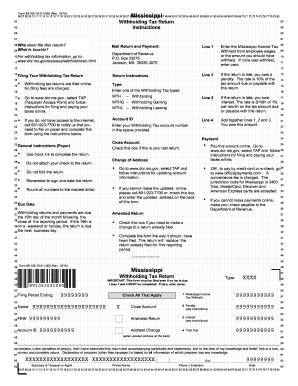

Form 89 105 15 3 1 000 Rev 2015

What is the Form 89 105 15 3 1 000 Rev

The Form 89 105 15 3 1 000 Rev is a specific document used in various administrative processes within the United States. It serves a unique purpose, often related to compliance or regulatory requirements. Understanding the nature of this form is essential for individuals and businesses that may need to utilize it for official purposes.

How to use the Form 89 105 15 3 1 000 Rev

Using the Form 89 105 15 3 1 000 Rev involves several steps to ensure accurate completion and submission. First, gather all necessary information that pertains to the form. This may include personal identification details, financial information, or other relevant data. Next, carefully fill out each section of the form, making sure to follow any specific instructions provided. After completing the form, review it for accuracy before submitting it to the appropriate authority.

Steps to complete the Form 89 105 15 3 1 000 Rev

Completing the Form 89 105 15 3 1 000 Rev requires attention to detail. Here are the steps to follow:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information needed for the form.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check the information for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified submission methods.

Legal use of the Form 89 105 15 3 1 000 Rev

The legal use of the Form 89 105 15 3 1 000 Rev is critical for compliance with U.S. regulations. This form may be required in various legal contexts, and its proper completion is essential to avoid potential penalties. It is advisable to consult with a legal professional if there are any uncertainties regarding the form's use or implications.

Key elements of the Form 89 105 15 3 1 000 Rev

The Form 89 105 15 3 1 000 Rev contains several key elements that are vital for its validity. Important sections typically include:

- Identification information of the individual or entity submitting the form.

- Details relevant to the specific purpose of the form.

- Signature lines for the authorized individuals.

- Any required attachments or supporting documentation.

Who Issues the Form

The Form 89 105 15 3 1 000 Rev is issued by a designated governmental agency. This agency is responsible for overseeing the compliance and regulatory processes associated with the form. It is important for users to be aware of the issuing authority to ensure they are following the correct procedures when submitting the form.

Quick guide on how to complete form 89 105 15 3 1 000 rev

Complete Form 89 105 15 3 1 000 Rev effortlessly on any device

Web-based document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and efficiently. Manage Form 89 105 15 3 1 000 Rev on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 89 105 15 3 1 000 Rev without stress

- Find Form 89 105 15 3 1 000 Rev and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal value as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 89 105 15 3 1 000 Rev and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 89 105 15 3 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 89 105 15 3 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 89 105 15 3 1 000 Rev. and how can airSlate SignNow help?

Form 89 105 15 3 1 000 Rev. is a document used for specific administrative purposes. airSlate SignNow provides an easy-to-use platform that allows you to fill out, send, and eSign this form efficiently. With our solution, you can streamline your document management process and ensure compliance with all necessary regulations.

-

How much does it cost to use airSlate SignNow for Form 89 105 15 3 1 000 Rev.?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for handling documents like Form 89 105 15 3 1 000 Rev. Our cost-effective solution ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 89 105 15 3 1 000 Rev.?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like Form 89 105 15 3 1 000 Rev. These tools enhance your workflow, making it easier to manage and process important documents efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 89 105 15 3 1 000 Rev.?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage Form 89 105 15 3 1 000 Rev. alongside your existing tools. This integration capability enhances productivity and ensures that your document workflows are streamlined across platforms.

-

What are the benefits of using airSlate SignNow for Form 89 105 15 3 1 000 Rev.?

Using airSlate SignNow for Form 89 105 15 3 1 000 Rev. provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security for your documents. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling Form 89 105 15 3 1 000 Rev.?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form 89 105 15 3 1 000 Rev. Our platform is compliant with industry standards, ensuring that your sensitive information remains safe and confidential throughout the signing process.

-

How can I get started with airSlate SignNow for Form 89 105 15 3 1 000 Rev.?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose a pricing plan that suits your needs, and begin creating or uploading your Form 89 105 15 3 1 000 Rev. documents. Our user-friendly interface guides you through the process, making it simple to eSign and manage your documents.

Get more for Form 89 105 15 3 1 000 Rev

Find out other Form 89 105 15 3 1 000 Rev

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself