DEPARTMENT of REVENUE SERVICES Business Ct Gov 2021-2026

Understanding the Connecticut Form CT 8379

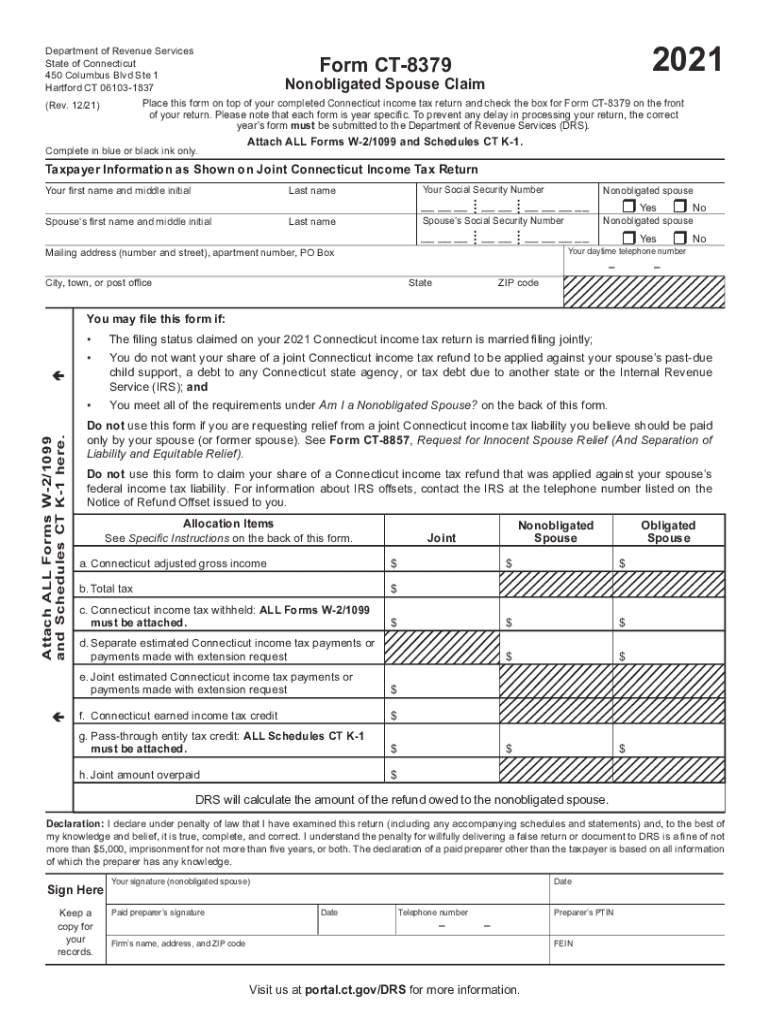

The Connecticut Form CT 8379, also known as the nonobligated spouse claim form, is specifically designed for individuals who wish to claim a refund of their Connecticut income tax withheld when their spouse is responsible for the tax liability. This form is particularly relevant for couples filing jointly where one spouse has a tax obligation that the other does not. Understanding the purpose and function of this form can help taxpayers navigate their tax responsibilities more effectively.

Eligibility Criteria for Form CT 8379

To qualify for using the CT 8379 form, taxpayers must meet specific criteria. Primarily, the individual must be a nonobligated spouse, meaning they are not responsible for the tax debt incurred by their partner. Additionally, the couple must have filed a joint tax return for the relevant tax year. It is essential to ensure that all eligibility requirements are met before submitting the form to avoid delays in processing.

Steps to Complete Form CT 8379

Completing the CT 8379 form involves several straightforward steps:

- Gather necessary information, including your Social Security number, your spouse's Social Security number, and details from your joint tax return.

- Fill out the form accurately, ensuring that all sections are completed, particularly those related to your income and withholding amounts.

- Review the form for any errors or omissions to prevent processing delays.

- Submit the completed form to the Connecticut Department of Revenue Services using the preferred submission method.

Form Submission Methods

Taxpayers can submit the CT 8379 form through various methods. The most common options include:

- Online submission through the Connecticut Department of Revenue Services website, which may provide immediate confirmation of receipt.

- Mailing the completed form to the appropriate address as specified by the Department of Revenue Services.

- In-person submission at designated state offices, allowing for direct interaction with tax officials.

Required Documents for Filing

When filing Form CT 8379, certain documents are necessary to support your claim. These typically include:

- A copy of your joint tax return for the year in question.

- Any W-2 forms or 1099 forms that document income and tax withholdings.

- Proof of your nonobligated status, which may include additional documentation depending on your situation.

Penalties for Non-Compliance

Failure to properly complete and submit Form CT 8379 can result in penalties. Taxpayers may face delays in receiving their refund, and in some cases, additional fines may be assessed. It is crucial to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete department of revenue services business ct gov

Complete DEPARTMENT OF REVENUE SERVICES Business ct gov seamlessly on any device

Managing documents online has gained traction among organizations and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle DEPARTMENT OF REVENUE SERVICES Business ct gov on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign DEPARTMENT OF REVENUE SERVICES Business ct gov effortlessly

- Locate DEPARTMENT OF REVENUE SERVICES Business ct gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or hide sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign DEPARTMENT OF REVENUE SERVICES Business ct gov and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services business ct gov

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services business ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 8379 and how does it relate to airSlate SignNow?

CT 8379 is a specific document type that can be efficiently managed using airSlate SignNow. This platform allows users to easily send, eSign, and store CT 8379 documents securely, streamlining the entire process for businesses.

-

How much does airSlate SignNow cost for managing CT 8379 documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring CT 8379 document management. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget while accessing all necessary features.

-

What features does airSlate SignNow provide for CT 8379 document handling?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for CT 8379 documents. These tools enhance efficiency and ensure compliance, making it easier for businesses to manage their documentation.

-

What are the benefits of using airSlate SignNow for CT 8379?

Using airSlate SignNow for CT 8379 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform simplifies the signing process, allowing businesses to focus on their core operations while ensuring compliance with legal standards.

-

Can airSlate SignNow integrate with other software for CT 8379 management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage CT 8379 documents. This integration allows for a more streamlined workflow, connecting your existing tools with airSlate SignNow's powerful features.

-

Is airSlate SignNow user-friendly for handling CT 8379 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage CT 8379 documents. The intuitive interface ensures that users can quickly learn how to send and eSign documents without extensive training.

-

How secure is airSlate SignNow for storing CT 8379 documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect CT 8379 documents. Your sensitive information is safeguarded, ensuring that only authorized users can access and manage your documents.

Get more for DEPARTMENT OF REVENUE SERVICES Business ct gov

Find out other DEPARTMENT OF REVENUE SERVICES Business ct gov

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template