Capital Gains Tax Forms 2022-2026

What is the Capital Gains Tax Form?

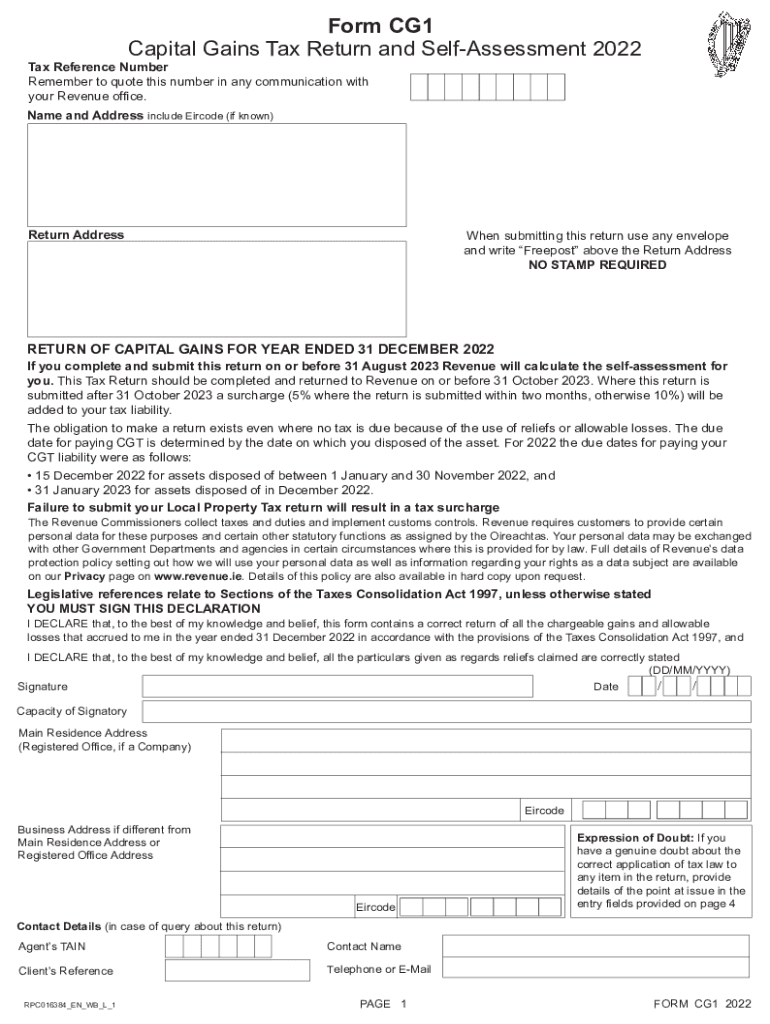

The Capital Gains Tax Form, specifically the form cg1 2020, is used to report capital gains and losses from the sale of assets. This form is essential for taxpayers who have sold investments, real estate, or other properties. The information provided on this form helps the Internal Revenue Service (IRS) determine the amount of tax owed on any profits made from these transactions. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with federal regulations.

Steps to Complete the Capital Gains Tax Form

Completing the form cg1 2020 involves several important steps:

- Gather Documentation: Collect all relevant documents, including purchase and sale receipts, to determine your capital gains or losses.

- Calculate Gains and Losses: Determine the difference between the selling price and the purchase price of the assets sold.

- Fill Out the Form: Enter the calculated gains and losses in the appropriate sections of the form.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the Form: File the completed form with the IRS by the designated deadline, either online or by mail.

Legal Use of the Capital Gains Tax Form

The form cg1 2020 is legally binding when completed accurately and submitted to the IRS. It must comply with federal tax laws, including the requirements set forth by the IRS regarding capital gains reporting. Failing to report capital gains can result in penalties or audits. Therefore, it is essential to ensure that all information is truthful and complete to maintain compliance with legal standards.

Filing Deadlines / Important Dates

Timely filing of the form cg1 2020 is crucial to avoid penalties. The IRS typically sets a deadline for tax returns on April fifteenth of each year, unless it falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should mark their calendars for this date and consider filing early to prevent last-minute issues.

Who Issues the Form?

The form cg1 2020 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. Taxpayers can obtain this form directly from the IRS website or through authorized tax preparation services. It is important to use the correct version of the form for the tax year in question to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the form cg1 2020:

- Online Submission: Many taxpayers choose to file electronically using tax software that supports the form, which can simplify the process and ensure accuracy.

- Mail Submission: The form can be printed and mailed to the IRS. It is advisable to use certified mail for tracking purposes.

- In-Person Submission: Some individuals may opt to submit their forms in person at local IRS offices, although this is less common.

Quick guide on how to complete capital gains tax forms

Effortlessly complete Capital Gains Tax Forms on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, amend, and eSign your documents quickly without complications. Manage Capital Gains Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and eSign Capital Gains Tax Forms with ease

- Locate Capital Gains Tax Forms and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow manages all your document management needs with just a few clicks from any device you choose. Modify and eSign Capital Gains Tax Forms and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct capital gains tax forms

Create this form in 5 minutes!

How to create an eSignature for the capital gains tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form cg1 2020?

Form cg1 2020 is a specific document utilized for various business processes, including contracts and agreements. It is essential for organizations looking to streamline their documentation workflow. Utilizing airSlate SignNow allows you to easily manage and eSign form cg1 2020 efficiently.

-

How much does airSlate SignNow cost for processing form cg1 2020?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Depending on the features you require to handle documents like form cg1 2020, you can choose a plan that fits your budget. Check our pricing page for detailed information on plans suitable for processing form cg1 2020.

-

What features does airSlate SignNow offer for form cg1 2020?

airSlate SignNow provides a range of features for managing form cg1 2020, including customizable templates, secure electronic signatures, and real-time tracking. These features simplify the transaction process and ensure compliance with legal standards. Start using airSlate SignNow to leverage these tools for form cg1 2020.

-

How can airSlate SignNow help speed up the approval process of form cg1 2020?

With airSlate SignNow, the approval process for form cg1 2020 can be expedited through automated workflows and eSigning capabilities. These tools eliminate the need for physical signatures and reduce turnaround time signNowly. You'll find that using airSlate SignNow accelerates your operational efficiency.

-

Can I integrate airSlate SignNow with other applications for managing form cg1 2020?

Yes, airSlate SignNow offers integrations with various applications to help manage form cg1 2020 effortlessly. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems to streamline your workflow. These integrations ensure a seamless experience when handling form cg1 2020.

-

Is it secure to eSign form cg1 2020 using airSlate SignNow?

Absolutely! airSlate SignNow places a strong emphasis on security and compliance. When you eSign form cg1 2020, our platform uses industry-standard encryption and secure storage to protect your sensitive information. You can trust airSlate SignNow for safe document handling.

-

What are the benefits of using airSlate SignNow for form cg1 2020?

Using airSlate SignNow for form cg1 2020 offers numerous benefits, including time savings, reduced costs, and enhanced productivity. The platform simplifies the documentation process, making it easier to manage important files. Businesses benefit from increased efficiency by leveraging airSlate SignNow for form cg1 2020.

Get more for Capital Gains Tax Forms

Find out other Capital Gains Tax Forms

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile