Form 1120 W Internal Revenue Service Irs

What is Form 1120 W?

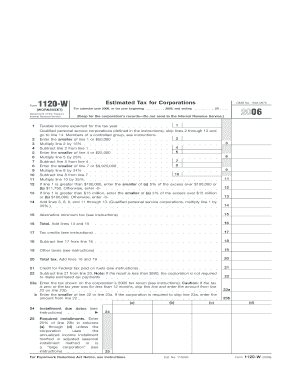

Form 1120 W is a tax form used by corporations to calculate their estimated tax payments for the current tax year. This form is issued by the Internal Revenue Service (IRS) and is essential for corporations to ensure they meet their tax obligations. By using Form 1120 W, businesses can project their tax liability based on their expected income, allowing them to make timely payments throughout the year. This helps prevent underpayment penalties and ensures compliance with federal tax regulations.

How to Use Form 1120 W

To effectively use Form 1120 W, corporations must first gather their financial information, including income, deductions, and credits. The form provides a structured way to estimate the tax liability based on projected earnings. Businesses should complete the form by following the instructions provided by the IRS, ensuring that all figures are accurate. Once completed, the form helps determine quarterly estimated tax payments, which are crucial for maintaining good standing with the IRS.

Steps to Complete Form 1120 W

Completing Form 1120 W involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill in the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Estimate the total income for the year and calculate the expected deductions and credits.

- Use the provided tables to calculate the estimated tax liability based on projected income.

- Determine the quarterly payment amounts and ensure they align with the estimated tax liability.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines when submitting Form 1120 W. Typically, the form should be filed by the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to keep track of these dates to avoid penalties for late filing or payment.

Form Submission Methods

Form 1120 W can be submitted to the IRS through various methods. Corporations have the option to file the form electronically or by mail. Electronic filing is often preferred for its speed and efficiency, allowing for quicker processing times. For those who choose to file by mail, it is essential to send the form to the correct IRS address, which can vary based on the corporation's location and whether payment is included.

Penalties for Non-Compliance

Failure to file Form 1120 W on time or to make the required estimated tax payments can result in significant penalties. The IRS may impose fines for late filing, and interest may accrue on unpaid taxes. Additionally, corporations may face underpayment penalties if their estimated payments do not meet the required thresholds. It is crucial for businesses to stay compliant with IRS regulations to avoid these financial repercussions.

Quick guide on how to complete form 1120 w internal revenue service irs

Complete [SKS] effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select how you wish to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 W Internal Revenue Service Irs

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 W from the Internal Revenue Service (IRS)?

Form 1120 W is a tax form used by corporations to calculate their estimated tax payments to the Internal Revenue Service (IRS). This form helps businesses determine their tax liability based on projected income. Understanding how to fill out Form 1120 W is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with Form 1120 W submissions?

airSlate SignNow provides a seamless platform for businesses to eSign and send Form 1120 W to the Internal Revenue Service (IRS). With our user-friendly interface, you can easily upload, sign, and submit your tax documents securely. This streamlines the process and ensures timely submissions to the IRS.

-

What are the pricing options for using airSlate SignNow for Form 1120 W?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans include features that simplify the eSigning process for documents like Form 1120 W. You can choose a plan that fits your budget while ensuring compliance with IRS requirements.

-

What features does airSlate SignNow offer for managing Form 1120 W?

With airSlate SignNow, you can easily create, edit, and eSign Form 1120 W. Our platform includes features like document templates, real-time tracking, and secure storage, making it easier to manage your tax documents. These features enhance efficiency and ensure that your submissions to the IRS are accurate and timely.

-

Is airSlate SignNow secure for submitting Form 1120 W to the IRS?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive documents like Form 1120 W. Our platform uses advanced encryption and secure cloud storage to protect your data. You can confidently submit your tax forms to the Internal Revenue Service (IRS) knowing that your information is safe.

-

Can I integrate airSlate SignNow with other software for Form 1120 W?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage Form 1120 W alongside your other financial documents. This integration helps streamline your workflow and ensures that all your tax-related tasks are efficiently handled.

-

What are the benefits of using airSlate SignNow for Form 1120 W?

Using airSlate SignNow for Form 1120 W offers numerous benefits, including time savings, enhanced accuracy, and improved compliance with IRS regulations. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring that your tax forms are submitted correctly and on time.

Get more for Form 1120 W Internal Revenue Service Irs

Find out other Form 1120 W Internal Revenue Service Irs

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free