Illinois Department of Revenue Year Ending Schedule F Gains from Sales or Exchanges of Property Month Year IL Attachment No Form

What is the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

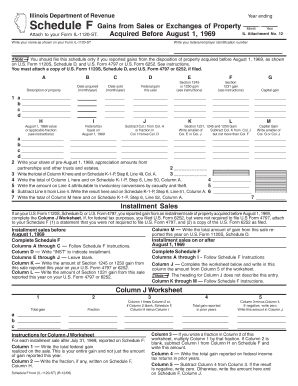

The Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No is a tax form used by individuals and businesses to report gains from the sale or exchange of property within the state of Illinois. This form is essential for accurately calculating taxable income derived from property transactions, ensuring compliance with state tax regulations. It includes detailed sections for reporting various types of gains, losses, and adjustments related to property sales, providing a comprehensive overview of the taxpayer's financial activity for the year.

Steps to complete the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

Completing the Illinois Department Of Revenue Year Ending Schedule F requires careful attention to detail and adherence to specific guidelines. Begin by gathering all necessary documentation related to property transactions, including purchase and sale agreements, closing statements, and any relevant financial records. Next, follow these steps:

- Fill out personal information, including your name, address, and taxpayer identification number.

- List all properties sold or exchanged during the tax year, providing details such as dates of transactions and amounts received.

- Calculate the total gains or losses for each transaction, taking into account adjustments for depreciation and other factors.

- Summarize the total gains or losses on the designated section of the form.

- Review all entries for accuracy before submitting the form to the Illinois Department of Revenue.

Key elements of the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

Several key elements are crucial for understanding and completing the Illinois Department Of Revenue Year Ending Schedule F. These include:

- Transaction Details: Accurate reporting of each property transaction, including dates and amounts.

- Gain or Loss Calculation: A clear method for determining the gain or loss from each sale or exchange.

- Adjustment Factors: Consideration of depreciation and other adjustments that may affect the final figures.

- Compliance Information: Instructions on how to ensure compliance with state tax laws and regulations.

Legal use of the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

The legal use of the Illinois Department Of Revenue Year Ending Schedule F is to ensure that taxpayers accurately report their financial activities related to property sales or exchanges. Proper completion of this form is essential for compliance with Illinois tax laws. Failure to report gains or losses can result in penalties, interest, or audits. It is important for taxpayers to understand their obligations and the legal implications of their reported information.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Department Of Revenue Year Ending Schedule F are critical for taxpayers to observe. Typically, the form must be submitted by the due date of the individual or business tax return, which is usually April 15 of the following year. However, taxpayers should verify specific deadlines each year, as they may vary based on weekends or holidays. Timely submission is essential to avoid penalties and ensure compliance with state tax regulations.

Examples of using the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

Examples of using the Illinois Department Of Revenue Year Ending Schedule F can provide clarity on how to report various transactions. For instance, if an individual sells a rental property for a profit, they would report the sale on this form, detailing the purchase price, sale price, and any expenses incurred during the transaction. Similarly, if a business exchanges equipment for another asset, the gains from this exchange must also be documented. Each scenario requires careful calculation of gains or losses to ensure accurate reporting.

Quick guide on how to complete illinois department of revenue year ending schedule f gains from sales or exchanges of property month year il attachment no

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue year ending schedule f gains from sales or exchanges of property month year il attachment no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No.?

The Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. is a form used to report gains from the sale or exchange of property. This attachment is essential for accurately calculating your tax obligations in Illinois. Understanding this form can help ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Illinois Department Of Revenue Year Ending Schedule F?

airSlate SignNow provides an efficient platform for preparing and eSigning the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. Our user-friendly interface simplifies document management, making it easier to complete and submit your tax forms accurately and on time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Each plan includes features that support the completion of documents like the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow. This includes popular tools that can assist in managing the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. By integrating with your existing systems, you can streamline your document processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features designed for efficient document management, including eSigning, templates, and real-time collaboration. These features are particularly useful when dealing with the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. They help ensure that all parties can review and sign documents quickly and securely.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. You can trust that your sensitive information is safe while using our platform.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your documents on the go. This flexibility is particularly beneficial for completing the Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No. You can easily eSign and send documents from anywhere, at any time.

Get more for Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

Find out other Illinois Department Of Revenue Year Ending Schedule F Gains From Sales Or Exchanges Of Property Month Year IL Attachment No

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT