Mississippi 04 Withholding Tax Return 04 05 Instructions 05 2020-2026

Understanding the Mississippi Withholding Tax Return

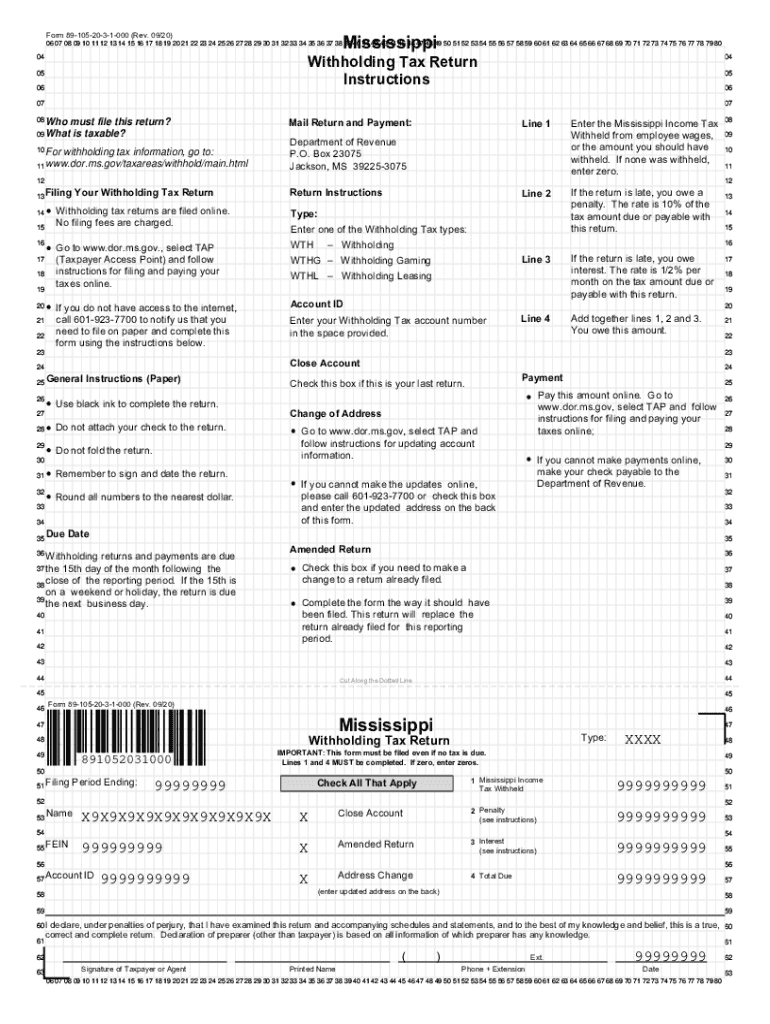

The Mississippi withholding tax return is a crucial document for employers in the state, used to report and remit the state income taxes withheld from employees' wages. This form is essential for maintaining compliance with state tax laws and ensuring that employees' tax obligations are met. Employers must accurately fill out this return to avoid penalties and ensure proper credit for their employees.

Steps to Complete the Mississippi Withholding Tax Return

Completing the Mississippi withholding tax return involves several key steps:

- Gather necessary employee information, including names, Social Security numbers, and earnings.

- Calculate the total amount of state income tax withheld for the reporting period.

- Fill out the Mississippi withholding tax return form, ensuring all fields are completed accurately.

- Review the completed form for errors before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines for the Mississippi Withholding Tax Return

Employers must be aware of the filing deadlines for the Mississippi withholding tax return to avoid late fees. Typically, the return is due on the last day of the month following the end of each quarter. For example, the first quarter's return is due by April 30. It is essential to keep track of these dates to ensure timely submissions.

Required Documents for Filing

To complete the Mississippi withholding tax return, employers need to gather specific documents:

- Employee W-2 forms for the reporting year.

- Records of all wages paid and taxes withheld.

- Any prior year tax returns, if applicable, for reference.

Submission Methods for the Mississippi Withholding Tax Return

The Mississippi withholding tax return can be submitted in several ways:

- Online through the Mississippi Department of Revenue's e-filing system.

- By mail, sending the completed form to the appropriate state office.

- In-person at designated state revenue offices.

Penalties for Non-Compliance

Failure to file the Mississippi withholding tax return on time can result in significant penalties. These may include fines based on the amount of tax due, interest on unpaid taxes, and potential legal action for continued non-compliance. It is vital for employers to adhere to filing requirements to avoid these repercussions.

Quick guide on how to complete mississippi 04 withholding tax return 04 05 instructions 05

Complete Mississippi 04 Withholding Tax Return 04 05 Instructions 05 effortlessly on any device

Managing documents online has gained immense popularity among organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents swiftly without any delays. Handle Mississippi 04 Withholding Tax Return 04 05 Instructions 05 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Mississippi 04 Withholding Tax Return 04 05 Instructions 05 effortlessly

- Obtain Mississippi 04 Withholding Tax Return 04 05 Instructions 05 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Mississippi 04 Withholding Tax Return 04 05 Instructions 05 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mississippi 04 withholding tax return 04 05 instructions 05

Create this form in 5 minutes!

How to create an eSignature for the mississippi 04 withholding tax return 04 05 instructions 05

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi withholding tax return form?

The Mississippi withholding tax return form is a document that employers in Mississippi must file to report the state income tax withheld from employees' wages. This form ensures compliance with state tax laws and helps businesses manage their tax obligations effectively.

-

How can airSlate SignNow help with the Mississippi withholding tax return form?

airSlate SignNow provides an easy-to-use platform for businesses to electronically sign and send the Mississippi withholding tax return form. This streamlines the filing process, reduces paperwork, and ensures that your forms are submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Mississippi withholding tax return form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, allowing you to manage your Mississippi withholding tax return form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the Mississippi withholding tax return form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These features make it easy to create, send, and manage your Mississippi withholding tax return form efficiently.

-

Can I integrate airSlate SignNow with other software for my Mississippi withholding tax return form?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll software, making it easier to manage your Mississippi withholding tax return form alongside your other financial documents. This ensures a seamless workflow for your business.

-

What are the benefits of using airSlate SignNow for the Mississippi withholding tax return form?

Using airSlate SignNow for your Mississippi withholding tax return form provides numerous benefits, including time savings, reduced errors, and enhanced security. The platform simplifies the filing process, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow when handling the Mississippi withholding tax return form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Mississippi withholding tax return form. You can trust that your sensitive information is safe and secure.

Get more for Mississippi 04 Withholding Tax Return 04 05 Instructions 05

- Moda reimbursement form

- Quarterly report of surplus lines business nebraska form

- Consent of surety sample form

- Tty quick reference card georgia apco form

- Mobile car wash permit application city of lubbock form

- Form il 1041 illinois department of revenue

- Form 1040me

- Worksheets for tax credits 2023maine revenue services form

Find out other Mississippi 04 Withholding Tax Return 04 05 Instructions 05

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy