Form 1042 2015

What is the Form 1042

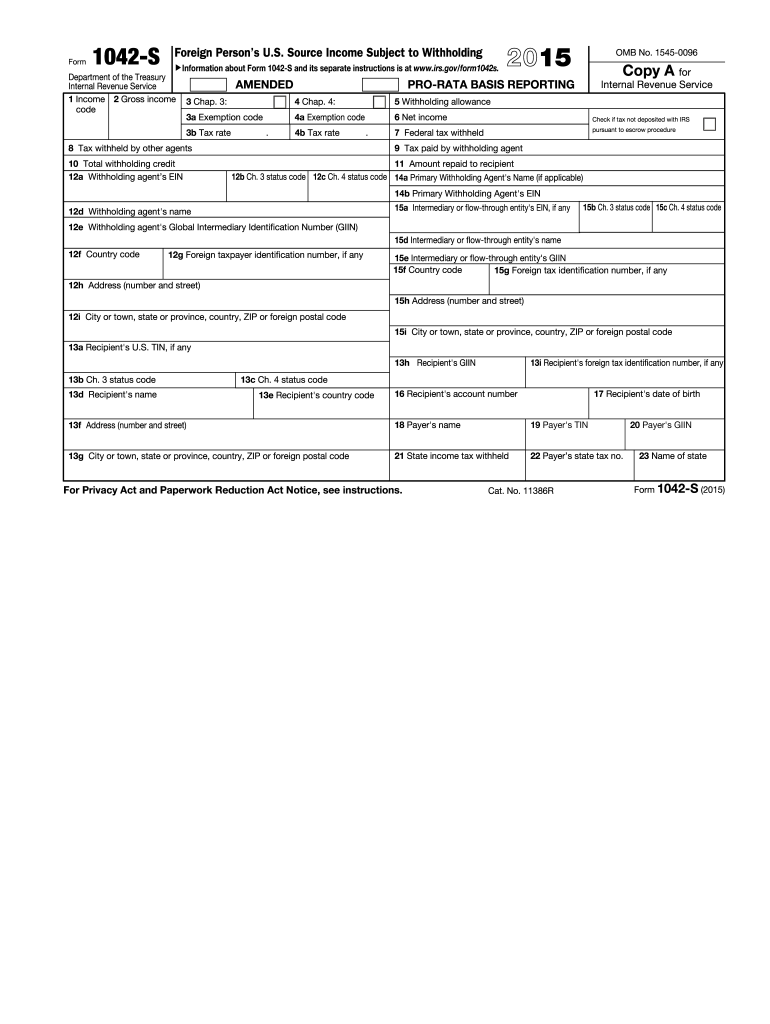

The Form 1042 is a tax document used by withholding agents to report income paid to foreign persons, including non-resident aliens and foreign corporations. This form is essential for compliance with U.S. tax laws, as it helps ensure that the correct amount of tax is withheld from payments made to foreign entities. The income reported on this form may include interest, dividends, royalties, and other types of income that are subject to withholding tax under U.S. law.

How to use the Form 1042

To use the Form 1042, withholding agents must first determine the types of payments made to foreign persons and whether those payments are subject to U.S. withholding tax. After identifying the applicable payments, the agent must accurately complete the form by providing necessary information such as the recipient's name, address, and taxpayer identification number. Once completed, the form must be submitted to the IRS, along with any required payment of withholding tax.

Steps to complete the Form 1042

Completing the Form 1042 involves several key steps:

- Gather relevant information about the foreign payees, including their names, addresses, and taxpayer identification numbers.

- Identify the types of income being reported and the applicable withholding tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form electronically or by mail, along with any necessary payments.

Legal use of the Form 1042

The legal use of the Form 1042 is crucial for withholding agents to avoid penalties and ensure compliance with U.S. tax laws. The form serves as a record of income paid to foreign persons and the taxes withheld on those payments. It is important for withholding agents to understand the legal implications of the form, including the requirements for accurate reporting and timely submission to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 are critical for compliance. The form must be submitted to the IRS by March 15 of the year following the calendar year in which the payments were made. Additionally, withholding agents are required to provide copies of the form to payees by the same deadline. Missing these deadlines can result in penalties and interest charges.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1042 can lead to significant penalties. These penalties may include fines for late filing, failure to file, and inaccuracies in reporting income or withholding amounts. It is essential for withholding agents to adhere to all filing requirements to avoid these financial repercussions.

Quick guide on how to complete form 1042 2015

Prepare Form 1042 effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form 1042 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Form 1042 with ease

- Find Form 1042 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes moments and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, laborious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Revise and eSign Form 1042 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1042 2015

Create this form in 5 minutes!

How to create an eSignature for the form 1042 2015

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is Form 1042 and why is it important for businesses?

Form 1042 is a tax form used by U.S. withholding agents to report amounts paid to foreign persons and the tax withheld on those payments. It is important for businesses to accurately complete and submit Form 1042 to avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with filling out Form 1042?

airSlate SignNow simplifies the process of filling out Form 1042 by providing templates and an intuitive interface. With the ability to easily eSign and send documents, businesses can streamline their tax filing process and ensure that all necessary information is accurately captured.

-

Are there any costs associated with using airSlate SignNow for Form 1042?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there may be a cost associated with using the platform, the efficiency and ease of use in managing Form 1042 can save businesses both time and money in the long run.

-

What features does airSlate SignNow offer for managing Form 1042?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage, making it ideal for managing Form 1042. These tools help ensure that your tax forms are completed accurately and can be easily accessed when needed.

-

Can I integrate airSlate SignNow with other software for Form 1042 management?

Yes, airSlate SignNow offers integrations with various software solutions, allowing you to seamlessly manage Form 1042 alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all data is consolidated for easy access.

-

Is airSlate SignNow compliant with IRS requirements for Form 1042?

Absolutely! airSlate SignNow is designed with compliance in mind, ensuring that your eSigned documents, including Form 1042, meet IRS requirements. This helps businesses maintain compliance and minimizes the risk of issues with tax filings.

-

What are the benefits of using airSlate SignNow for Form 1042 over traditional methods?

Using airSlate SignNow for Form 1042 offers numerous benefits, including faster processing times, reduced paper usage, and enhanced security. By digitizing the signing process, businesses can improve efficiency and focus more on their core activities.

Get more for Form 1042

- 5081 sales use and withholding taxes annual return form

- Dor business tax forms ingov 536478856

- 5250 a provides that a buyer transferee of real property located in maine must withhold tax if the form

- Form 1041me income tax return 1809100 sign

- For estates of decedents dying during calendar year 2020 form

- Wi dor a212 on line form

- Ptax 324 form

- St 556 form

Find out other Form 1042

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement