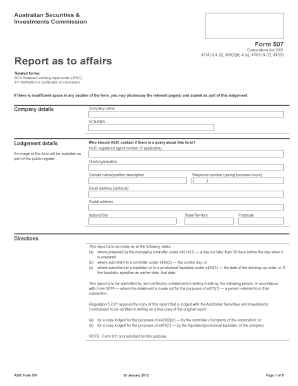

Forms 507 2012-2026

What is the 507 affairs investments form?

The 507 affairs investments form is a crucial document used for reporting investments and financial activities to the relevant authorities. This form is essential for individuals and businesses involved in investment activities, ensuring compliance with regulatory requirements. It captures detailed information about various investment transactions, helping to maintain transparency and accountability in financial reporting. Understanding the purpose and significance of this form is vital for anyone engaged in investment-related activities.

Steps to complete the 507 affairs investments form

Completing the 507 affairs investments form involves several critical steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information, including personal identification details, investment types, and transaction amounts.

- Carefully read the instructions provided with the form to understand the specific requirements.

- Fill in each section of the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the 507 affairs investments form

The legal use of the 507 affairs investments form is paramount for ensuring that all investment activities are reported accurately and in compliance with applicable laws. This form serves as an official record that can be used in legal proceedings or audits. It is essential to provide truthful and complete information, as inaccuracies may lead to penalties or legal repercussions. Understanding the legal implications of this form helps individuals and businesses protect themselves from potential liabilities.

Form submission methods

There are several methods available for submitting the 507 affairs investments form, each catering to different preferences and situations:

- Online submission: Many jurisdictions allow for electronic filing, providing a convenient and efficient way to submit the form.

- Mail: The form can be printed and mailed to the appropriate authority, ensuring it is sent to the correct address.

- In-person submission: Individuals may choose to deliver the form directly to the relevant office, allowing for immediate confirmation of receipt.

Key elements of the 507 affairs investments form

The 507 affairs investments form includes several key elements that must be accurately reported. These elements typically consist of:

- Personal information: This includes the name, address, and identification number of the individual or business filing the form.

- Investment details: A comprehensive list of all investments made during the reporting period, including types, amounts, and dates.

- Signature: The form must be signed by the individual or authorized representative, confirming the accuracy of the information provided.

Penalties for non-compliance

Failure to comply with the requirements of the 507 affairs investments form can result in significant penalties. These may include:

- Fines: Monetary penalties may be imposed for late submissions or inaccuracies in reporting.

- Legal action: In severe cases, non-compliance can lead to legal proceedings against the individual or business.

- Reputational damage: Non-compliance may harm the credibility of the individual or business within the financial community.

Quick guide on how to complete form 507 report as to affairs condon associates group

A concise guide on how to create your Forms 507

Locating the right template can turn into a challenge when you need to provide official international documentation. Even if you possess the necessary form, it may be tedious to swiftly prepare it according to all the stipulations if you rely on paper copies instead of managing everything digitally. airSlate SignNow is the web-based eSignature platform that assists you in overcoming these obstacles. It allows you to retrieve your Forms 507 and efficiently complete and sign it on-site without needing to reprint documents whenever you make an error.

Here are the actions you need to take to create your Forms 507 with airSlate SignNow:

- Click the Obtain Form button to upload your document to our editor instantly.

- Begin with the first blank field, input your information, and proceed with the Next tool.

- Complete the empty sections using the Cross and Check tools from the menu above.

- Select the Highlight or Line options to mark the most important details.

- Click on Image and upload one if your Forms 507 requires it.

- Utilize the right-side menu to add more fields for you or others to complete if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Finish button and selecting your file-sharing preferences.

Once your Forms 507 is prepared, you can share it in whatever manner you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders based on your preferences. Don’t spend time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct form 507 report as to affairs condon associates group

FAQs

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

Create this form in 5 minutes!

How to create an eSignature for the form 507 report as to affairs condon associates group

How to make an eSignature for the Form 507 Report As To Affairs Condon Associates Group online

How to create an electronic signature for the Form 507 Report As To Affairs Condon Associates Group in Chrome

How to generate an electronic signature for signing the Form 507 Report As To Affairs Condon Associates Group in Gmail

How to make an eSignature for the Form 507 Report As To Affairs Condon Associates Group from your smartphone

How to make an electronic signature for the Form 507 Report As To Affairs Condon Associates Group on iOS devices

How to create an electronic signature for the Form 507 Report As To Affairs Condon Associates Group on Android devices

People also ask

-

What is the form amp 507a download?

The form amp 507a download is a specific document used for various regulatory and compliance purposes. It is essential for businesses to have access to this form to ensure they meet legal requirements. Using airSlate SignNow, you can easily create, edit, and eSign the form amp 507a.

-

How can I download the form amp 507a using airSlate SignNow?

To download the form amp 507a, simply log into your airSlate SignNow account and navigate to the 'Forms' section. Locate the form you need and choose the download option. This seamless process ensures you have the latest version of the form amp 507a ready for your use.

-

Is there any cost associated with the form amp 507a download?

Accessing and downloading the form amp 507a via airSlate SignNow is included in our subscription plans. We offer various pricing options to fit different business needs. You can choose a plan that best suits your requirements for document management and eSigning.

-

What features does airSlate SignNow offer for the form amp 507a download?

airSlate SignNow provides a user-friendly interface for the form amp 507a download, allowing for easy editing and signing. Additional features include real-time collaboration, secure cloud storage, and automated workflows to streamline the document process. These tools make it efficient to handle the form amp 507a.

-

Are there any benefits to using airSlate SignNow for the form amp 507a download?

Using airSlate SignNow for the form amp 507a download offers signNow benefits, such as time-saving automation and robust compliance tools. The platform allows for effortless tracking of document status and instant notifications, enhancing team productivity. These advantages make managing the form amp 507a simple.

-

Can I integrate airSlate SignNow with other applications for the form amp 507a download?

Yes, airSlate SignNow integrates with a wide range of applications to facilitate the form amp 507a download and management process. This includes seamless connections with popular CRM and productivity tools. These integrations enhance your workflow and make it easy to access the form amp 507a effortlessly.

-

What kind of support is available for using the form amp 507a download?

airSlate SignNow offers excellent customer support for users needing assistance with the form amp 507a download. Our support team is available via chat, email, and phone to help you with any questions or concerns. We're here to ensure you have a smooth experience using the form amp 507a.

Get more for Forms 507

- Tricare service requestnotification form

- Employment verification form spectrum enterprises

- Section a 1 substitute w 9 form offeror registration raytheon

- Pre task plan example form

- V20 2 new user certification form

- Employment application k1 speed form

- Bemployee warning noticeb office pride form

- Education and employment form

Find out other Forms 507

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online