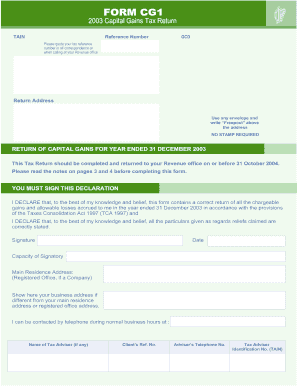

Form CG1 Capital Gains Tax Return for Revenue 2003

What is the Form CG1 Capital Gains Tax Return For Revenue

The Form CG1 Capital Gains Tax Return for Revenue is a crucial document used by individuals and entities to report capital gains and losses from the sale of assets. This form is essential for calculating tax liabilities related to capital gains, which can arise from various transactions, including the sale of stocks, real estate, or other investments. Properly completing this form ensures compliance with tax regulations and helps taxpayers accurately report their financial activities to the Internal Revenue Service (IRS).

How to use the Form CG1 Capital Gains Tax Return For Revenue

Using the Form CG1 involves several steps to ensure accurate reporting of capital gains. Taxpayers should first gather all relevant financial documents, including transaction records and previous tax returns. Once the necessary information is compiled, the form can be filled out, detailing the specific assets sold, the purchase and sale prices, and any associated costs. After completing the form, it should be reviewed for accuracy before submission to the IRS.

Steps to complete the Form CG1 Capital Gains Tax Return For Revenue

Completing the Form CG1 requires a methodical approach to ensure all necessary information is included. Follow these steps:

- Gather all relevant documents, including purchase and sale records.

- Calculate the capital gains or losses for each transaction.

- Fill out the form, entering details such as asset descriptions, dates of acquisition and sale, and amounts.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, as per IRS guidelines.

Legal use of the Form CG1 Capital Gains Tax Return For Revenue

The legal use of the Form CG1 is essential for ensuring compliance with tax laws. This form must be completed accurately and submitted within the designated deadlines to avoid penalties. It serves as a formal declaration of capital gains and losses, which the IRS uses to assess tax liabilities. Failing to file this form or providing incorrect information can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form CG1 are critical for taxpayers to adhere to. Typically, the form must be submitted by April 15 of the year following the tax year in which the capital gains occurred. However, extensions may be available under certain circumstances. It is important for taxpayers to stay informed about any changes in deadlines to ensure timely filing and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form CG1 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file electronically through approved e-filing software, which often simplifies the process.

- Mail: The completed form can be printed and mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person: Some taxpayers may choose to submit their forms in person at designated IRS offices, although this option may be less common.

Quick guide on how to complete form cg1 2003 capital gains tax return for revenue

Complete Form CG1 Capital Gains Tax Return For Revenue effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form CG1 Capital Gains Tax Return For Revenue on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form CG1 Capital Gains Tax Return For Revenue with ease

- Find Form CG1 Capital Gains Tax Return For Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form CG1 Capital Gains Tax Return For Revenue and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cg1 2003 capital gains tax return for revenue

Create this form in 5 minutes!

How to create an eSignature for the form cg1 2003 capital gains tax return for revenue

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the Form CG1 Capital Gains Tax Return For Revenue?

The Form CG1 Capital Gains Tax Return For Revenue is a tax document that individuals use to report capital gains to the revenue authorities. It provides detailed information about the sale of assets, ensuring compliance with tax regulations. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

-

How can airSlate SignNow facilitate my Form CG1 Capital Gains Tax Return For Revenue submissions?

airSlate SignNow streamlines the process of completing and submitting your Form CG1 Capital Gains Tax Return For Revenue by providing an easy-to-use interface for eSigning and sharing documents. Users can complete the form electronically, eliminating paperwork and ensuring timely submissions. This feature enhances productivity and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Form CG1 Capital Gains Tax Return For Revenue?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. The cost may vary based on the chosen plan and additional features you may require. This investment can ultimately save you time and potential penalties when submitting your Form CG1 Capital Gains Tax Return For Revenue.

-

What features does airSlate SignNow offer for managing the Form CG1 Capital Gains Tax Return For Revenue?

airSlate SignNow provides features like customizable templates, automated workflows, and secure eSigning capabilities specifically tailored for the Form CG1 Capital Gains Tax Return For Revenue. These tools help you manage documents efficiently, track submission status, and ensure compliance with tax regulations. Further, the platform simplifies collaboration among team members for improved accuracy.

-

Can I integrate airSlate SignNow with other software for my Form CG1 Capital Gains Tax Return For Revenue?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to manage your Form CG1 Capital Gains Tax Return For Revenue effortlessly. This ensures that data transfer is smooth and reduces the need for manual entry, thereby minimizing errors and saving time.

-

How secure is my information when using airSlate SignNow for the Form CG1 Capital Gains Tax Return For Revenue?

Security is a top priority at airSlate SignNow. All documents, including your Form CG1 Capital Gains Tax Return For Revenue, are protected with advanced encryption and secure storage solutions. This ensures that your sensitive information remains confidential and compliant with data protection regulations.

-

What benefits can I expect by using airSlate SignNow for the Form CG1 Capital Gains Tax Return For Revenue?

Using airSlate SignNow for your Form CG1 Capital Gains Tax Return For Revenue comes with numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform simplifies document management and approval workflows, allowing you to focus on your financial strategy rather than administrative tasks. Additionally, eSigning ensures that your submissions are completed and submitted quickly.

Get more for Form CG1 Capital Gains Tax Return For Revenue

- Bill of sale form colorado warranty deed form templates

- If so with regard to each form

- Application for demolition permit city of hemet form

- Stop lending notice individual form

- Conditions of sale first applicable obs sales form

- Alaska state construction lien statutes tradition lien service form

- And two individuals hereinafter form

- Above this line reserved for official use only 490101448 form

Find out other Form CG1 Capital Gains Tax Return For Revenue

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy