IL 1120 X Business Income Tax Corporate Tax Illinois Form

What is the IL 1120 X Business Income Tax Corporate Tax Illinois

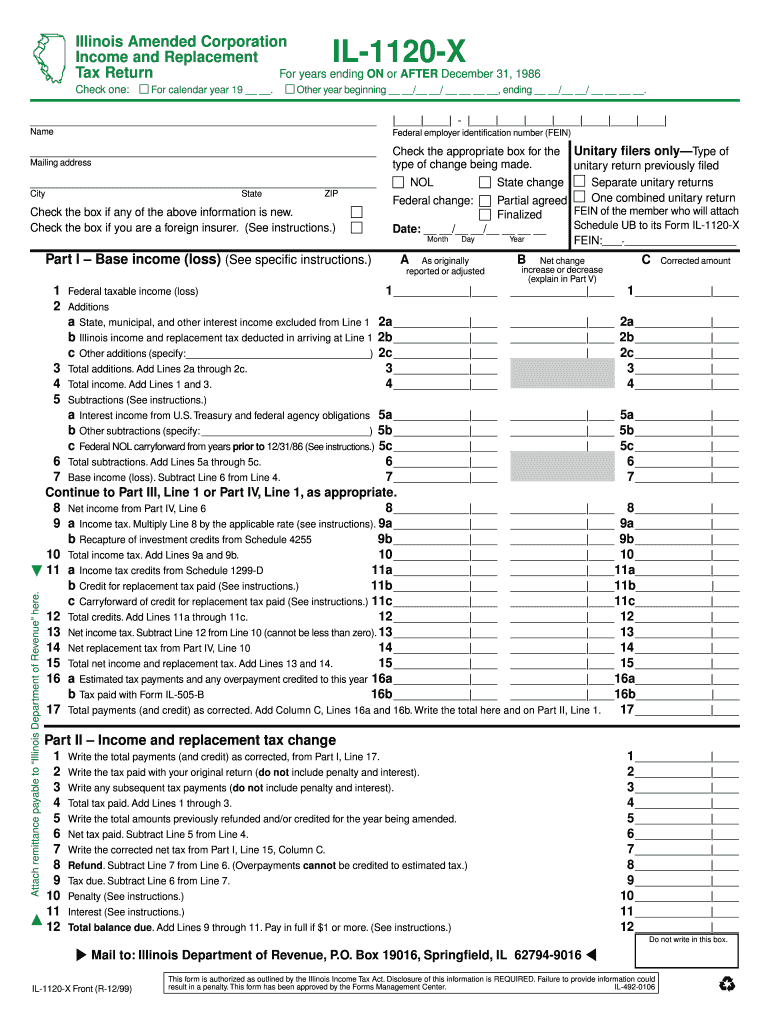

The IL 1120 X form is a crucial document used by corporations in Illinois to amend their previously filed business income tax returns. This form allows businesses to correct errors or make changes to their tax filings, ensuring compliance with state tax regulations. The IL 1120 X is specifically designed for corporate entities, including C corporations and S corporations, and is essential for maintaining accurate tax records.

Steps to complete the IL 1120 X Business Income Tax Corporate Tax Illinois

Completing the IL 1120 X involves several steps to ensure accuracy and compliance:

- Gather all relevant financial documents and previous tax returns.

- Obtain the IL 1120 X form from the Illinois Department of Revenue website or through authorized channels.

- Fill out the form, providing detailed information about the changes being made.

- Attach any supporting documentation that justifies the amendments.

- Review the completed form for accuracy before submission.

- Submit the form either electronically or by mail, following the guidelines provided by the Illinois Department of Revenue.

Required Documents

When filing the IL 1120 X, certain documents are necessary to support the amendments being made. These may include:

- Previous IL 1120 tax returns.

- Financial statements relevant to the tax year in question.

- Documentation of any changes in income, deductions, or credits.

- Any correspondence from the Illinois Department of Revenue regarding the original filing.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the IL 1120 X. Generally, the amended return must be filed within three years from the original due date of the return being amended. Specific deadlines may vary based on individual circumstances, so it is advisable to consult the Illinois Department of Revenue for the most accurate information.

Penalties for Non-Compliance

Failure to file the IL 1120 X correctly or on time can result in penalties imposed by the Illinois Department of Revenue. These penalties may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid tax amounts.

- Potential audits or further scrutiny of the business's tax filings.

Who Issues the Form

The IL 1120 X form is issued by the Illinois Department of Revenue, which oversees the collection of state taxes and ensures compliance with tax laws. This department provides resources and guidance for businesses to navigate the tax filing process effectively.

Quick guide on how to complete il 1120 x business income tax corporate tax illinois

Prepare [SKS] with ease on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage [SKS] seamlessly on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or the need for new printed copies due to errors. airSlate SignNow fulfills your requirements in document management with just a few clicks from your preferred device. Edit and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1120 X Business Income Tax Corporate Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1120 x business income tax corporate tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1120 X Business Income Tax Corporate Tax Illinois?

The IL 1120 X Business Income Tax Corporate Tax Illinois is a form used by corporations to amend their previously filed Illinois corporate income tax returns. This form allows businesses to correct errors or make changes to their reported income, deductions, or credits. Understanding this form is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with the IL 1120 X Business Income Tax Corporate Tax Illinois?

airSlate SignNow provides a streamlined solution for businesses to electronically sign and send the IL 1120 X Business Income Tax Corporate Tax Illinois form. Our platform simplifies the document management process, ensuring that your tax amendments are handled efficiently and securely. This can save time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your IL 1120 X Business Income Tax Corporate Tax Illinois documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your IL 1120 X Business Income Tax Corporate Tax Illinois forms. These features enhance efficiency and ensure that your documents are processed accurately and promptly. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant Illinois tax regulations, including those pertaining to the IL 1120 X Business Income Tax Corporate Tax Illinois. Our platform ensures that your documents meet legal standards, providing peace of mind when submitting your tax forms. Compliance is a top priority for us.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your IL 1120 X Business Income Tax Corporate Tax Illinois documents alongside your other financial records. This integration streamlines your workflow and enhances productivity by reducing the need for manual data entry.

-

What are the benefits of using airSlate SignNow for corporate tax documents?

Using airSlate SignNow for your IL 1120 X Business Income Tax Corporate Tax Illinois documents provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform allows for quick eSigning and document sharing, which can signNowly speed up the amendment process. Additionally, you can track the status of your documents in real-time.

Get more for IL 1120 X Business Income Tax Corporate Tax Illinois

- Sellers information for appraiser provided to buyer virginia

- Subcontractors agreement virginia form

- Va pay workers form

- Virginia workers compensation 497427945 form

- Option to purchase addendum to residential lease lease or rent to own virginia form

- Virginia prenuptial premarital agreement uniform premarital agreement act with financial statements virginia

- Virginia prenuptial form

- Fd 9n application for a new product registration rev 7 2015docx form

Find out other IL 1120 X Business Income Tax Corporate Tax Illinois

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free