Financial Institution Tax Payment Voucher Nd Form

What is the Financial Institution Tax Payment Voucher Nd

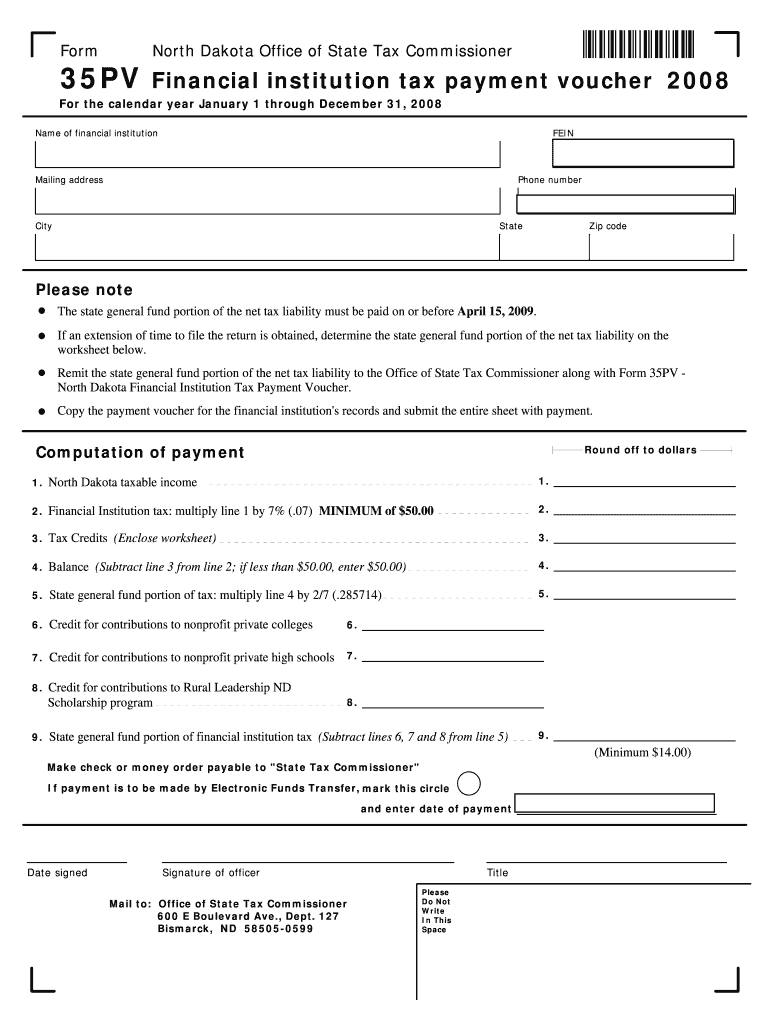

The Financial Institution Tax Payment Voucher Nd is a specific form used by financial institutions to report and remit taxes owed to the state. This voucher serves as a formal request for payment and includes essential information such as the institution's name, tax identification number, and the amount due. It is crucial for ensuring compliance with state tax regulations and facilitating accurate record-keeping for both the institution and the tax authorities.

How to use the Financial Institution Tax Payment Voucher Nd

Using the Financial Institution Tax Payment Voucher Nd involves several straightforward steps. First, financial institutions must gather the necessary information, including their tax identification number and the amount of tax owed. Next, they should complete the voucher by filling in all required fields accurately. Once the form is filled out, it can be submitted either electronically or via mail, depending on state guidelines. It is important to retain a copy of the completed voucher for record-keeping purposes.

Steps to complete the Financial Institution Tax Payment Voucher Nd

Completing the Financial Institution Tax Payment Voucher Nd requires careful attention to detail. Follow these steps:

- Begin by entering the financial institution's name and address in the designated fields.

- Provide the tax identification number to ensure proper identification by the tax authorities.

- Indicate the tax period for which the payment is being made.

- Calculate the total amount due and enter it in the appropriate section.

- Review all information for accuracy before submitting the voucher.

Key elements of the Financial Institution Tax Payment Voucher Nd

The Financial Institution Tax Payment Voucher Nd includes several key elements that are essential for its proper use. These elements are:

- Institution Information: Name, address, and tax identification number.

- Tax Period: The specific period for which the tax payment is being made.

- Amount Due: The total amount of tax owed.

- Signature: An authorized representative must sign the voucher to validate the payment.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Financial Institution Tax Payment Voucher Nd is crucial for compliance. Generally, financial institutions must submit their tax payment vouchers by specific dates set by the state tax authority. These deadlines may vary depending on the type of tax being reported and the institution's fiscal year. It is advisable to check the state’s tax regulations for the most accurate and up-to-date information regarding these important dates.

Form Submission Methods

The Financial Institution Tax Payment Voucher Nd can typically be submitted through various methods, including:

- Online Submission: Many states offer electronic filing options through their tax authority websites.

- Mail: Institutions can print the completed voucher and send it to the designated tax office address.

- In-Person: Some states allow for in-person submissions at local tax offices, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete financial institution tax payment voucher nd

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without any hassles. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or conceal sensitive information using the features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method of sharing your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Financial Institution Tax Payment Voucher Nd

Create this form in 5 minutes!

How to create an eSignature for the financial institution tax payment voucher nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Financial Institution Tax Payment Voucher Nd?

The Financial Institution Tax Payment Voucher Nd is a document used by financial institutions in North Dakota to facilitate tax payments. It ensures that payments are processed efficiently and accurately, helping institutions comply with state tax regulations.

-

How can airSlate SignNow help with the Financial Institution Tax Payment Voucher Nd?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the Financial Institution Tax Payment Voucher Nd. This streamlines the process, reduces paperwork, and ensures that your tax payments are submitted on time.

-

What are the pricing options for using airSlate SignNow for the Financial Institution Tax Payment Voucher Nd?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, ensuring that you have access to the tools necessary for managing the Financial Institution Tax Payment Voucher Nd efficiently.

-

Are there any features specifically designed for the Financial Institution Tax Payment Voucher Nd?

Yes, airSlate SignNow includes features tailored for the Financial Institution Tax Payment Voucher Nd, such as customizable templates, automated reminders, and secure eSigning. These features enhance the efficiency of tax payment processing for financial institutions.

-

What are the benefits of using airSlate SignNow for tax payment vouchers?

Using airSlate SignNow for the Financial Institution Tax Payment Voucher Nd offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. This allows financial institutions to focus on their core operations while ensuring compliance with tax obligations.

-

Can airSlate SignNow integrate with other financial software for tax payments?

Absolutely! airSlate SignNow can seamlessly integrate with various financial software solutions, making it easier to manage the Financial Institution Tax Payment Voucher Nd alongside your existing systems. This integration helps streamline workflows and improve overall efficiency.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Financial Institution Tax Payment Voucher Nd, are protected. The platform uses advanced encryption and secure storage to safeguard sensitive information.

Get more for Financial Institution Tax Payment Voucher Nd

- 4f1 19049 f rev 1014indd form

- Va pamphlet 29 9 service disabled veterans insurance premium form

- Tricare waiver form 2013 2019

- Constitutional blood test requisition form indiana university

- Test requisition form cytogenetic laboratories iu health

- Member information king county

- Teamcare disability form

- Ufrgs universidade federal do rio grande do sul rs www1 capes gov form

Find out other Financial Institution Tax Payment Voucher Nd

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free