Instructions 1098 Form 2016

What is the Instructions 1098 Form

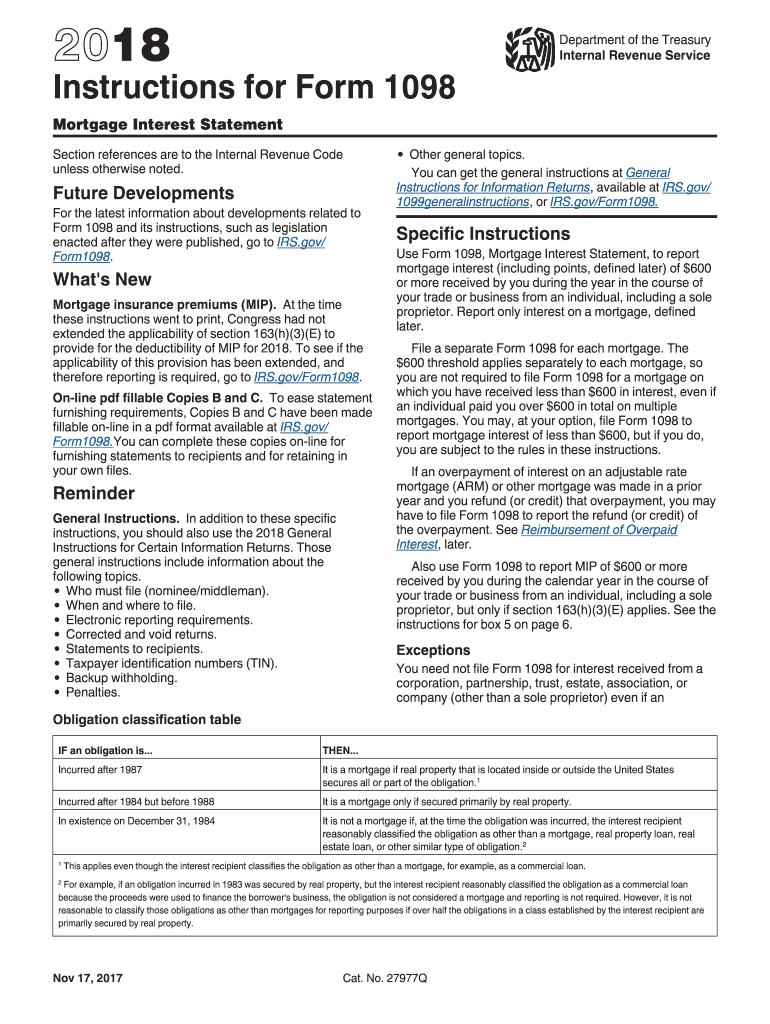

The Instructions 1098 Form is a crucial document used in the United States for reporting mortgage interest payments. This form is typically issued by lenders to borrowers who have paid interest on a mortgage during the tax year. It provides essential information needed for taxpayers to accurately report their mortgage interest deductions on their tax returns. The form includes details such as the amount of interest paid, the outstanding mortgage balance, and the property address associated with the loan.

How to use the Instructions 1098 Form

Using the Instructions 1098 Form involves several steps to ensure accurate reporting of mortgage interest. First, taxpayers should receive the form from their mortgage lender, usually by the end of January each year. Once received, review the form for accuracy, ensuring that all details, such as the interest amount and property address, are correct. This information will be necessary when completing your tax return, particularly when claiming deductions for mortgage interest on Schedule A of Form 1040.

Steps to complete the Instructions 1098 Form

Completing the Instructions 1098 Form requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including previous tax returns and any additional mortgage statements.

- Verify the information on the form, checking the interest amount and ensuring it matches your records.

- Fill out your tax return, using the information from the Instructions 1098 Form to claim the mortgage interest deduction.

- Keep a copy of the form for your records, as it may be needed for future reference or audits.

Legal use of the Instructions 1098 Form

The Instructions 1098 Form is legally binding and must be accurately completed to comply with IRS regulations. Taxpayers are responsible for ensuring that the information reported on their tax returns aligns with the details provided on the form. Misreporting or failing to include the mortgage interest deduction can lead to penalties or increased scrutiny from the IRS. It is essential to maintain accurate records and consult with a tax professional if there are any uncertainties regarding the use of this form.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Instructions 1098 Form is vital for compliance. Typically, lenders must send out the form to borrowers by January 31. Taxpayers should ensure they have received their form by this date to prepare their tax returns accurately. The deadline for filing individual tax returns is usually April 15, unless an extension is requested. Being aware of these dates helps taxpayers avoid late penalties and ensures timely submission of their tax documents.

Who Issues the Form

The Instructions 1098 Form is issued by mortgage lenders or financial institutions that hold the mortgage. This includes banks, credit unions, and other lending organizations. It is important for borrowers to keep in contact with their lenders to ensure they receive the form in a timely manner, as it is essential for accurate tax reporting. If a borrower does not receive the form, they should reach out to their lender to obtain the necessary information.

Quick guide on how to complete 2016 instructions 1098 form

Complete Instructions 1098 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without any setbacks. Manage Instructions 1098 Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Instructions 1098 Form without hassle

- Obtain Instructions 1098 Form and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, monotonous form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and electronically sign Instructions 1098 Form and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 instructions 1098 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 instructions 1098 form

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What are the Instructions 1098 Form guidelines?

The Instructions 1098 Form provide essential details on how to fill out and submit this important tax document. These guidelines include the required information, submission deadlines, and any penalties for late filing. Understanding these instructions will ensure you accurately report mortgage interest payments when required.

-

How can airSlate SignNow help me with the Instructions 1098 Form?

airSlate SignNow simplifies the process of completing the Instructions 1098 Form by providing an easy-to-use eSignature platform. Users can quickly upload their forms, complete the necessary fields, and securely eSign documents. This streamlines the submission process, reducing errors and saving time.

-

Is there a cost associated with using airSlate SignNow for Instructions 1098 Form processing?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs when processing Instructions 1098 Form. Each plan provides a range of features, including document editing, eSigning capabilities, and cloud storage. Ultimately, the cost depends on the level of service required and the number of users.

-

What features does airSlate SignNow offer for Instructions 1098 Form preparation?

airSlate SignNow includes features such as customizable templates for the Instructions 1098 Form, secure eSigning, and document sharing options. Users can also track the status of their forms and manage multiple documents efficiently. These features enhance the overall experience of preparing tax documents.

-

Can I integrate airSlate SignNow with other applications for Instructions 1098 Form?

Yes, airSlate SignNow offers integrations with various applications that can facilitate the processing of Instructions 1098 Form. This includes accounting software and document management systems, which enhance workflow efficiency. By integrating these tools, you can streamline the entire process from preparation to filing.

-

What are the benefits of using airSlate SignNow for Instructions 1098 Form management?

Using airSlate SignNow for Instructions 1098 Form management offers time savings, increased accuracy, and enhanced security. The platform's easy-to-use interface reduces the likelihood of errors, while secure eSigning ensures that your documents are safely transmitted. Additionally, you can access your forms anytime, anywhere, providing you with great flexibility.

-

How do I get started with airSlate SignNow for Instructions 1098 Form?

To get started with airSlate SignNow for Instructions 1098 Form, simply sign up for an account on our website. After setting up your profile, you can access templates and tools specifically designed for tax document preparation. Our user-friendly interface makes it easy to get acquainted with the platform's functionalities quickly.

Get more for Instructions 1098 Form

- Salib lhd salib oncology form

- First appointment instructions valencia agnew form

- History authorization form

- Medicationsnamedosage form

- Safe travels accidental death and dismemberment claim form safe travels accidental death and dismemberment claim form

- Beneficiary designation form nebco

- Intake inquiry packet form

- Customs clearance services csaci form

Find out other Instructions 1098 Form

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document