Penalties For Businesses

Using the IL 2220 is legally mandated for businesses that have underpaid their estimated taxes in Illinois. This form serves as a formal declaration of the penalties incurred and is necessary for compliance with state tax laws. Proper use of the form ensures that businesses can address any discrepancies in their tax payments and avoid further legal complications. It is advisable for businesses to consult with a tax professional to ensure that they are using the form correctly and in accordance with all legal requirements.

Filing Deadlines / Important Dates

Timely submission of the IL 2220 is crucial to avoid additional penalties. The form must be filed by the due date for the business's income tax return, which typically aligns with the annual tax deadlines. Businesses should be aware of specific dates, such as the end of the tax year and any extensions that may apply. Keeping track of these deadlines helps ensure compliance and mitigates the risk of incurring further penalties.

Required Documents

To complete the IL 2220, businesses need to have several documents on hand. These typically include financial statements, previous tax returns, and records of estimated tax payments made throughout the year. Having these documents readily available streamlines the process of filling out the form and ensures that all calculations are based on accurate and comprehensive data.

Penalties for Non-Compliance

Failing to submit the IL 2220 or inaccurately reporting penalties can lead to significant consequences for businesses. Non-compliance may result in additional fines, interest on unpaid taxes, and potential legal action from the Illinois Department of Revenue. Understanding the implications of non-compliance emphasizes the importance of accurately completing and submitting the form on time.

Quick guide on how to complete il 2220 computation of penalties for businesses

Complete [SKS] seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2220 Computation Of Penalties For Businesses

Create this form in 5 minutes!

How to create an eSignature for the il 2220 computation of penalties for businesses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 2220 Computation Of Penalties For Businesses?

The IL 2220 Computation Of Penalties For Businesses is a form used by businesses in Illinois to calculate penalties for underpayment of estimated tax. Understanding this computation is crucial for compliance and avoiding unnecessary penalties. By utilizing airSlate SignNow, businesses can easily manage and eSign their tax documents, ensuring accuracy and timely submissions.

-

How can airSlate SignNow help with the IL 2220 Computation Of Penalties For Businesses?

airSlate SignNow streamlines the process of preparing and submitting the IL 2220 Computation Of Penalties For Businesses. Our platform allows users to fill out, sign, and send documents securely and efficiently. This not only saves time but also reduces the risk of errors that could lead to penalties.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features designed for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features are particularly beneficial for the IL 2220 Computation Of Penalties For Businesses, ensuring that all necessary forms are completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses handling the IL 2220 Computation Of Penalties For Businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the IL 2220 Computation Of Penalties For Businesses. Our pricing plans are designed to fit various budgets, allowing businesses to access essential features without overspending. This affordability helps businesses focus on compliance without financial strain.

-

Can I integrate airSlate SignNow with other accounting software for the IL 2220 Computation Of Penalties For Businesses?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage the IL 2220 Computation Of Penalties For Businesses. This integration allows for automatic data transfer, reducing manual entry and minimizing errors in your tax documentation.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance, including the IL 2220 Computation Of Penalties For Businesses, offers numerous benefits. These include enhanced document security, improved workflow efficiency, and the ability to access documents from anywhere. This ensures that businesses can stay compliant and organized throughout the tax season.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to the IL 2220 Computation Of Penalties For Businesses. Our platform employs advanced encryption and secure cloud storage to protect sensitive information. This commitment to security helps businesses feel confident in their document management.

Get more for IL 2220 Computation Of Penalties For Businesses

- Pl 664 passenger carrier equipment statement california public cpuc ca form

- 2014 a 772 wage assignment reduction request form revenue wi

- Dhs iowa form

- Wh 385 v certification for serious injury or illness of dol form

- 2006 form u pdf epa

- Nasser atrash license 1295969 nycgov form

- Lic61 physical examination form nyc

- Application for roadside tree blanket permit form

Find out other IL 2220 Computation Of Penalties For Businesses

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter