Insolvency Worksheet Form

What is the Insolvency Worksheet

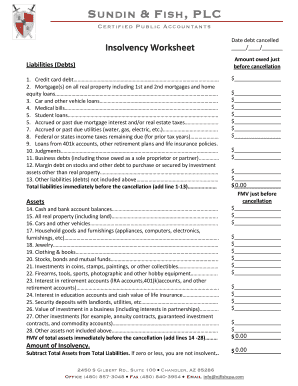

The insolvency worksheet is a financial document used to assess an individual's or business's financial situation when facing insolvency. It helps determine whether a person or entity is insolvent, which means their liabilities exceed their assets. This worksheet is crucial for public accountants and financial advisors in evaluating the financial health of their clients and guiding them through the insolvency process. It typically includes sections for listing assets, liabilities, income, and expenses, providing a comprehensive view of the financial status.

How to use the Insolvency Worksheet

Using the insolvency worksheet involves several steps to ensure accurate and thorough completion. First, gather all relevant financial documents, including bank statements, tax returns, and debt statements. Next, fill out the worksheet by entering information about your assets, such as cash, property, and investments, followed by your liabilities, including loans and credit card debts. It is essential to be honest and precise when reporting figures to reflect an accurate financial picture. Once completed, review the worksheet to assess your insolvency status and discuss the findings with a financial professional if needed.

Steps to complete the Insolvency Worksheet

Completing the insolvency worksheet requires careful attention to detail. Follow these steps for effective completion:

- Collect all financial documents, including a list of assets and liabilities.

- Begin by listing all assets, categorizing them into liquid assets, real estate, and personal property.

- Next, list all liabilities, ensuring to include both secured and unsecured debts.

- Calculate total assets and total liabilities to determine your net worth.

- Review your income and expenses to provide context for your financial situation.

- Finalize the worksheet by ensuring all entries are accurate and complete.

Key elements of the Insolvency Worksheet

The insolvency worksheet contains several key elements that are vital for assessing financial status. These include:

- Asset Section: A comprehensive list of all assets, including cash, real estate, and personal belongings.

- Liability Section: A detailed account of all debts, including loans, credit cards, and any other financial obligations.

- Income and Expense Section: A breakdown of monthly income sources and regular expenses to evaluate cash flow.

- Net Worth Calculation: A summary that subtracts total liabilities from total assets to determine insolvency status.

Legal use of the Insolvency Worksheet

The insolvency worksheet serves a legal purpose in the context of bankruptcy and financial assessments. It may be required by courts or financial institutions when filing for bankruptcy or negotiating debt settlements. Properly completed worksheets can support claims of insolvency and provide a basis for legal proceedings regarding debt relief. It is advisable to consult with a legal professional to ensure compliance with all legal requirements when using this document.

Examples of using the Insolvency Worksheet

There are various scenarios where the insolvency worksheet can be beneficial. For instance, a small business owner facing financial difficulties can use the worksheet to assess their financial situation before filing for bankruptcy. Similarly, individuals contemplating debt restructuring can utilize the worksheet to present a clear picture of their financial status to creditors. These examples illustrate the worksheet's role in facilitating informed decisions regarding financial recovery and management.

Quick guide on how to complete insolvency worksheet

Effortlessly Create Insolvency Worksheet on Any Gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary format and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage Insolvency Worksheet on any device using airSlate SignNow's Android or iOS applications, and simplify any document-related task today.

How to Alter and Electronically Sign Insolvency Worksheet with Ease

- Locate Insolvency Worksheet and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure private information with features that airSlate SignNow offers specifically for that purpose.

- Produce your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Insolvency Worksheet and guarantee outstanding communication at every phase of the document creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the insolvency worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insolvency worksheet?

An insolvency worksheet is a structured document that helps individuals and businesses assess their financial situation during insolvency proceedings. It typically includes details about assets, liabilities, income, and expenses, making it easier to understand one's financial standing. Using an insolvency worksheet can streamline the process of filing for bankruptcy or negotiating with creditors.

-

How can airSlate SignNow assist with my insolvency worksheet?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your insolvency worksheet securely. With our solution, you can easily collaborate with financial advisors or legal professionals to ensure all necessary information is included. This simplifies the process and helps you stay organized during your insolvency proceedings.

-

Is there a cost associated with using the insolvency worksheet feature?

Yes, airSlate SignNow offers various pricing plans that include access to the insolvency worksheet feature. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can manage their documents without breaking the bank. You can choose a plan that best fits your needs and budget.

-

What are the key features of the insolvency worksheet in airSlate SignNow?

The insolvency worksheet in airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time collaboration. These features allow you to tailor the worksheet to your specific needs while ensuring that all parties can access and sign the document easily. Additionally, our platform offers cloud storage for easy retrieval.

-

Can I integrate airSlate SignNow with other tools for my insolvency worksheet?

Absolutely! airSlate SignNow offers integrations with various tools and applications, allowing you to enhance your insolvency worksheet process. Whether you need to connect with accounting software or customer relationship management (CRM) systems, our platform can seamlessly integrate to improve your workflow.

-

What benefits does using an insolvency worksheet provide?

Using an insolvency worksheet helps you gain clarity on your financial situation, which is crucial during insolvency proceedings. It allows you to organize your financial data systematically, making it easier to communicate with creditors and legal advisors. This proactive approach can lead to better outcomes in managing your insolvency.

-

Is airSlate SignNow secure for handling my insolvency worksheet?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your insolvency worksheet and other documents are protected. We use advanced encryption and secure cloud storage to safeguard your sensitive information. You can trust that your data is safe while using our platform.

Get more for Insolvency Worksheet

- Poster peer review form

- Aufta form

- Application for mail order sales of the america the beautiful form

- Key2benefits login form

- Fillable online chugach descendant registration form ampamp

- Fill fillable form av r1 application for absentee ballot state

- Fire fighter exam accommodation request form

- John croyle speaking engagement request form big bigoak

Find out other Insolvency Worksheet

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word