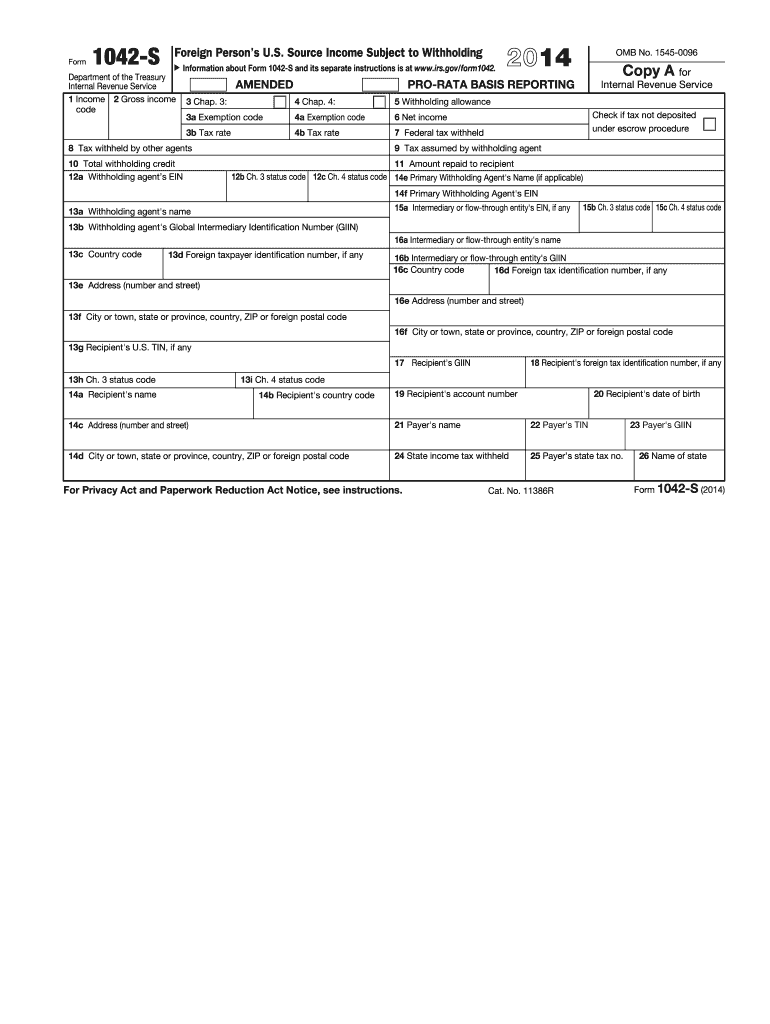

Form 1042 S 2014

What is the Form 1042-S

The Form 1042-S is a tax document used in the United States to report income that is subject to withholding for non-resident aliens. This form is primarily utilized by U.S. withholding agents, such as employers or financial institutions, to report payments made to foreign persons, including non-resident aliens and foreign entities. The form captures various types of income, such as interest, dividends, royalties, and compensation for services performed in the U.S. It is essential for ensuring compliance with U.S. tax laws and for the recipients to accurately report their income on their tax returns.

How to use the Form 1042-S

Using the Form 1042-S involves several steps. First, the withholding agent must gather all necessary information about the recipient, including their name, address, and taxpayer identification number (TIN). Next, the agent must determine the type of income being reported and the applicable withholding tax rate. After completing the form, the withholding agent must provide a copy to the recipient and submit the form to the IRS. Recipients of the Form 1042-S should use the information provided to accurately report their income and claim any applicable tax treaty benefits on their U.S. tax returns.

Steps to complete the Form 1042-S

Completing the Form 1042-S requires attention to detail and accuracy. Here are the steps involved:

- Gather information about the recipient, including their name, address, and TIN.

- Identify the type of income being reported and the appropriate withholding tax rate.

- Fill out the form, ensuring all required fields are completed accurately.

- Provide the completed form to the recipient by the required deadline.

- Submit the form to the IRS, along with any required accompanying documents.

Legal use of the Form 1042-S

The legal use of the Form 1042-S is governed by U.S. tax laws and regulations. It is crucial for withholding agents to comply with IRS guidelines when reporting payments to foreign persons. Failure to accurately complete and file the form can result in penalties for both the withholding agent and the recipient. The form must be filed annually, and withholding agents should retain copies for their records to ensure compliance in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042-S are critical to ensure compliance with IRS regulations. The form must be provided to recipients by March 15 of the year following the tax year in which the income was paid. Additionally, the form must be submitted to the IRS by March 15, unless filed electronically, in which case the deadline may extend to March 31. It is essential for withholding agents to be aware of these deadlines to avoid potential penalties.

Penalties for Non-Compliance

Non-compliance with the requirements for the Form 1042-S can lead to significant penalties. The IRS may impose fines for failure to file the form on time, inaccuracies, or for not providing copies to recipients. Penalties can vary based on the severity of the violation and may include both monetary fines and interest on unpaid taxes. Withholding agents should prioritize accurate and timely filing to mitigate these risks.

Quick guide on how to complete 2014 form 1042 s

Complete Form 1042 S seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and efficiently. Manage Form 1042 S on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1042 S effortlessly

- Locate Form 1042 S and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 1042 S and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1042 s

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1042 s

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 1042 S and when should I use it?

Form 1042 S is used to report income, such as interest and dividends, paid to non-U.S. residents. You should use Form 1042 S if your business pays foreign individuals or entities, ensuring compliance with U.S. tax regulations. This form helps in avoiding penalties and facilitates smooth international transactions.

-

How can airSlate SignNow assist with completing Form 1042 S?

airSlate SignNow provides an efficient platform for businesses to electronically sign and share Form 1042 S. With our easy-to-use interface, you can quickly fill out, send, and eSign your forms securely. This simplifies the process, saves time, and ensures that all necessary approvals are obtained efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 1042 S?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective while providing all necessary features for managing Form 1042 S and other documents. You can choose a plan based on your signing frequency and specific requirements.

-

What features does airSlate SignNow offer for managing Form 1042 S?

airSlate SignNow offers features such as customizable templates, in-app collaboration, and secure cloud storage specifically for managing Form 1042 S. Our platform also includes automated reminders and status tracking, ensuring that you never miss a deadline. These features empower your team to work efficiently and remain compliant.

-

Can I integrate airSlate SignNow with other applications for Form 1042 S processing?

Yes, airSlate SignNow supports integration with various applications like CRM systems, accounting software, and cloud storage services. This enables seamless data transfer and promotes a streamlined workflow for processing Form 1042 S. Integrating SignNow enhances efficiency and reduces the possibility of errors.

-

What are the benefits of using airSlate SignNow for Form 1042 S?

Using airSlate SignNow for Form 1042 S provides numerous benefits, including increased speed and efficiency in document handling. You can ensure that your forms are signed and returned quickly, which improves overall compliance with tax regulations. Additionally, our electronic solutions reduce paper waste and administrative costs.

-

How secure is the data shared through airSlate SignNow for Form 1042 S?

AirSlate SignNow prioritizes the security of your documents. Our platform uses advanced encryption to protect data shared while processing Form 1042 S. We also implement strict authentication measures to ensure that only authorized users have access to sensitive information.

Get more for Form 1042 S

Find out other Form 1042 S

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service