6251 Instructions Form 2014

What is the 6251 Instructions Form

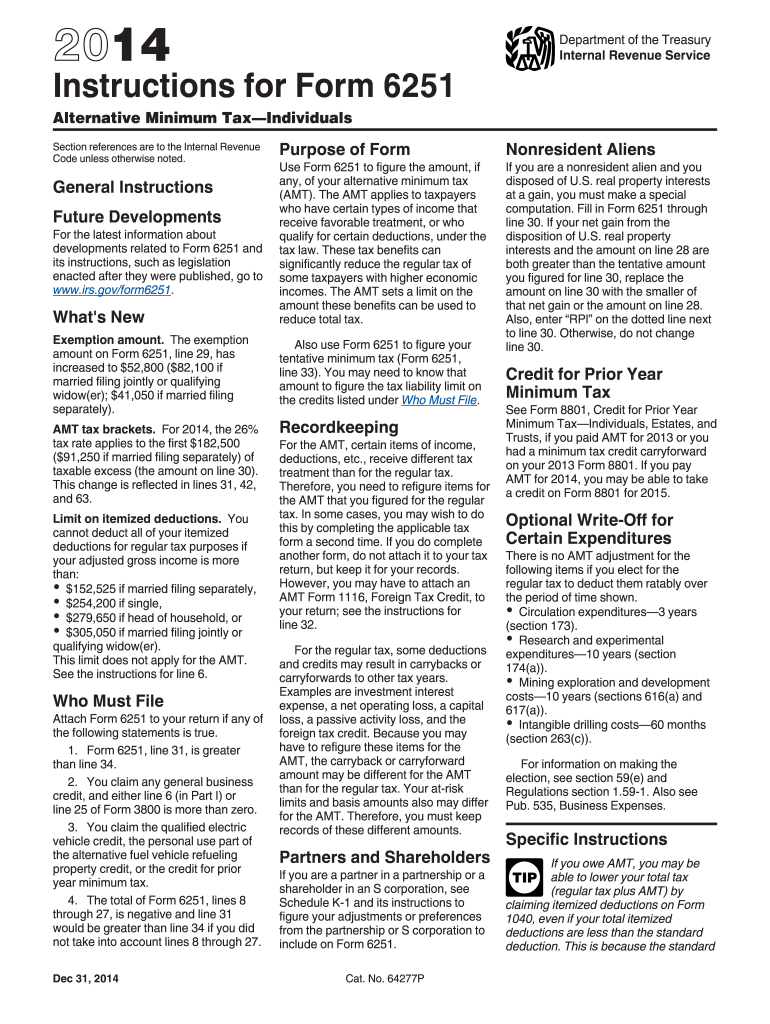

The 6251 Instructions Form is a crucial document used by taxpayers in the United States to report and calculate the Alternative Minimum Tax (AMT). This form provides guidance on how to complete the related tax form, ensuring that taxpayers understand their obligations under the AMT rules. The instructions cover various aspects, including income adjustments, deductions, and credits that may affect the AMT calculation. Understanding this form is essential for individuals and businesses alike, as it helps ensure compliance with federal tax regulations.

How to use the 6251 Instructions Form

Using the 6251 Instructions Form involves several steps to accurately report your tax information. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, follow the instructions carefully to determine if you are subject to the AMT. The form outlines specific calculations to assess your income and allowable deductions, which can be complex. It is advisable to read each section thoroughly to ensure that you are applying the correct figures and following the guidelines accurately.

Steps to complete the 6251 Instructions Form

Completing the 6251 Instructions Form requires a systematic approach. First, review your standard tax return to identify your total income. Then, adjust this figure according to the AMT rules, which may involve adding back certain deductions. Next, calculate your AMT taxable income by following the detailed steps outlined in the instructions. After determining your AMT liability, you will need to compare it with your regular tax liability to see if you owe additional taxes. Finally, ensure that all calculations are correct before submitting the form.

Legal use of the 6251 Instructions Form

The legal use of the 6251 Instructions Form is governed by IRS regulations. It is essential to complete the form accurately and submit it by the designated deadlines to avoid penalties. The form must be filed along with your annual tax return if you are subject to the AMT. Compliance with the guidelines ensures that your tax obligations are met and protects you from potential audits or legal issues. Using electronic filing methods can also enhance the accuracy and security of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the 6251 Instructions Form align with the standard tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of each year. If you require additional time, you may file for an extension, which usually grants you until October 15 to submit your return. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these dates is crucial for maintaining compliance with IRS regulations.

Required Documents

To complete the 6251 Instructions Form, several documents are necessary. You will need your W-2 forms, 1099 forms, and any other income statements that reflect your earnings for the year. Additionally, gather documentation for any deductions you plan to claim, such as mortgage interest statements, property tax receipts, and records of charitable contributions. Having these documents on hand will facilitate the completion of the form and help ensure that all information is accurate and up-to-date.

IRS Guidelines

The IRS provides specific guidelines for completing the 6251 Instructions Form, which are essential for ensuring compliance. These guidelines include detailed instructions on how to calculate your AMT, what income to report, and which deductions are permissible. It is important to refer to the latest IRS publications and updates regarding the AMT to stay informed about any changes in tax law that may affect your filing. Adhering to these guidelines helps prevent errors and potential issues with your tax return.

Quick guide on how to complete 2014 6251 instructions form

Effortlessly Prepare 6251 Instructions Form on Any Device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you all the tools required to create, modify, and eSign your documents quickly without delays. Manage 6251 Instructions Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to Modify and eSign 6251 Instructions Form with Ease

- Locate 6251 Instructions Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign 6251 Instructions Form and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 6251 instructions form

Create this form in 5 minutes!

How to create an eSignature for the 2014 6251 instructions form

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 6251 Instructions Form?

The 6251 Instructions Form provides guidance for individuals to calculate their alternative minimum tax (AMT). This form is crucial for understanding your tax obligations and ensuring compliance with IRS regulations. By following the detailed instructions, you can accurately complete your tax documentation regarding AMT.

-

How can airSlate SignNow assist with completing the 6251 Instructions Form?

airSlate SignNow simplifies the process of signing and sending the 6251 Instructions Form. With our user-friendly interface, you can easily upload and manage your tax documents, ensuring a smooth eSignature experience. This can save you time and reduce errors in completing important tax forms.

-

Are there any costs associated with using airSlate SignNow for the 6251 Instructions Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs. These plans include features that streamline the management of documents, including tax forms like the 6251 Instructions Form. It's a cost-effective solution designed to enhance your efficiency.

-

What features does airSlate SignNow provide for managing the 6251 Instructions Form?

With airSlate SignNow, you can easily create, manage, and digitally sign the 6251 Instructions Form. Key features include customizable templates, audit trails, and integration with popular cloud storage services. These functionalities ensure you can handle your tax documentation efficiently.

-

Can I integrate airSlate SignNow with other software for handling the 6251 Instructions Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to complete the 6251 Instructions Form. This includes popular tools for accounting, document management, and cloud storage, helping you streamline workflows.

-

What are the benefits of using airSlate SignNow for tax-related documents like the 6251 Instructions Form?

The primary benefits of using airSlate SignNow for your tax-related documents, including the 6251 Instructions Form, are speed and efficiency. Our platform enables you to sign documents quickly, track their statuses, and access them on the go. This helps reduce the stress often associated with tax season.

-

Is airSlate SignNow secure for managing sensitive documents like the 6251 Instructions Form?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption and multi-factor authentication to protect your sensitive documents, including the 6251 Instructions Form. This ensures your personal and financial information remains confidential and secure.

Get more for 6251 Instructions Form

- Telemedicine informed form

- Periodic medical questionnaire allone health form

- Domestic violence dv screeningdocumentation form

- Aetnaenrollment form

- New patient info barry brace dmd ampamp associates form

- Iodp jrso expedition participant medical information packet

- Underwrllten in federal insurance company or vigilant insurance company form

- I understand my health record is private and is known under the law as protected health information phi

Find out other 6251 Instructions Form

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will