Report on Value Lost because of School District Participation Form

What is the Report On Value Lost Because Of School District Participation

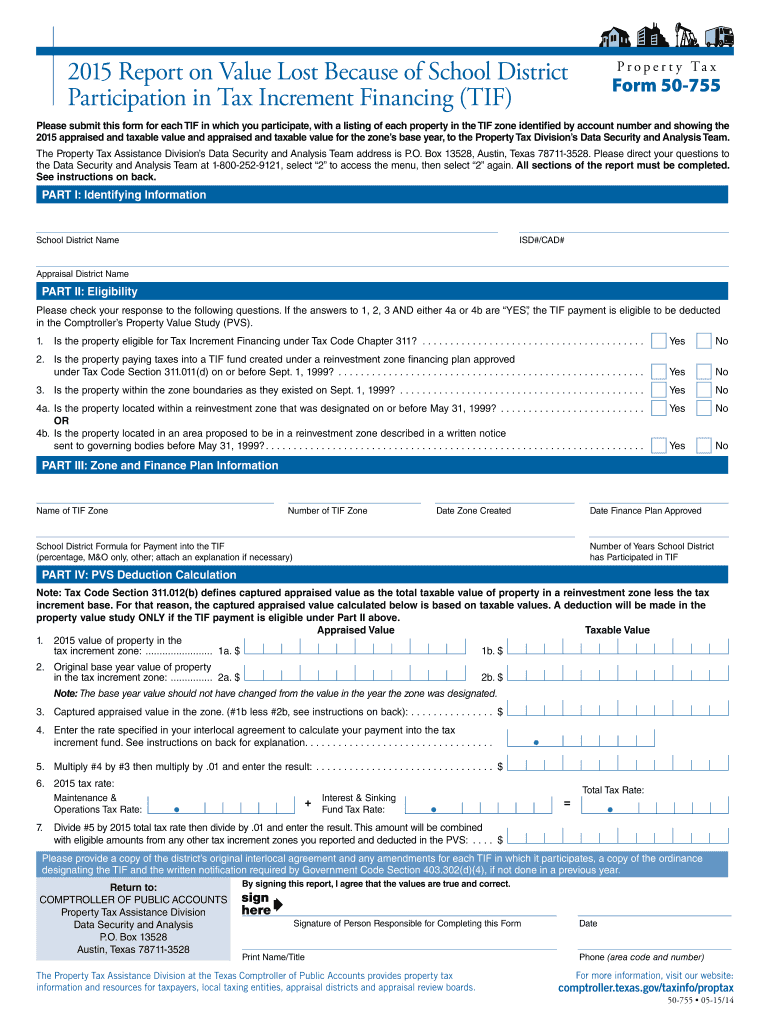

The Report On Value Lost Because Of School District Participation is a formal document that assesses the financial impact of a school district's involvement in various programs or initiatives. This report is crucial for understanding how participation can affect funding, resource allocation, and overall educational quality. It typically includes data on lost revenue opportunities, potential funding cuts, and the economic implications for both the district and the community it serves.

How to use the Report On Value Lost Because Of School District Participation

This report can be utilized by school administrators, policymakers, and community stakeholders to evaluate the financial ramifications of school district participation in specific programs. By analyzing the data presented in the report, users can make informed decisions regarding future participation, budget adjustments, and resource management. It serves as a tool for advocacy, enabling stakeholders to present a case for or against certain programs based on their financial impact.

Steps to complete the Report On Value Lost Because Of School District Participation

Completing the Report On Value Lost Because Of School District Participation involves several key steps:

- Gather relevant financial data, including budgets and funding sources.

- Identify the specific programs or initiatives under review.

- Analyze the potential financial impacts of participation, including lost revenue and costs incurred.

- Compile findings into a structured report format, ensuring clarity and accuracy.

- Review the report with stakeholders for feedback and necessary adjustments.

Key elements of the Report On Value Lost Because Of School District Participation

Essential components of the report include:

- Executive Summary: A brief overview of findings and recommendations.

- Financial Analysis: Detailed breakdown of costs and lost revenue opportunities.

- Impact Assessment: Evaluation of how participation affects educational outcomes.

- Recommendations: Suggestions for future actions based on the analysis.

Legal use of the Report On Value Lost Because Of School District Participation

The report must comply with relevant federal and state regulations regarding educational funding and transparency. It is essential that the data presented is accurate and verifiable to avoid legal repercussions. Additionally, stakeholders should ensure that the report is accessible to the public as part of transparency initiatives, fostering trust and accountability within the community.

Examples of using the Report On Value Lost Because Of School District Participation

Examples of practical applications of this report include:

- Assessing the impact of a new educational program on district finances.

- Evaluating the financial consequences of withdrawing from a state-funded initiative.

- Providing evidence for budget requests to local government bodies.

Quick guide on how to complete report on value lost because of school district participation

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly and without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Alter and eSign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specially provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to secure your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Report On Value Lost Because Of School District Participation

Create this form in 5 minutes!

How to create an eSignature for the report on value lost because of school district participation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Report On Value Lost Because Of School District Participation?

A Report On Value Lost Because Of School District Participation provides insights into the financial impact of school district involvement on resources and funding. This report helps stakeholders understand the potential losses incurred due to participation, enabling better decision-making and resource allocation.

-

How can airSlate SignNow help in generating a Report On Value Lost Because Of School District Participation?

airSlate SignNow offers an intuitive platform that simplifies the process of collecting and signing documents necessary for generating a Report On Value Lost Because Of School District Participation. With its eSignature capabilities, you can quickly gather necessary approvals and data from various stakeholders.

-

What features does airSlate SignNow offer for creating reports?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSignatures, all of which are essential for creating a comprehensive Report On Value Lost Because Of School District Participation. These tools streamline the reporting process and enhance collaboration among team members.

-

Is there a cost associated with generating a Report On Value Lost Because Of School District Participation using airSlate SignNow?

While airSlate SignNow offers various pricing plans, the cost of generating a Report On Value Lost Because Of School District Participation will depend on the features you choose. The platform is designed to be cost-effective, ensuring that you get the best value for your investment.

-

What are the benefits of using airSlate SignNow for school districts?

Using airSlate SignNow allows school districts to efficiently manage documents and streamline communication. This efficiency is crucial when preparing a Report On Value Lost Because Of School District Participation, as it saves time and reduces errors in data collection and reporting.

-

Can airSlate SignNow integrate with other tools for reporting?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your ability to create a Report On Value Lost Because Of School District Participation. These integrations allow for easy data import and export, making your reporting process more efficient.

-

How secure is the data when using airSlate SignNow for reports?

airSlate SignNow prioritizes data security, employing advanced encryption and compliance measures to protect your information. When generating a Report On Value Lost Because Of School District Participation, you can trust that your data is secure and confidential.

Get more for Report On Value Lost Because Of School District Participation

Find out other Report On Value Lost Because Of School District Participation

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form