Form 3520 2011

What is the Form 3520

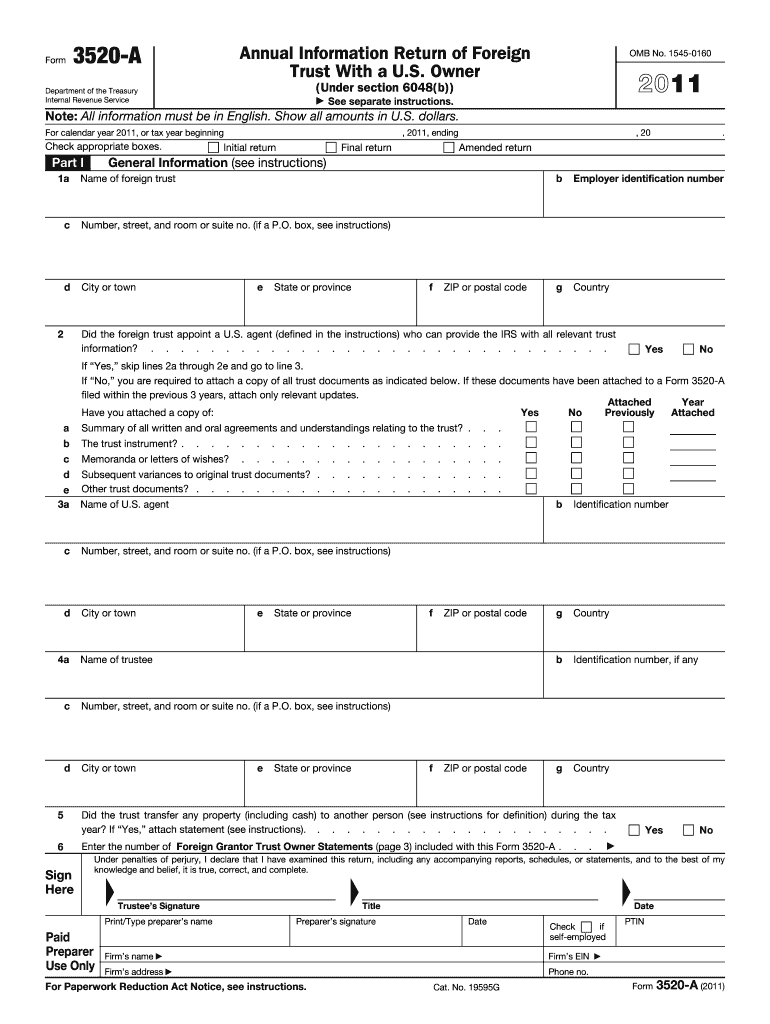

The Form 3520 is a tax document required by the Internal Revenue Service (IRS) for U.S. taxpayers who receive certain foreign gifts or inheritances, or who have transactions with foreign trusts. This form serves to report these transactions to ensure compliance with U.S. tax laws. The IRS uses the information provided on the Form 3520 to monitor and assess any potential tax liabilities associated with foreign assets and income.

How to use the Form 3520

Using the Form 3520 involves understanding the specific requirements for reporting foreign gifts, inheritances, and trusts. Taxpayers must accurately fill out the form, providing details about the foreign entities involved and the amounts received. It is important to follow the IRS guidelines closely to avoid penalties. The form can be filed separately or included with your annual tax return, depending on the circumstances surrounding the foreign transactions.

Steps to complete the Form 3520

Completing the Form 3520 requires several steps:

- Gather all necessary information regarding the foreign gift or trust.

- Fill out the taxpayer identification information, including name, address, and Social Security number.

- Provide details about the foreign trust or the donor of the gift, including their name and address.

- Report the amount received and the nature of the transaction.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The Form 3520 must be filed by the due date of your income tax return, including extensions. Generally, this means it is due on April 15 for most taxpayers. If you need additional time, you can request an extension, but it is crucial to file the form by the extended deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 3520 when required can result in significant penalties. The IRS imposes a penalty of five percent of the amount of the foreign gift or inheritance for each month the form is late, up to a maximum of 25 percent. Additionally, if the IRS deems the failure to be willful, the penalties can be even more severe. It is essential to ensure timely and accurate filing to avoid these consequences.

Legal use of the Form 3520

The legal use of the Form 3520 is governed by U.S. tax laws, which require transparency regarding foreign financial transactions. Proper use of this form helps taxpayers comply with regulations and avoid legal issues related to tax evasion. Understanding the legal implications of the information reported on the Form 3520 is crucial for maintaining compliance with IRS requirements.

Quick guide on how to complete 2011 form 3520

Complete Form 3520 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, enabling you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Manage Form 3520 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and eSign Form 3520 effortlessly

- Locate Form 3520 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your chosen device. Edit and eSign Form 3520 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 3520

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 3520

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Form 3520 and who needs to file it?

Form 3520 is an IRS form required for U.S. taxpayers to report transactions with foreign trusts, ownership of foreign trusts, or receipt of foreign gifts. Individuals meeting these criteria must file Form 3520 to avoid penalties and ensure compliance with tax obligations.

-

How can airSlate SignNow help with signing Form 3520?

airSlate SignNow provides an easy-to-use platform that allows users to electronically sign Form 3520 securely and efficiently. With its intuitive interface, you can complete and send your documents for eSignature without hassle, ensuring timely submission to the IRS.

-

What are the pricing options for using airSlate SignNow for Form 3520?

airSlate SignNow offers various pricing plans tailored to fit different needs and budgets. Whether you are a small business or a large enterprise, you can choose a plan that provides the necessary features to manage documents like Form 3520 efficiently.

-

Are there any features in airSlate SignNow specifically beneficial for Form 3520?

Yes, airSlate SignNow includes features like customizable templates and tracking capabilities that simplify the process of preparing and signing Form 3520. These tools ensure accuracy and help keep all parties informed about the document's status.

-

Is airSlate SignNow compliant with IRS regulations for Form 3520?

Absolutely! airSlate SignNow complies with all necessary legal standards and encryption protocols, making it a secure choice for signing Form 3520. You can confidently manage your tax documents, knowing they are handled with the highest level of security.

-

Can I integrate airSlate SignNow with other tools for managing Form 3520?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive and Dropbox, allowing you to manage Form 3520 and other documents in one central location. This integration streamlines your workflow and enhances productivity.

-

What benefits does eSigning Form 3520 offer over traditional signing methods?

eSigning Form 3520 through airSlate SignNow is faster, more convenient, and environmentally friendly compared to traditional methods. It eliminates the need for printing or mailing documents, ensuring that your filing is efficient and timeliness is maintained.

Get more for Form 3520

- Addressname change inactive non retired members erfc 29a form

- Horse riding release form

- Teacher reference form

- Kes pta nominating committee flyer 3 15docx form

- School records release form date requested as the parent stowe k12 vt

- Washington state patrol background check form solid ground solid ground

- Wcdjfs form

- Well being index form

Find out other Form 3520

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free