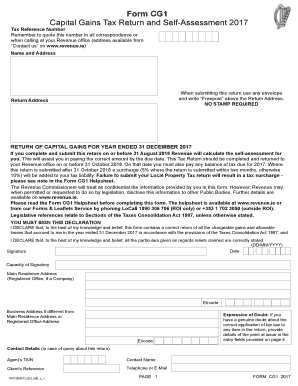

Form Cg1 2017

What is the Form Cg1

The 2014 Form Cg1 is a specific document used for reporting certain financial information to the relevant authorities. This form is essential for individuals and businesses who need to provide detailed information about their income, deductions, and other financial activities. Understanding the purpose of the Form Cg1 is crucial for ensuring compliance with tax regulations and for accurate reporting.

How to use the Form Cg1

Using the Form Cg1 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form completely, ensuring that all fields are addressed. It is important to review the completed form for accuracy before submission to avoid potential penalties for incorrect information.

Steps to complete the Form Cg1

Completing the Form Cg1 requires careful attention to detail. Begin by entering your personal information, such as your name and address. Follow this by detailing your income sources, including wages, business income, and any other earnings. Next, list any deductions you are eligible for, ensuring to include supporting documentation. Finally, sign and date the form to validate the information provided.

Legal use of the Form Cg1

The legal use of the Form Cg1 is governed by specific regulations that dictate how and when it should be filed. It is important to ensure that the form is submitted by the designated deadlines to avoid penalties. Additionally, the information provided must be truthful and accurate, as false reporting can lead to legal repercussions, including fines or other penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form Cg1 are critical to ensure compliance with tax regulations. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline. It is advisable to check the current year's deadlines, as they may vary. Being aware of these dates helps in planning and avoiding last-minute submissions.

Required Documents

To successfully complete the Form Cg1, certain documents are required. These may include income statements such as W-2s or 1099s, receipts for deductible expenses, and any previous tax returns. Having these documents ready will facilitate the completion process and ensure that all necessary information is accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The Form Cg1 can typically be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient, allowing for immediate processing. Mailing the form requires ensuring it is sent to the correct address and is postmarked by the deadline. In-person submissions may be available at designated offices, providing an option for those who prefer direct interaction.

Quick guide on how to complete form cg1 capital gains tax return 2017 revenue

A brief manual on how to prepare your Form Cg1

Finding the right template can be difficult when you need to submit official international documents. Even if you possess the necessary form, it might be overwhelming to promptly prepare it according to all specifications if you rely on paper versions rather than handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these challenges. It enables you to select your Form Cg1 and swiftly complete and sign it on-site without the need to reprint documents whenever an error occurs.

Follow these steps to prepare your Form Cg1 with airSlate SignNow:

- Click the Get Form button to instantly upload your document to our editor.

- Begin with the first blank field, enter your information, and proceed with the Next feature.

- Fill in the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize vital information.

- Click on Image to upload one if your Form Cg1 requires it.

- Use the pane on the right to add more fields for yourself or others to complete if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude the editing process by clicking the Done button and choosing your file-sharing preferences.

Once your Form Cg1 is finalized, you can share it as you wish - send it to recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your liking. Don’t waste time on manual form completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct form cg1 capital gains tax return 2017 revenue

FAQs

-

What are the needed forms to be filled out for paying tax on capital gains as a US citizen?

If you have Shares in Common Stock:Schedule D- Summary Of Capital Gains Flowing from Forms 8949 (6x8949)Forms 8949 - Discloses all Capital Gains Transactions which you will include from the for 1099-B and Realized Gain and Loss Statements sent to you by February 1st containing all your Capital Transaction. They require denoting whether the cost basis was reported to the IRS, The Sales Price was reported to the IRS, or whether were reported to the IRS, and there are Short Term and Long Term forms 8949 as well)Schedule D compiles the information also found on form 4797 if you have a Home business and have sold Section 1231 Assets, 1245 Assets and 1251 Assets)Form 8694 which is used to calculate if you are above the threshold for filing Net Investment Income (Obamacare tax).Schedule D also compiles Capital Gains flowing from Schedule K-1 Lines 8, 9A, 9B, &9C, plus Box 10 if you have partnership

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

Create this form in 5 minutes!

How to create an eSignature for the form cg1 capital gains tax return 2017 revenue

How to generate an electronic signature for your Form Cg1 Capital Gains Tax Return 2017 Revenue online

How to make an eSignature for your Form Cg1 Capital Gains Tax Return 2017 Revenue in Google Chrome

How to make an electronic signature for signing the Form Cg1 Capital Gains Tax Return 2017 Revenue in Gmail

How to create an electronic signature for the Form Cg1 Capital Gains Tax Return 2017 Revenue right from your smart phone

How to make an electronic signature for the Form Cg1 Capital Gains Tax Return 2017 Revenue on iOS devices

How to generate an eSignature for the Form Cg1 Capital Gains Tax Return 2017 Revenue on Android OS

People also ask

-

What is Form Cg1 and how can airSlate SignNow help with it?

Form Cg1 is a crucial document used in various business processes. With airSlate SignNow, you can easily create, send, and eSign Form Cg1, ensuring a streamlined workflow. Our platform simplifies the management of this form, making it accessible and secure for all users.

-

How much does it cost to use airSlate SignNow for Form Cg1?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs, including those specifically for handling Form Cg1. We provide a free trial, allowing you to explore our features before committing. Pricing is designed to be cost-effective while ensuring you have all the necessary tools for managing Form Cg1 efficiently.

-

What features does airSlate SignNow offer for managing Form Cg1?

Our platform provides a variety of features specifically for Form Cg1, including customizable templates, secure eSignature capabilities, and real-time tracking. You can also automate workflows associated with Form Cg1 to enhance efficiency. These features ensure that handling this form is both easy and effective.

-

Can I integrate airSlate SignNow with other applications for Form Cg1?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage Form Cg1. You can connect with CRM systems, cloud storage services, and other business tools to streamline your workflow. This integration capability makes handling Form Cg1 even more efficient.

-

Is airSlate SignNow secure for eSigning Form Cg1?

Absolutely! Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with international security standards to protect your data while eSigning Form Cg1, ensuring that your documents are safe from unauthorized access.

-

How can airSlate SignNow improve the efficiency of processing Form Cg1?

By using airSlate SignNow, you can signNowly speed up the processing of Form Cg1. Our automated workflows and eSignature features reduce the time needed for approvals and document management. This efficiency allows you to focus more on your core business activities rather than paperwork.

-

What types of businesses can benefit from using airSlate SignNow for Form Cg1?

Any business that requires the use of Form Cg1 can benefit from airSlate SignNow. Whether you are in finance, healthcare, or any other sector, our platform is designed to cater to diverse industries. The flexibility and ease of use make it suitable for small businesses to large enterprises.

Get more for Form Cg1

- Cruisemaster xt suspension reviews form

- Medical expense claim form new era life insurance companies

- Pdf authorization to use and disclose health information the hospitals

- Satirical user generated memes as an effective source of political www2 warwick ac form

- Eisseisaa application form for eis or seis advance assurance request the form is used by companies seeking assurance in advance

- Sierra nevada college lesson plan form

- Joint services transcript official jst official coastal form

- Health form medical history immunization reinhardt university reinhardt

Find out other Form Cg1

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy