Where to Send Form 8379 for Ct 2011

Understanding the Fillable CT 8379 Form

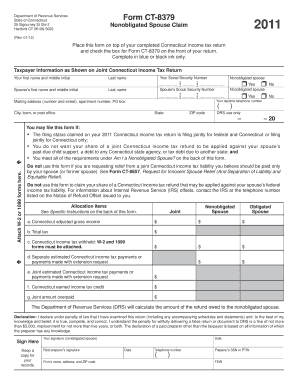

The fillable CT 8379 form, also known as the CT Injured Spouse form, is a crucial document for taxpayers in Connecticut who wish to claim their share of a joint tax refund that may be applied to their spouse's past-due obligations. This form is essential for individuals who have been affected by their spouse's debts, such as child support or student loans, and who want to ensure they receive their rightful portion of the refund. Completing this form accurately is vital to protect your financial interests and ensure compliance with state tax regulations.

Steps to Complete the Fillable CT 8379 Form

Completing the CT 8379 form involves several key steps:

- Gather necessary information, including your and your spouse's Social Security numbers, tax filing status, and details about any debts.

- Fill out the form, ensuring that all sections are completed accurately. Pay special attention to the allocation of income and tax payments.

- Review the form for any errors or omissions before submission to avoid delays in processing.

- Sign and date the form to validate your submission.

Where to Send the CT 8379 Form

After completing the fillable CT 8379 form, it is essential to send it to the correct address to ensure timely processing. In Connecticut, the form should be mailed to the Connecticut Department of Revenue Services. The specific address may vary based on whether you are filing electronically or by mail, so it is important to verify the correct mailing address on the Connecticut Department of Revenue Services website or the form instructions.

Filing Deadlines for the CT 8379 Form

Timely submission of the CT 8379 form is crucial. Generally, the form must be filed within three years from the due date of the original tax return. This includes any extensions that may have been granted. If you miss this deadline, you may lose your right to claim your portion of the refund. Keeping track of filing deadlines ensures that you remain compliant and can access your funds when eligible.

Eligibility Criteria for the CT 8379 Form

To qualify for filing the CT 8379 form, you must meet specific criteria. You must have filed a joint tax return with your spouse and have a portion of your refund that is subject to being withheld due to your spouse's debts. Additionally, you should not be responsible for the debts in question. Understanding these eligibility requirements is essential for ensuring that you can successfully claim your share of the tax refund.

Examples of Using the CT 8379 Form

There are various scenarios in which the CT 8379 form may be applicable. For instance, if your spouse owes back child support and you filed a joint tax return, you can use this form to claim your portion of the refund. Another example is when your spouse has federal student loans in default, which may also affect your joint refund. In both cases, filing the CT 8379 form helps protect your financial interests and ensures you receive the refund you are entitled to.

Quick guide on how to complete where to send form 8379 for ct

Complete Where To Send Form 8379 For Ct effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to generate, modify, and eSign your documents swiftly without delays. Handle Where To Send Form 8379 For Ct on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Where To Send Form 8379 For Ct without stress

- Locate Where To Send Form 8379 For Ct and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Where To Send Form 8379 For Ct and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct where to send form 8379 for ct

Create this form in 5 minutes!

How to create an eSignature for the where to send form 8379 for ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable ct 8379 form?

The fillable ct 8379 form is a tax form used for claiming a refund for certain tax credits. It allows taxpayers to report their income and deductions in a structured format. Using a fillable ct 8379 form simplifies the filing process and ensures accuracy in your tax submissions.

-

How can I create a fillable ct 8379 form using airSlate SignNow?

Creating a fillable ct 8379 form with airSlate SignNow is straightforward. You can upload your document, add fillable fields, and customize it to meet your needs. This feature ensures that your form is user-friendly and ready for electronic signatures.

-

Is there a cost associated with using the fillable ct 8379 form on airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to fillable ct 8379 forms. Depending on your business needs, you can choose a plan that fits your budget while providing essential features for document management and eSigning.

-

What are the benefits of using airSlate SignNow for fillable ct 8379 forms?

Using airSlate SignNow for fillable ct 8379 forms streamlines your document workflow. It enhances collaboration, reduces processing time, and ensures compliance with tax regulations. Additionally, the platform provides secure storage and easy access to your forms.

-

Can I integrate airSlate SignNow with other applications for fillable ct 8379 forms?

Yes, airSlate SignNow offers integrations with various applications, allowing you to enhance your workflow with fillable ct 8379 forms. You can connect with CRM systems, cloud storage services, and other tools to streamline your document management process.

-

How secure is the fillable ct 8379 form when using airSlate SignNow?

airSlate SignNow prioritizes security for all documents, including fillable ct 8379 forms. The platform uses encryption and secure access protocols to protect your sensitive information. You can confidently manage your forms knowing they are safeguarded against unauthorized access.

-

Can I track the status of my fillable ct 8379 form in airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features for your fillable ct 8379 forms. You can monitor when the form is sent, viewed, and signed, ensuring you stay informed throughout the process.

Get more for Where To Send Form 8379 For Ct

- Salvage branding of new york state registered vehicles form

- Certification candidates must submit the entire certification application package including the test form

- How to get in transit vehicle permits temporary registrations form

- Request for interim extension license form

- Wwwdmvvirginiagovwebdocpdfdrivers license and identification card application virginia form

- Illinoistemporary visitor drivers license tvdl quick guide chinese form

- Self service storage facility form

- Si tiene una queja en contra de su abogado state bar of form

Find out other Where To Send Form 8379 For Ct

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document