Form Eic 2010

What is the Form EIC

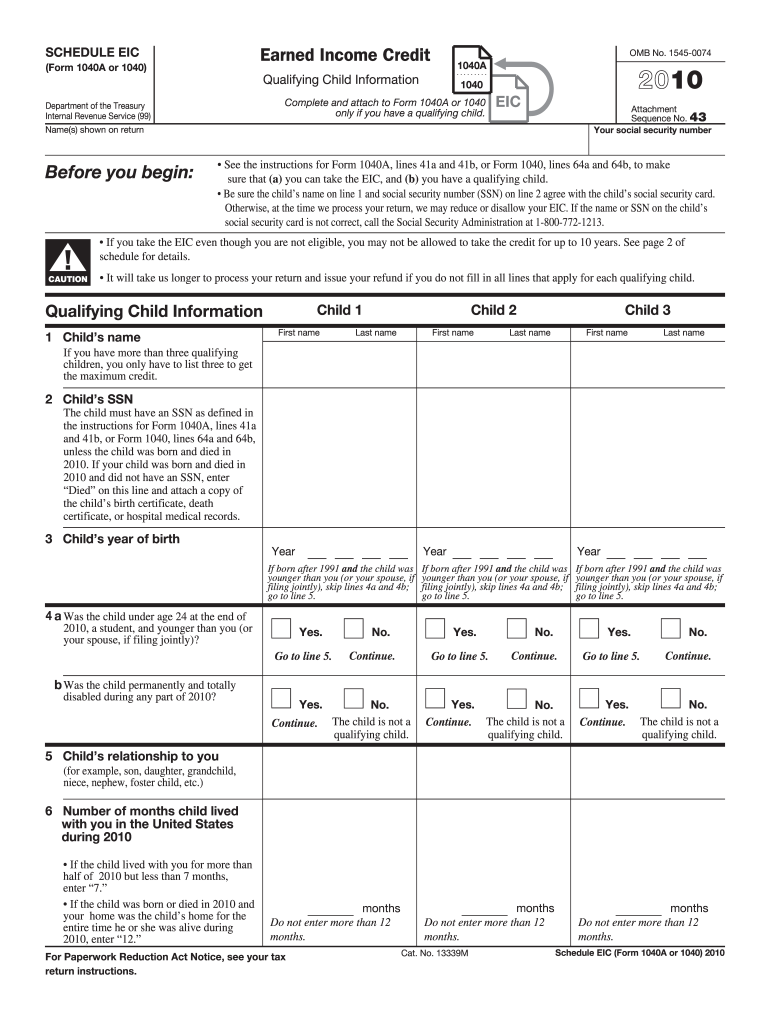

The Form EIC, or Earned Income Credit, is a tax form used in the United States to claim the Earned Income Tax Credit (EITC). This credit is designed to benefit low to moderate-income working individuals and families, providing them with a financial boost. The EIC reduces the amount of tax owed and may result in a refund, making it an important tool for eligible taxpayers. Understanding the specifics of the Form EIC is crucial for maximizing potential tax benefits.

How to use the Form EIC

Using the Form EIC involves determining eligibility, completing the form accurately, and submitting it with your tax return. To start, taxpayers must review the eligibility criteria, which include income limits and qualifying children. Once eligibility is confirmed, the form can be filled out, detailing income information and any qualifying dependents. After completing the form, it should be included with the annual tax return, ensuring that all required documentation is attached for processing.

Steps to complete the Form EIC

Completing the Form EIC requires several key steps:

- Gather necessary documents, such as W-2 forms and Social Security numbers for all qualifying children.

- Review the income limits and eligibility requirements to ensure qualification for the credit.

- Fill out the form, providing accurate income information and detailing any dependents.

- Double-check the form for accuracy and completeness to avoid processing delays.

- Submit the completed Form EIC with your tax return, either electronically or via mail.

Legal use of the Form EIC

The Form EIC must be used in compliance with IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or denial of the credit. The IRS may require documentation to support claims made on the form, particularly regarding income and the number of qualifying children. Understanding the legal implications of using the Form EIC helps taxpayers navigate the process more effectively.

Eligibility Criteria

To qualify for the Earned Income Credit using the Form EIC, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits, which vary based on filing status and the number of qualifying children.

- Having a valid Social Security number.

- Filing a tax return, even if no tax is owed.

- Being a U.S. citizen or a resident alien for the entire tax year.

Filing Deadlines / Important Dates

Filing deadlines for the Form EIC align with the annual tax return deadlines. Typically, individual tax returns must be filed by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to be aware of these dates to ensure timely submission and avoid penalties. Taxpayers should also consider any extensions that may apply to their specific situation.

Quick guide on how to complete 2010 form eic

Complete Form Eic effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Form Eic on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Form Eic without difficulty

- Find Form Eic and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form Eic and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form eic

Create this form in 5 minutes!

How to create an eSignature for the 2010 form eic

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is Form Eic and how can airSlate SignNow help with it?

Form Eic is a specific tax form that individuals can use to claim the Earned Income Credit. airSlate SignNow simplifies the process of completing and submitting Form Eic by providing an intuitive eSigning platform that ensures your documents are securely signed and sent in a timely manner.

-

What features does airSlate SignNow offer for managing Form Eic?

airSlate SignNow offers various features tailored for Form Eic management, including customizable templates, secure eSigning, and workflow automation. These tools ensure that you can efficiently fill out, sign, and manage your Form Eic documents with ease and compliance.

-

How does airSlate SignNow ensure the security of my Form Eic documents?

Security is a top priority at airSlate SignNow. When you send or sign your Form Eic through our platform, it is protected by industry-leading encryption and secure cloud storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Is there a trial available for airSlate SignNow to help with Form Eic?

Yes, airSlate SignNow offers a trial period that allows you to explore all features, including those specifically for Form Eic. Take advantage of the trial to see how our solution can streamline your document management without any financial commitment at first.

-

What are the pricing options available for using airSlate SignNow for Form Eic?

airSlate SignNow provides flexible pricing plans to cater to different business needs, including options for individuals and teams. By checking our pricing page, you can find a plan that is both affordable and tailored to effectively manage your Form Eic submissions.

-

Can airSlate SignNow integrate with other software used for Form Eic?

Absolutely! airSlate SignNow boasts robust integrations with various CRM and document management systems, making it easy to connect your workflow for efficiently handling Form Eic. This connectivity helps streamline processes and reduce the need for manual data entry.

-

What benefits can businesses expect from using airSlate SignNow for Form Eic?

Using airSlate SignNow for Form Eic brings many benefits, including increased efficiency in document processing, reduced turnaround times for signatures, and improved organizational compliance. These advantages help businesses save time and enhance operational effectiveness.

Get more for Form Eic

Find out other Form Eic

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word