Form W 9 2005

What is the Form W-9

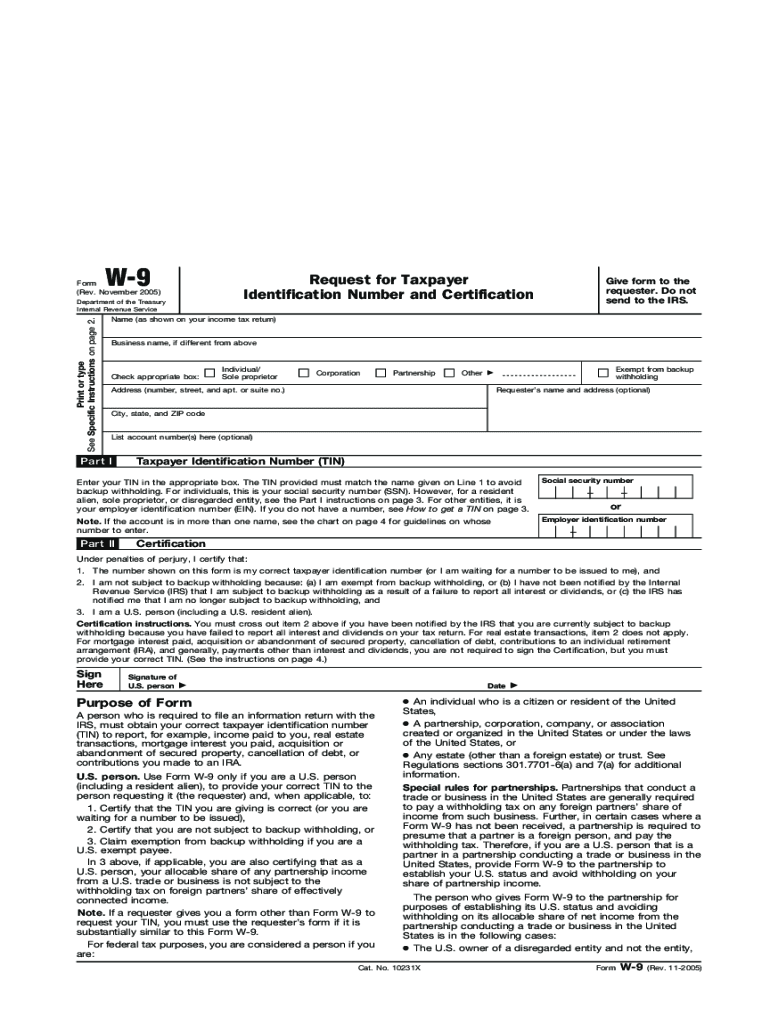

The Form W-9 is an official document used in the United States by individuals and entities to provide their taxpayer identification information to others. This form is essential for businesses that need to report payments made to contractors, freelancers, or other service providers. By completing the W-9, the requester can accurately report income to the IRS, ensuring compliance with tax regulations. The form requires the individual’s name, business name (if applicable), address, and taxpayer identification number, which can be a Social Security Number or Employer Identification Number.

Steps to complete the Form W-9

Completing the Form W-9 involves several straightforward steps:

- Begin by entering your name as it appears on your tax return.

- If applicable, provide your business name in the designated field.

- Fill in your address, ensuring it matches the address on your tax return.

- Indicate your taxpayer identification number, either your Social Security Number or Employer Identification Number.

- Certify your information by signing and dating the form.

It is crucial to ensure the accuracy of the information provided, as errors may lead to tax complications.

How to obtain the Form W-9

The Form W-9 can be easily obtained from the IRS website or through various tax preparation software. It is available as a downloadable PDF, which you can print and fill out. Additionally, many businesses may provide their own copies of the W-9 for contractors to complete. When requesting the form, ensure you are using the most current version to avoid any compliance issues.

Legal use of the Form W-9

The legal use of the Form W-9 is primarily for tax reporting purposes. It is used by businesses to collect taxpayer information necessary for reporting payments made to independent contractors and freelancers. The information provided on the form must be accurate and truthful, as submitting false information can lead to penalties from the IRS. The form also serves as a means for the requester to ensure they are not subject to backup withholding.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Form W-9. It is important to follow these guidelines to ensure compliance. The form should be completed when requested by a business or individual who will be making payments to you. The IRS advises that the W-9 should not be sent directly to them but rather kept on file by the requester for their records. Additionally, if there are any changes in your information, such as a name change or change in taxpayer identification number, a new W-9 should be submitted to the requester.

Penalties for Non-Compliance

Failing to provide accurate information on the Form W-9 can lead to significant penalties. If the IRS determines that you have provided incorrect information, you may be subject to backup withholding, where a portion of your payments is withheld for tax purposes. Additionally, there can be fines for failing to provide the form when required. It is essential to ensure all information is correct and submitted in a timely manner to avoid these penalties.

Quick guide on how to complete 2005 form w 9

Effortlessly Prepare Form W 9 on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools needed to generate, edit, and eSign your documents quickly and without delays. Manage Form W 9 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form W 9 with ease

- Obtain Form W 9 and click Get Form to begin.

- Utilize the features we provide to submit your form.

- Emphasize relevant parts of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you select. Modify and eSign Form W 9 and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2005 form w 9

Create this form in 5 minutes!

How to create an eSignature for the 2005 form w 9

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the 2005 W 9 blank form used for?

The 2005 W 9 blank form is used by businesses to request taxpayer identification information from individuals or entities. It is essential for accurate tax reporting and helps ensure compliance with IRS regulations.

-

How can I fill out a 2005 W 9 blank form using airSlate SignNow?

You can easily fill out a 2005 W 9 blank form using airSlate SignNow by uploading the document and utilizing our intuitive editing tools. This allows you to complete all necessary fields and prepare the form for electronic signatures.

-

Is airSlate SignNow compatible with the 2005 W 9 blank form?

Yes, airSlate SignNow is fully compatible with the 2005 W 9 blank form. Our platform supports various document formats, making it easy to import, manage, and eSign your forms seamlessly.

-

What features does airSlate SignNow offer for managing the 2005 W 9 blank form?

airSlate SignNow provides features such as customizable templates, electronic signatures, document tracking, and secure storage for managing the 2005 W 9 blank form. These tools enhance efficiency and ensure that your documents are always accessible.

-

What are the benefits of using airSlate SignNow for the 2005 W 9 blank form?

Using airSlate SignNow for the 2005 W 9 blank form offers several benefits, including time savings, reduced paperwork, and enhanced compliance. The platform streamlines the eSigning process, making it easier to manage tax-related documents.

-

What pricing plans does airSlate SignNow offer for accessing features related to the 2005 W 9 blank form?

AirSlate SignNow offers various pricing plans to accommodate different business needs, including plans that provide full access to features related to the 2005 W 9 blank form. You can choose a plan that best fits your usage and budget.

-

Can airSlate SignNow integrate with other software for processing the 2005 W 9 blank form?

Yes, airSlate SignNow integrates smoothly with various software applications, enhancing your workflow for processing the 2005 W 9 blank form. Our integrations with popular tools streamline document management and keep your processes efficient.

Get more for Form W 9

- Intake demographic form

- 19 payment waiver and agreement formdoc

- Dr gregory hrasky mdmesa az 85202pediatric form

- Client information sheet

- Snap adhd form

- Acenewpatientform new

- Columbus otolaryngology clinic adult registration forms accident or injury contains the forms required by the columbus

- Handydart application form

Find out other Form W 9

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile