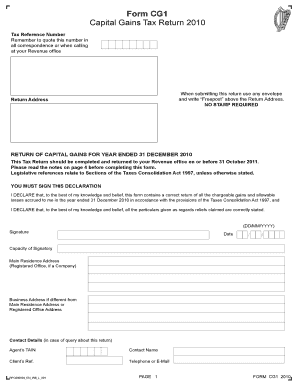

Form CG1 Capital Gains Tax Return Revenue Revenue 2010

What is the Form CG1 Capital Gains Tax Return Revenue

The Form CG1 Capital Gains Tax Return Revenue is a critical document used by taxpayers in the United States to report capital gains and losses from the sale of assets. This form is essential for individuals and businesses to accurately calculate their tax obligations related to capital gains. It ensures compliance with tax laws and helps in determining the amount of tax owed or refund due. Understanding the purpose of this form is vital for effective tax planning and compliance.

Steps to complete the Form CG1 Capital Gains Tax Return Revenue

Completing the Form CG1 Capital Gains Tax Return Revenue involves several key steps:

- Gather necessary documents: Collect all relevant documentation, including records of asset purchases, sales, and any related expenses.

- Calculate gains and losses: Determine the capital gains or losses for each asset sold during the tax year.

- Fill out the form: Input the calculated figures into the appropriate sections of the form, ensuring accuracy in reporting.

- Review for accuracy: Double-check all entries for errors or omissions before finalizing the form.

- Submit the form: File the completed form with the appropriate tax authority, either electronically or by mail.

Legal use of the Form CG1 Capital Gains Tax Return Revenue

The legal use of the Form CG1 Capital Gains Tax Return Revenue is governed by tax regulations that require accurate reporting of capital transactions. This form must be completed in compliance with IRS guidelines to be considered valid. Failure to properly fill out and submit this form can lead to penalties, including fines and interest on unpaid taxes. It is crucial for taxpayers to understand their legal obligations when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CG1 Capital Gains Tax Return Revenue typically align with the annual tax filing schedule. Taxpayers must submit the form by the due date, which is usually April 15 of the following year for individual taxpayers. Extensions may be available, but it is essential to check specific IRS guidelines for any changes or updates to deadlines. Missing the deadline can result in penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The Form CG1 Capital Gains Tax Return Revenue can be submitted through various methods, providing flexibility for taxpayers:

- Online submission: Many taxpayers opt to file electronically using tax preparation software or through the IRS e-file system.

- Mail: The form can be printed and mailed to the appropriate tax authority, ensuring it is postmarked by the filing deadline.

- In-person: Some taxpayers may choose to submit the form in person at a local IRS office, although this method is less common.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form CG1 Capital Gains Tax Return Revenue can result in significant penalties. Taxpayers who fail to file the form on time or provide inaccurate information may face financial penalties, including fines and interest on any unpaid taxes. Additionally, the IRS may initiate audits or further investigations, which can lead to additional complications. Understanding these potential consequences emphasizes the importance of accurate and timely filing.

Quick guide on how to complete form cg1 capital gains tax return 2010 revenue revenue

Effortlessly Prepare Form CG1 Capital Gains Tax Return Revenue Revenue on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely archive it online. airSlate SignNow offers all the essential tools needed to create, modify, and electronically sign your documents promptly without delays. Handle Form CG1 Capital Gains Tax Return Revenue Revenue on any platform using airSlate SignNow's Android or iOS applications and upgrade any document-related process today.

How to Alter and eSign Form CG1 Capital Gains Tax Return Revenue Revenue with Ease

- Obtain Form CG1 Capital Gains Tax Return Revenue Revenue and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form CG1 Capital Gains Tax Return Revenue Revenue to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cg1 capital gains tax return 2010 revenue revenue

Create this form in 5 minutes!

How to create an eSignature for the form cg1 capital gains tax return 2010 revenue revenue

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Form CG1 Capital Gains Tax Return Revenue Revenue?

The Form CG1 Capital Gains Tax Return Revenue Revenue is a specific tax document used to report capital gains to the Revenue Commissioners in Ireland. It is essential for individuals and businesses that need to declare capital gains for tax purposes. Understanding how to complete this form accurately can help you meet your tax obligations efficiently.

-

How does airSlate SignNow help with the Form CG1 Capital Gains Tax Return Revenue Revenue?

airSlate SignNow simplifies the process of completing and submitting the Form CG1 Capital Gains Tax Return Revenue Revenue by providing an intuitive eSigning platform. With our solution, users can easily fill out the required fields, sign the document securely, and submit it electronically. This streamlines the tax filing process, reducing paperwork and saving time.

-

What features does airSlate SignNow offer for eSigning the Form CG1 Capital Gains Tax Return Revenue Revenue?

airSlate SignNow offers features tailored for eSigning the Form CG1 Capital Gains Tax Return Revenue Revenue, such as customizable templates, secure cloud storage, and real-time tracking. You can add a signature, initials, and other necessary fields without printing or scanning documents. This ensures a hassle-free signing experience.

-

Is airSlate SignNow cost-effective for businesses needing to file the Form CG1 Capital Gains Tax Return Revenue Revenue?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses that frequently need to file the Form CG1 Capital Gains Tax Return Revenue Revenue. Our subscription plans are flexible and tailored to different business sizes, ensuring you only pay for what you need while enjoying comprehensive eSigning features.

-

Can I use airSlate SignNow to integrate with other tools for my Form CG1 Capital Gains Tax Return Revenue Revenue?

Absolutely! airSlate SignNow offers seamless integrations with popular business tools such as Google Drive, Dropbox, and various CRM systems. This enables you to easily manage your documents related to the Form CG1 Capital Gains Tax Return Revenue Revenue, enhancing productivity and ensuring a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Form CG1 Capital Gains Tax Return Revenue Revenue?

Using airSlate SignNow for the Form CG1 Capital Gains Tax Return Revenue Revenue provides numerous benefits, including enhanced security, faster turnaround times, and reduced document handling. You can track the status of your forms in real time, receive alerts when documents are signed, and maintain compliance with eSignature laws.

-

How can I get started with airSlate SignNow for my Form CG1 Capital Gains Tax Return Revenue Revenue?

Getting started with airSlate SignNow is simple! You can sign up for a free trial on our website, explore the features, and see how they can assist you in managing the Form CG1 Capital Gains Tax Return Revenue Revenue. Our user-friendly interface makes it easy to begin eSigning in no time.

Get more for Form CG1 Capital Gains Tax Return Revenue Revenue

- Petition neglected uncared form abused childyouth jud ct

- Application and writ habeas corpus jud ct form

- Summary guiide to juvenile court jurisdiction connecticut bar examining committee additional response page form 2s jud ct

- Foreclosure plaintiffs bid at foreclosure sale and committees response jud ct form

- Order termination of parental rights and appointment of statutory parentguardian jud ct form

- Jd ap 183 connecticut judicial branch ctgov jud ct form

- Erasure of recordpetitionorder jud ct form

- Federal gender discrimination complaint in connecticut form

Find out other Form CG1 Capital Gains Tax Return Revenue Revenue

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement