Form 8829 2012

What is the Form 8829

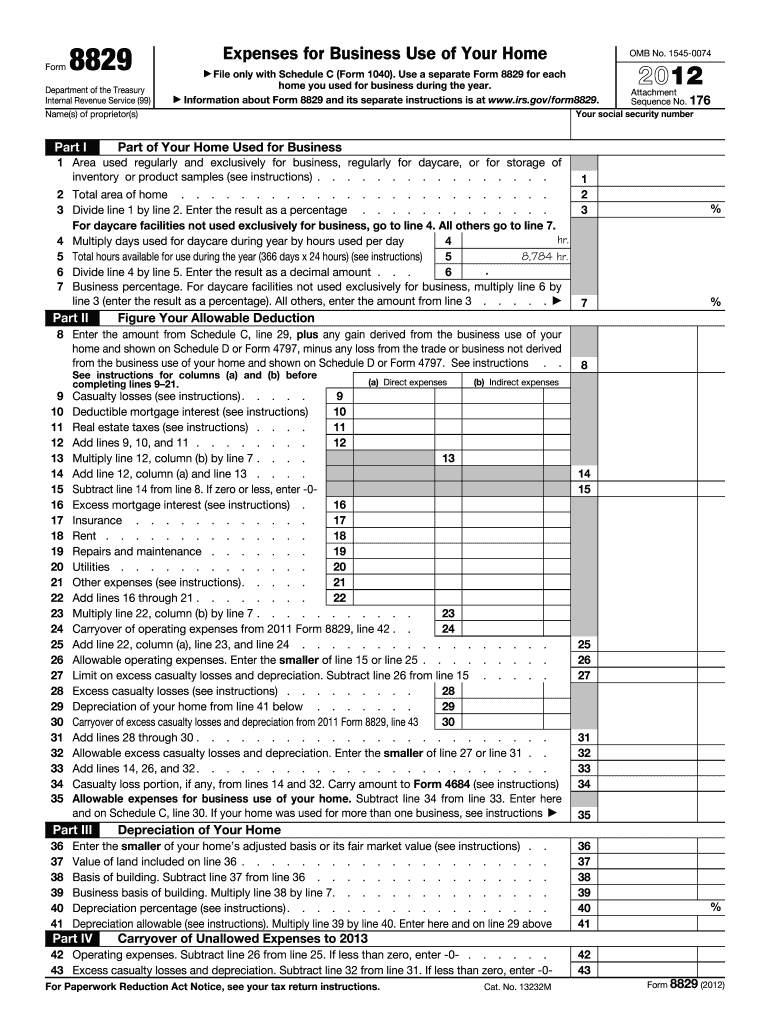

The Form 8829, officially known as the "Expenses for Business Use of Your Home," is a tax form used by individuals who operate a business from their home. This form allows taxpayers to calculate and claim deductions for expenses related to the business use of their home. It is particularly relevant for self-employed individuals and small business owners who want to maximize their tax benefits by accurately reporting home office expenses. The form covers various costs, including mortgage interest, utilities, repairs, and depreciation, ensuring that taxpayers can take full advantage of the deductions available to them under IRS guidelines.

How to use the Form 8829

Using the Form 8829 involves several steps that help taxpayers accurately report their home office expenses. First, you must determine the portion of your home used for business purposes, which can be calculated based on the square footage of the home office compared to the total home size. Next, gather all relevant expense records, including receipts and statements for utilities, repairs, and mortgage interest. Once you have this information, complete the form by entering your calculated business use percentage and total expenses in the appropriate sections. Finally, transfer the calculated deductions to your tax return, ensuring that you maintain copies of the form and supporting documents for your records.

Steps to complete the Form 8829

Completing the Form 8829 requires careful attention to detail. Follow these steps to ensure accuracy:

- Step 1: Determine the area of your home used for business. Measure the square footage of your home office and divide it by the total square footage of your home.

- Step 2: Collect all relevant expenses related to your home office, including mortgage interest, property taxes, utilities, repairs, and depreciation.

- Step 3: Fill out the form, starting with your business use percentage and entering total expenses in the designated sections.

- Step 4: Calculate the allowable deductions based on the provided IRS guidelines and transfer these amounts to your tax return.

- Step 5: Keep copies of the completed form and all supporting documentation for future reference and potential audits.

Legal use of the Form 8829

The legal use of Form 8829 is governed by IRS regulations that outline the eligibility criteria for claiming home office deductions. To qualify, the space used for business must be exclusively and regularly used for business purposes. This means that any personal use of the space may disqualify you from claiming the deduction. Additionally, taxpayers must maintain accurate records of all expenses and ensure compliance with IRS guidelines to avoid potential penalties. Proper use of the form can lead to significant tax savings, making it essential for eligible taxpayers to understand their rights and responsibilities when claiming these deductions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8829. Taxpayers should familiarize themselves with these rules to ensure compliance. Key guidelines include:

- Understanding the difference between direct and indirect expenses related to home office use.

- Calculating the business use percentage accurately to avoid overestimating deductions.

- Keeping thorough records of all expenses, including receipts and invoices, for at least three years after filing.

- Reviewing any updates or changes to IRS regulations regarding home office deductions, as these can impact eligibility and calculations.

Filing Deadlines / Important Dates

Filing deadlines for Form 8829 align with the general tax return deadlines for individuals. Typically, the deadline for submitting your federal income tax return, including Form 8829, is April 15 of each year. If you require additional time, you may file for an extension, which grants you until October 15 to submit your return. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is crucial to stay informed about any changes to these dates, especially in light of potential extensions or changes in tax law.

Quick guide on how to complete 2012 form 8829

Effortlessly Prepare Form 8829 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle Form 8829 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Adjust and eSign Form 8829 with Ease

- Obtain Form 8829 and select Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you select. Modify and eSign Form 8829 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8829

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8829

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 8829 and why do I need it?

Form 8829 is utilized to deduct expenses for business use of your home on your tax return. By accurately filling out Form 8829, you can claim deductions for various expenses such as mortgage interest, utilities, and repairs related to your home office. Understanding how to complete Form 8829 can signNowly reduce your taxable income.

-

How can airSlate SignNow help me with Form 8829?

airSlate SignNow streamlines the process of preparing and signing Form 8829 by allowing you to easily create, send, and eSign your documents. Our user-friendly platform ensures that you can efficiently fill out Form 8829 and gather necessary signatures, making tax season less stressful. With airSlate SignNow, you can manage your documents securely and access them anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for Form 8829?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for handling Form 8829 and other documents. You can choose from monthly or annual subscriptions, and we often provide discounts for annual plans. Investing in airSlate SignNow will save you time and hassle during tax filing.

-

What features does airSlate SignNow offer for managing Form 8829?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure electronic signatures, all of which simplify the management of Form 8829. Additionally, you have the ability to track the status of your documents, ensuring that you never miss a signature or a deadline. These features enhance your efficiency when dealing with tax documents.

-

Can I integrate airSlate SignNow with other applications for Form 8829?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and CRM systems, allowing you to manage your Form 8829 documents effortlessly. These integrations facilitate easy access to your files and ensure smooth workflow across different platforms. You can streamline your document management process with simple integrations.

-

How secure is airSlate SignNow when handling Form 8829?

Security is a top priority at airSlate SignNow. We employ advanced encryption and authentication protocols to protect your documents, including Form 8829, from unauthorized access. You can rest assured that your sensitive tax information is handled with the utmost care and complies with industry standards.

-

What are the benefits of using airSlate SignNow for Form 8829 compared to traditional methods?

Using airSlate SignNow for Form 8829 offers numerous benefits, including enhanced efficiency, reduced paperwork, and faster turnaround times. Unlike traditional methods, our platform eliminates the need for printing and mailing documents, allowing you to complete your tax filings quickly and conveniently. Embracing digital solutions like airSlate SignNow can lead to signNow time savings.

Get more for Form 8829

- Physical therapy referral form university of puget sound

- Purehealthintegrativemedicine client intake form the practice of integrative medicine requires the understanding of clients as

- Client care record form

- Meba medical plan designation of authorized representative form

- Camp bsa medical form with ny state scouting event

- Colonial life insurance wellness claim form

- First name middle initial last name email department name form

- Forms uconn student health services university of

Find out other Form 8829

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form