It214 Form 2023

What is the It214 Form

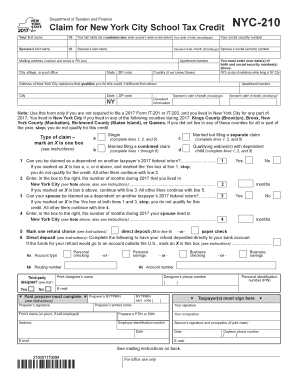

The It214 Form is a tax form used in the United States, specifically in New York State, to claim a credit for real property taxes paid. This form is primarily utilized by homeowners and renters who meet specific eligibility criteria. The purpose of the It214 Form is to provide financial relief by allowing taxpayers to receive a credit that can help offset the cost of property taxes. Understanding this form is essential for those looking to maximize their tax benefits while ensuring compliance with state regulations.

How to use the It214 Form

Using the It214 Form involves several straightforward steps. First, gather all necessary documentation, including proof of property tax payments and personal identification information. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which can include online filing or mailing it to the appropriate state department. Proper use of the It214 Form can lead to significant tax savings.

Steps to complete the It214 Form

Completing the It214 Form requires careful attention to detail. Follow these steps:

- Obtain the It214 Form from the New York State Department of Taxation and Finance website or a local office.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your property, including the address and the amount of property taxes paid.

- Indicate your eligibility for the credit by checking the appropriate boxes and providing any necessary documentation.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the It214 Form, taxpayers must meet specific eligibility criteria. Generally, applicants must be residents of New York State and have paid real property taxes on their primary residence. Additionally, income limits may apply, which can affect the amount of credit received. It is crucial to review the latest guidelines from the New York State Department of Taxation and Finance to ensure compliance with all requirements.

Required Documents

When completing the It214 Form, certain documents are necessary to support your claim. These may include:

- Proof of property tax payments, such as receipts or tax bills.

- Identification documents, including a valid driver's license or Social Security card.

- Income documentation, such as W-2 forms or tax returns, to verify eligibility.

Having these documents ready can streamline the process and help avoid delays in processing your claim.

Form Submission Methods

The It214 Form can be submitted through various methods, depending on the preferences of the taxpayer. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can enhance the efficiency of the filing process.

Quick guide on how to complete it214 form

Effortlessly prepare It214 Form on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle It214 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The easiest method to edit and eSign It214 Form seamlessly

- Locate It214 Form and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent parts of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign It214 Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it214 form

Create this form in 5 minutes!

How to create an eSignature for the it214 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the It214 Form and why is it important?

The It214 Form is a tax document used to claim certain credits and deductions. Understanding its importance can help you maximize your tax benefits and ensure compliance with state regulations. Using airSlate SignNow, you can easily eSign and send your It214 Form securely.

-

How can airSlate SignNow help with the It214 Form?

airSlate SignNow simplifies the process of completing and signing the It214 Form. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. With our eSignature feature, you can quickly obtain necessary signatures without the hassle of printing.

-

Is there a cost associated with using airSlate SignNow for the It214 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the It214 Form efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the It214 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the It214 Form. These tools enhance your workflow, making it easier to manage and store your tax documents. Additionally, our platform ensures that your data is protected with top-notch security measures.

-

Can I integrate airSlate SignNow with other software for the It214 Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the It214 Form. Whether you use CRM systems or accounting software, our integrations help you manage your documents more effectively.

-

What are the benefits of using airSlate SignNow for the It214 Form?

Using airSlate SignNow for the It214 Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents quickly, which can save you valuable time during tax season. Additionally, our secure environment ensures your sensitive information is protected.

-

How do I get started with airSlate SignNow for the It214 Form?

Getting started with airSlate SignNow for the It214 Form is easy! Simply sign up for an account on our website, choose a pricing plan, and start creating or uploading your documents. Our user-friendly interface will guide you through the process of preparing and eSigning your It214 Form.

Get more for It214 Form

Find out other It214 Form

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy