Schedule M1R Sequence #14 Age 65 or OlderDisabled Subtraction Before You Complete This Schedule, Read the Instructions on the Ba Form

Understanding Schedule M1R Sequence #14 for Seniors and Disabled Individuals

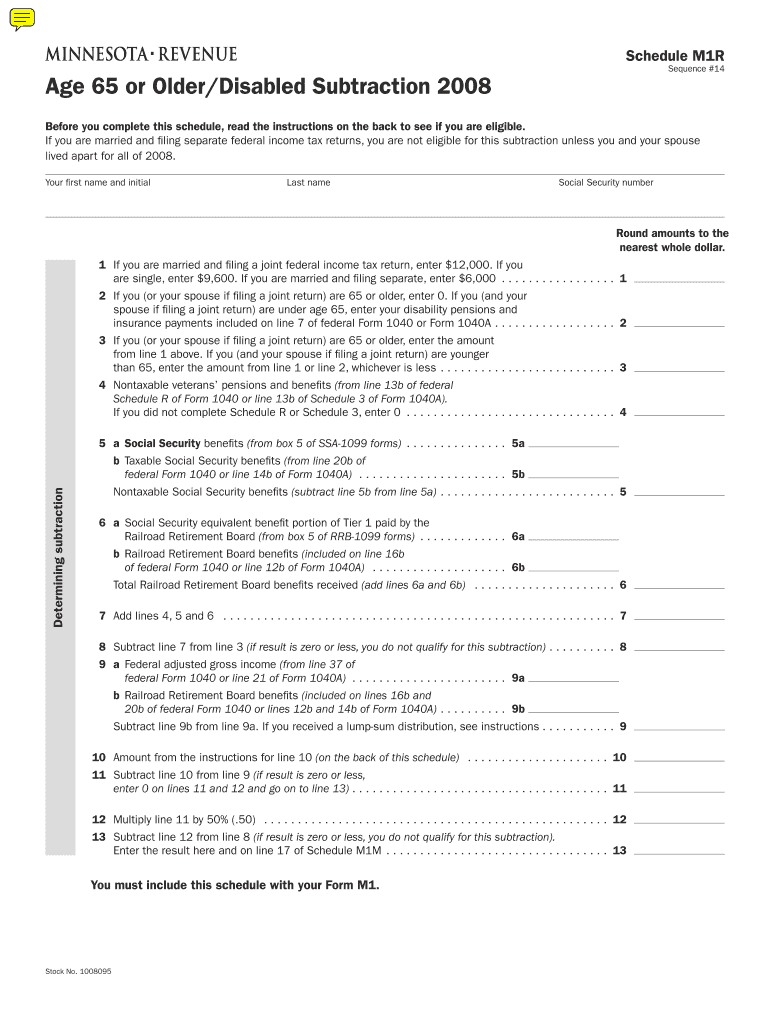

The Schedule M1R Sequence #14 is specifically designed for taxpayers aged 65 or older and individuals with disabilities. This form allows eligible individuals to claim a subtraction on their Minnesota tax return, which can significantly reduce their taxable income. Before filling out this schedule, it is essential to review the instructions provided on the back of the form to determine eligibility. This ensures that you meet all necessary criteria and can benefit from the available tax relief.

Steps to Complete Schedule M1R Sequence #14

Completing the Schedule M1R Sequence #14 involves several key steps:

- Gather all necessary documents, including your tax return and any relevant financial statements.

- Review the eligibility criteria outlined in the instructions to confirm you qualify for the subtraction.

- Fill out the required sections of the form accurately, ensuring all information matches your financial records.

- Double-check your calculations to avoid errors that could delay processing or lead to penalties.

- Submit the completed form along with your tax return by the appropriate deadline.

Eligibility Criteria for Schedule M1R Sequence #14

To qualify for the Schedule M1R Sequence #14 subtraction, you must meet specific eligibility criteria:

- You must be aged 65 or older as of December 31 of the tax year.

- You must be classified as disabled according to the definitions provided by the IRS.

- Your income must fall within the limits set forth in the instructions for the current tax year.

- Residency in Minnesota for the entire tax year is required.

Required Documents for Schedule M1R Sequence #14

When preparing to complete the Schedule M1R Sequence #14, ensure you have the following documents:

- Your most recent Minnesota tax return.

- Proof of age or disability, such as a birth certificate or Social Security documentation.

- Any additional financial documentation required to support your claims, including income statements.

Form Submission Methods for Schedule M1R Sequence #14

You can submit the Schedule M1R Sequence #14 in several ways:

- Online submission through the Minnesota Department of Revenue’s e-filing system.

- Mailing the completed form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, if available.

IRS Guidelines for Schedule M1R Sequence #14

It is crucial to adhere to IRS guidelines when completing the Schedule M1R Sequence #14. This includes following the instructions for eligibility, ensuring accurate reporting of income, and understanding the implications of the subtraction on your overall tax situation. Familiarity with IRS regulations helps in avoiding mistakes that could lead to audits or penalties.

Quick guide on how to complete schedule m1r sequence 14 age 65 or olderdisabled subtraction before you complete this schedule read the instructions on the

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as it allows you to access the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly and without hindrances. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign [SKS] seamlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or redact sensitive data with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

Create this form in 5 minutes!

How to create an eSignature for the schedule m1r sequence 14 age 65 or olderdisabled subtraction before you complete this schedule read the instructions on the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction?

The Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction is a tax form designed for individuals aged 65 or older who are disabled. It allows eligible taxpayers to subtract a specific amount from their taxable income. Before you complete this schedule, read the instructions on the back to see if you are eligible.

-

How can I determine my eligibility for the Schedule M1R Sequence #14?

To determine your eligibility for the Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction, you should review the instructions provided on the back of the form. These instructions outline the criteria you must meet to qualify for the subtraction. It's essential to ensure you meet all requirements before proceeding.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features for document signing, including customizable templates, real-time tracking, and secure cloud storage. These features streamline the signing process, making it easy for users to manage their documents efficiently. With airSlate SignNow, you can focus on completing your Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction without hassle.

-

Is there a cost associated with using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The plans are designed to be cost-effective while providing essential features for document management and eSigning. Investing in airSlate SignNow can simplify your process for completing the Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with various applications, enhancing your workflow. Whether you use CRM systems, cloud storage, or other business tools, integrating airSlate SignNow can help you manage your documents more effectively, especially when dealing with the Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows you to eSign documents quickly and securely, ensuring that you can complete your Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction without delays. This can save you time and reduce stress during tax season.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure cloud storage. This ensures that your sensitive information, such as that related to the Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction, remains confidential and secure. You can trust airSlate SignNow to keep your documents safe.

Get more for Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

Find out other Schedule M1R Sequence #14 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document