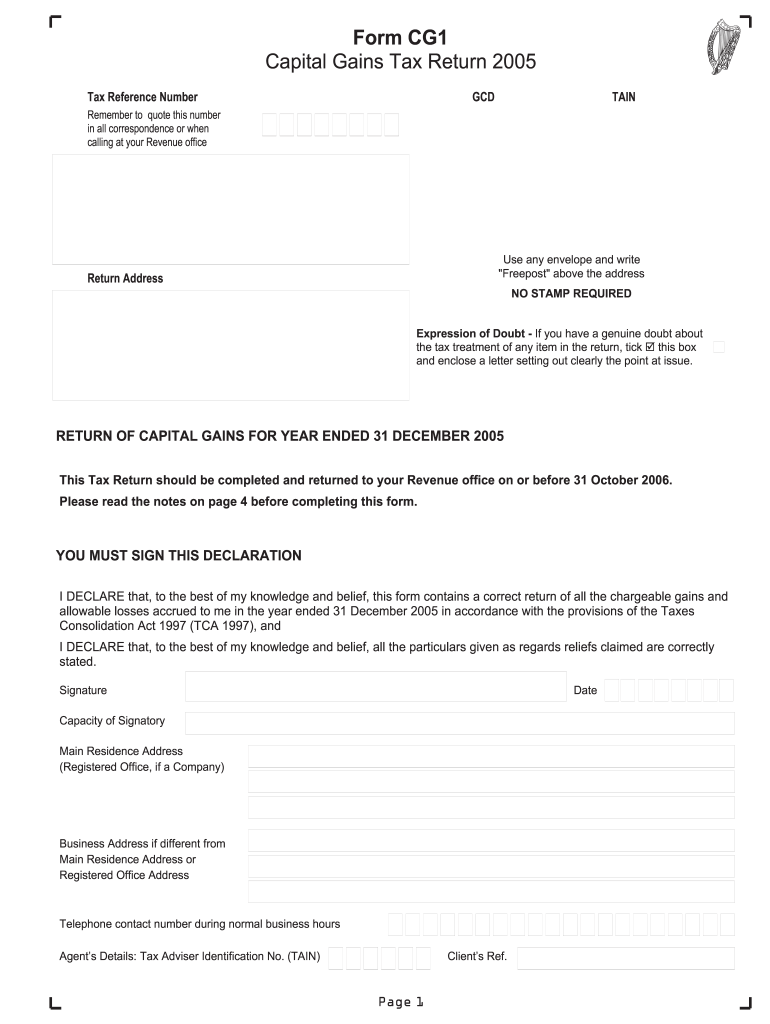

Form CG1 Capital Gains Tax Return for Revenue 2015

What is the Form CG1 Capital Gains Tax Return For Revenue

The Form CG1 Capital Gains Tax Return is a crucial document used by individuals and businesses in the United States to report capital gains and losses to the Internal Revenue Service (IRS). This form helps taxpayers calculate their tax liability on profits made from the sale of assets such as stocks, real estate, and other investments. It is essential for ensuring compliance with tax regulations and accurately reflecting financial activities during the tax year.

How to use the Form CG1 Capital Gains Tax Return For Revenue

Using the Form CG1 involves several steps to ensure accurate reporting of capital gains. Taxpayers must first gather all relevant financial information, including details of asset sales, purchase prices, and any associated costs. Once this information is compiled, taxpayers can fill out the form, providing necessary details such as the type of asset, sale date, and gain or loss amount. After completing the form, it should be submitted to the IRS by the designated deadline.

Steps to complete the Form CG1 Capital Gains Tax Return For Revenue

Completing the Form CG1 requires a systematic approach:

- Gather all documentation related to asset sales, including purchase and sale receipts.

- Calculate the total capital gains or losses by subtracting the purchase price from the sale price for each asset.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the specified deadline, either electronically or via mail.

Legal use of the Form CG1 Capital Gains Tax Return For Revenue

The Form CG1 is legally binding when completed and submitted according to IRS guidelines. It must be filled out truthfully, as providing false information can lead to penalties, including fines or legal action. The form serves as an official record of capital gains and losses, which the IRS may review during audits. Therefore, maintaining accurate records and adhering to legal requirements is essential for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Form CG1 are typically aligned with the annual tax return due date, which is usually April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to be aware of any changes to deadlines and to plan accordingly to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form CG1 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this option may require an appointment.

Quick guide on how to complete form cg1 2005 capital gains tax return for 2005 revenue

Easily prepare Form CG1 Capital Gains Tax Return For Revenue on any device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as it allows you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Handle Form CG1 Capital Gains Tax Return For Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form CG1 Capital Gains Tax Return For Revenue effortlessly

- Obtain Form CG1 Capital Gains Tax Return For Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form CG1 Capital Gains Tax Return For Revenue while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cg1 2005 capital gains tax return for 2005 revenue

Create this form in 5 minutes!

How to create an eSignature for the form cg1 2005 capital gains tax return for 2005 revenue

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Form CG1 Capital Gains Tax Return For Revenue?

The Form CG1 Capital Gains Tax Return For Revenue is a tax form used in Ireland to report gains made from the sale of assets. It is essential for individuals and businesses who have realized capital gains and need to fulfill their tax obligations. Understanding this form can help ensure compliance with tax regulations while maximizing financial outcomes.

-

How does airSlate SignNow simplify the submission of Form CG1 Capital Gains Tax Return For Revenue?

airSlate SignNow simplifies the submission process by allowing users to electronically sign and send the Form CG1 Capital Gains Tax Return For Revenue with ease. Using our platform, you can prepare and eSign the form in a secure environment, reducing the potential for errors and accelerating the filing process. This user-friendly approach ensures efficiency and peace of mind.

-

What features does airSlate SignNow offer for managing Form CG1 Capital Gains Tax Return For Revenue?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure storage to help manage the Form CG1 Capital Gains Tax Return For Revenue effectively. With these tools, you can easily create, share, and track the progress of your tax documents. Additionally, our platform supports various file formats, making it convenient to upload and integrate necessary documents.

-

Is there a cost associated with using airSlate SignNow for Form CG1 Capital Gains Tax Return For Revenue?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. We offer various pricing plans tailored to your needs, ensuring that you can access the necessary features for managing the Form CG1 Capital Gains Tax Return For Revenue without exceeding your budget. Explore our plans to find the best fit for your organization.

-

Can airSlate SignNow integrate with other software for filing Form CG1 Capital Gains Tax Return For Revenue?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software to facilitate filing the Form CG1 Capital Gains Tax Return For Revenue. This integration can help streamline your workflow, allowing you to pull data directly from your accounting systems and ensure accuracy when completing your tax forms.

-

What are the benefits of using airSlate SignNow for filing Form CG1 Capital Gains Tax Return For Revenue?

Using airSlate SignNow for filing the Form CG1 Capital Gains Tax Return For Revenue provides numerous benefits, including speed, accuracy, and security. Our platform ensures that your sensitive data is protected, while also limiting turnaround times with eSigning capabilities. This results in a more efficient filing process that can save you valuable time and resources.

-

How secure is the information provided in Form CG1 Capital Gains Tax Return For Revenue when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication protocols to protect all information related to the Form CG1 Capital Gains Tax Return For Revenue. This commitment to security ensures that your sensitive information remains confidential and secure throughout the signing and submission process.

Get more for Form CG1 Capital Gains Tax Return For Revenue

- Kansas kansas bankruptcy guide and forms package for chapters 7 or 13

- Company policies procedures 481375910 form

- Kentucky no fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without form

- Kentucky contractors forms package

- Kentucky contract for deed package form

- Power attorney form 481375916

- Kentucky process form

- Kentucky satisfaction cancellation or release of mortgage package form

Find out other Form CG1 Capital Gains Tax Return For Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors