Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit Your First Name and Initial Last Name Social Security Number Read the Form

Understanding the Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit

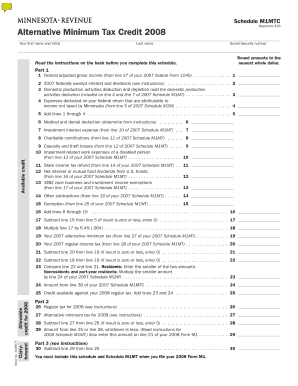

The Schedule M1MTC Sequence #16 is a form used to claim the Alternative Minimum Tax (AMT) credit in the United States. This credit is designed to reduce the tax burden for individuals who may have paid AMT in previous years. By utilizing this schedule, taxpayers can effectively offset their regular tax liability with the AMT credit, ensuring a fairer tax outcome. It is essential to read the instructions provided on the back of the schedule to understand the eligibility requirements and the proper way to complete the form.

Steps to Complete the Schedule M1MTC Sequence #16

Completing the Schedule M1MTC Sequence #16 requires careful attention to detail. Begin by gathering all necessary documentation, including your Social Security number and relevant income information. Follow these steps:

- Fill in your first name, middle initial, and last name at the top of the form.

- Provide your Social Security number to identify your tax records accurately.

- Review the instructions on the back of the schedule for specific calculations related to your AMT credit.

- Complete any required calculations, ensuring that you accurately reflect your tax situation.

- Double-check all entries for accuracy before submitting the form.

Eligibility Criteria for the Schedule M1MTC Sequence #16

To qualify for the Alternative Minimum Tax credit using the Schedule M1MTC Sequence #16, certain eligibility criteria must be met. Generally, taxpayers who have previously paid AMT and meet specific income thresholds may qualify. It is crucial to assess your tax situation to determine eligibility. Review the detailed guidelines on the back of the schedule to confirm if you meet the necessary criteria.

Filing Deadlines for the Schedule M1MTC Sequence #16

Filing deadlines for the Schedule M1MTC Sequence #16 align with the standard tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. If you require additional time, you may file for an extension, but ensure that any taxes owed are paid by the original deadline to avoid penalties. Always check for any updates regarding deadlines that may affect your filing requirements.

Required Documents for the Schedule M1MTC Sequence #16

When preparing to complete the Schedule M1MTC Sequence #16, gather the following documents:

- Your previous year’s tax return to reference any AMT paid.

- Documentation of income and deductions relevant to your current tax year.

- Any notices or correspondence from the IRS regarding your AMT status.

Having these documents on hand will streamline the process and ensure accuracy when filling out the form.

Form Submission Methods for the Schedule M1MTC Sequence #16

The Schedule M1MTC Sequence #16 can be submitted through various methods, including:

- Online submission through the IRS e-filing system, which is often the fastest option.

- Mailing a paper copy of the form to the appropriate IRS address, as specified in the instructions.

- In-person submission at designated IRS offices, if applicable.

Choose the method that best suits your needs and ensure that you follow any specific guidelines for submission.

Quick guide on how to complete schedule m1mtc sequence 16 alternative minimum tax credit your first name and initial last name social security number read the

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure superior communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit Your First Name And Initial Last Name Social Security Number Read The

Create this form in 5 minutes!

How to create an eSignature for the schedule m1mtc sequence 16 alternative minimum tax credit your first name and initial last name social security number read the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit?

The Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit is a tax form used to calculate the alternative minimum tax credit for individuals. It is essential to provide your First Name and Initial Last Name, along with your Social Security Number, to ensure accurate processing. Be sure to read the instructions on the back before you complete this schedule to avoid any errors.

-

How can airSlate SignNow help with completing the Schedule M1MTC Sequence #16?

airSlate SignNow offers an easy-to-use platform that simplifies the process of completing the Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit. With our document management features, you can easily fill out and eSign your forms securely. Our solution ensures that you have all the necessary information at your fingertips, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow provides a cost-effective solution for managing your tax documents, including the Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit. We offer various pricing plans to suit different needs, ensuring you get the best value for your investment. Check our website for detailed pricing information and choose the plan that fits your requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSigning, and secure storage, which are essential for managing your Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit. Our platform allows you to collaborate with others, track document status, and ensure compliance with tax regulations. These features streamline the process and enhance your productivity.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit. This seamless integration allows you to import and export data efficiently, ensuring that your tax documents are always up-to-date and accurate.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit, provides numerous benefits. You gain access to a user-friendly interface, enhanced security features, and the ability to eSign documents from anywhere. This flexibility and convenience can save you time and reduce the stress associated with tax filing.

-

How secure is my information when using airSlate SignNow?

Your security is our top priority at airSlate SignNow. When completing the Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit, all your information, including your First Name, Initial Last Name, and Social Security Number, is protected with advanced encryption and security protocols. We comply with industry standards to ensure your data remains confidential and secure.

Get more for Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit Your First Name And Initial Last Name Social Security Number Read The

Find out other Schedule M1MTC Sequence #16 Alternative Minimum Tax Credit Your First Name And Initial Last Name Social Security Number Read The

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement