Irs 1040nr Ez Form 2010

What is the IRS 1040NR EZ Form

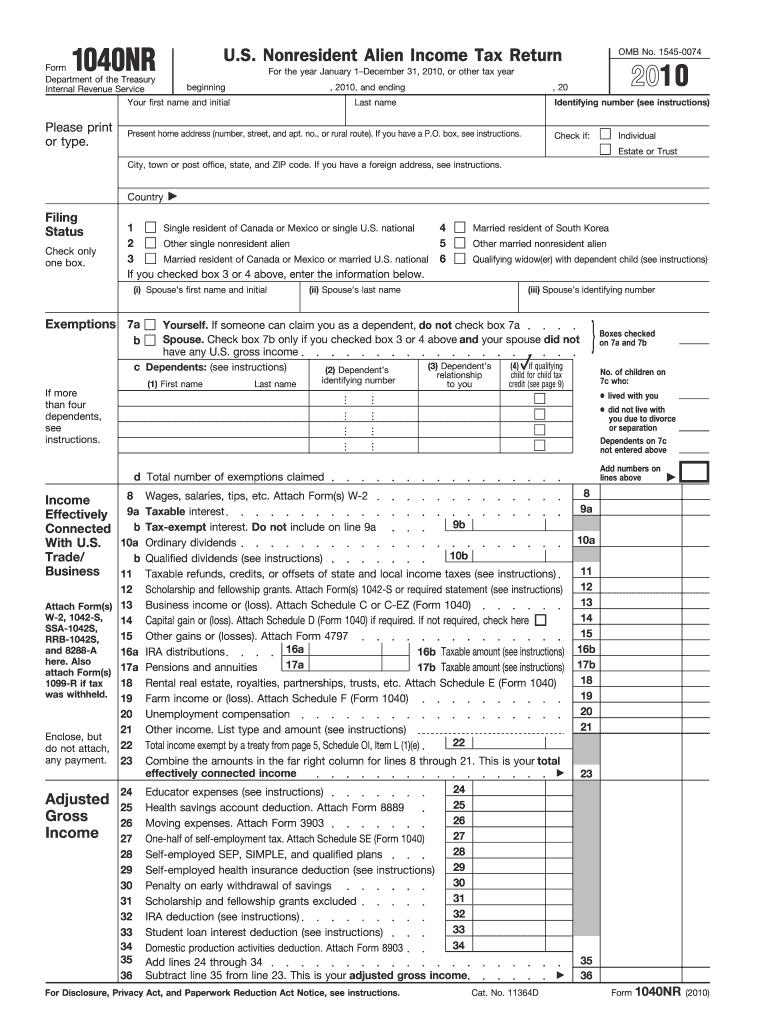

The IRS 1040NR EZ Form is a simplified tax return specifically designed for non-resident aliens in the United States. This form allows eligible individuals to report their income and calculate their tax liability efficiently. Unlike the standard 1040 form, the 1040NR EZ is streamlined, making it easier for those who meet specific criteria to file their taxes. It is primarily used by individuals who do not have dependents and who earn income solely from U.S. sources, such as wages or scholarships.

How to Use the IRS 1040NR EZ Form

To use the IRS 1040NR EZ Form, individuals must first ensure they meet the eligibility requirements. Once confirmed, they can obtain the form from the IRS website or authorized distributors. The form requires personal information, including name, address, and taxpayer identification number. After filling out the necessary sections, individuals should review their entries for accuracy. Finally, the completed form can be submitted either electronically or by mail, depending on the taxpayer's preference.

Steps to Complete the IRS 1040NR EZ Form

Completing the IRS 1040NR EZ Form involves several key steps:

- Gather all required documents, such as W-2 forms and any other income statements.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Report your income in the designated sections, ensuring accuracy in the amounts entered.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to validate your submission.

Legal Use of the IRS 1040NR EZ Form

The IRS 1040NR EZ Form is legally recognized for tax filing purposes for non-resident aliens. To ensure compliance, it is essential to follow IRS guidelines and accurately report all income earned within the U.S. The form must be submitted by the designated filing deadline to avoid penalties. Additionally, using a reliable eSignature solution can enhance the legitimacy of the submission, ensuring that all signatures are valid and compliant with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 1040NR EZ Form typically fall on April 15 for most taxpayers. However, non-resident aliens may have different deadlines depending on their specific circumstances. It is crucial to check the IRS website for the most current information regarding filing dates and any extensions that may apply. Missing the deadline can result in penalties and interest on any taxes owed.

Required Documents

When completing the IRS 1040NR EZ Form, several documents are necessary to ensure accurate reporting:

- W-2 forms from employers, detailing wages earned.

- Form 1042-S for income received from U.S. sources that may be subject to withholding.

- Any additional income statements that reflect earnings during the tax year.

- Identification documents, such as a passport or visa, to verify non-resident status.

Quick guide on how to complete irs 1040nr ez 2010 form

Effortlessly Prepare Irs 1040nr Ez Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them in the cloud. airSlate SignNow provides all the essential features to create, edit, and electronically sign your documents swiftly and efficiently. Handle Irs 1040nr Ez Form on any device using the airSlate SignNow apps available for Android and iOS, and simplify your document-related tasks today.

Steps to Edit and Electronically Sign Irs 1040nr Ez Form Effortlessly

- Locate Irs 1040nr Ez Form and click on Get Form to start.

- Make use of the tools available to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information using the specific tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to share the form via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting documents. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Irs 1040nr Ez Form to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1040nr ez 2010 form

Create this form in 5 minutes!

How to create an eSignature for the irs 1040nr ez 2010 form

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the IRS 1040NR EZ Form?

The IRS 1040NR EZ Form is a simplified tax return form designed for non-resident aliens who earn income from U.S. sources. This form allows individuals to easily report their income and claim withheld taxes. It's an efficient option for eligible non-residents looking to streamline their tax filing process.

-

Who is eligible to use the IRS 1040NR EZ Form?

Eligibility for the IRS 1040NR EZ Form is limited to non-resident aliens who meet specific criteria, including limited types of income and specific filing statuses. Generally, eligible individuals are those without dependents and who are not married filing jointly. Understanding these criteria ensures you can efficiently file your taxes.

-

How can airSlate SignNow help with the IRS 1040NR EZ Form?

AirSlate SignNow offers a user-friendly platform to electronically sign and send your IRS 1040NR EZ Form. Our solution simplifies document management, allowing you to prepare, sign, and submit your tax forms securely and quickly. This ensures a hassle-free compliance experience for non-resident taxpayers.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to meet different needs for businesses and individuals managing IRS 1040NR EZ Forms. Pricing starts at a competitive rate, with features designed to simplify document signing and management. Explore our website to find the best plan that suits your tax filing needs.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is compliant with all necessary regulations, making it a secure choice for handling IRS 1040NR EZ Forms. Our platform adheres to the latest standards for electronic signatures and document security, ensuring that your tax documents are processed lawfully and efficiently. You can trust our solution for all your eSigning needs.

-

Can I integrate airSlate SignNow with accounting software for my IRS 1040NR EZ Form?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting software, making it easy to manage your IRS 1040NR EZ Form directly from your preferred platform. This functionality enhances your workflow, ensuring that document preparation and filing is streamlined and efficient.

-

What benefits does airSlate SignNow provide for non-resident aliens filing the IRS 1040NR EZ Form?

AirSlate SignNow provides key benefits, including improved efficiency and document security for non-resident aliens filing the IRS 1040NR EZ Form. Our platform makes it simple to collect signatures, track submissions, and manage documents digitally. This translates into a more organized tax filing process for busy professionals.

Get more for Irs 1040nr Ez Form

- Purchase order request northwest area school district northwest k12 pa form

- Pakeys form

- Application welcome letter york township fire ytfd form

- Extended trip application girl scouts of eastern pennsylvania gsep form

- Interstate adsap form

- Preincident survey form

- The american legion educator of the year award program guide the american legion department of south dakota p sdlegion form

- Facility specification standards modification request form sf k12 sd

Find out other Irs 1040nr Ez Form

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free