Form W 2G Rev January Internal Revenue Service

What is the Form W-2G?

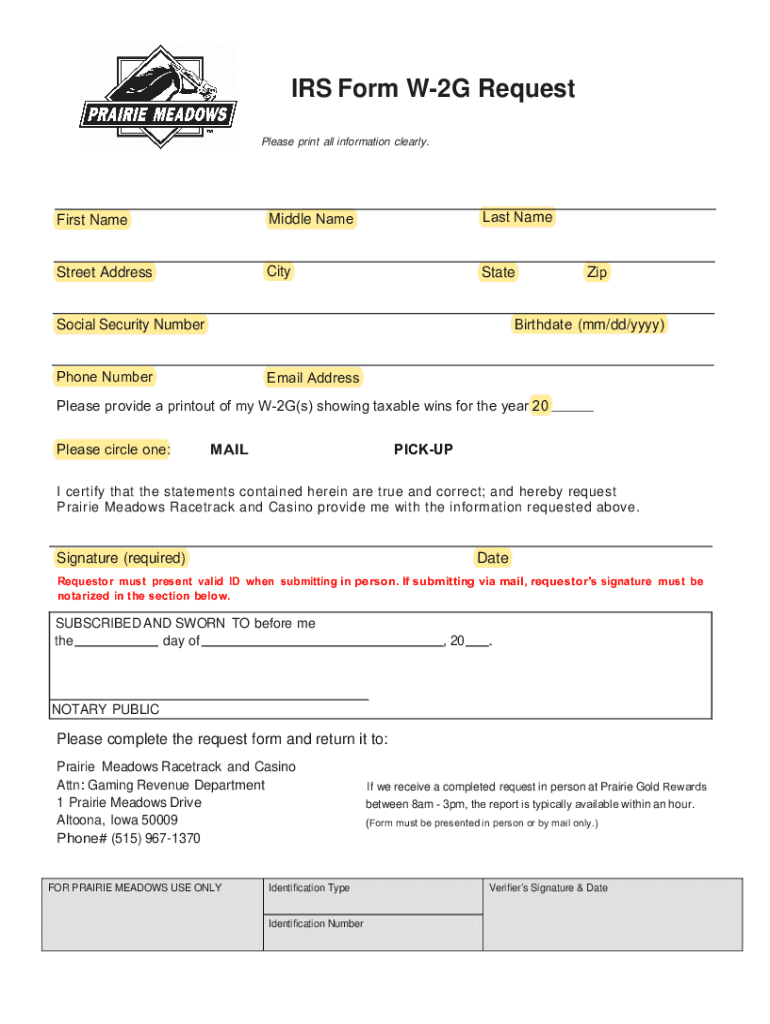

The Form W-2G, Revision January, is a tax document issued by the Internal Revenue Service (IRS) used to report gambling winnings. This form is essential for individuals who receive certain types of gambling income, including winnings from lotteries, raffles, and other gambling activities. The form provides information on the amount won, the type of gambling, and any federal income tax withheld. Understanding the W-2G is crucial for accurate tax reporting and compliance with IRS regulations.

How to Use the Form W-2G

The Form W-2G is used by both gamblers and the entities that pay out gambling winnings. Gamblers should receive this form from the payer when their winnings exceed a specific threshold, which varies depending on the type of gambling. Once received, individuals must include the reported winnings on their tax returns. Payers, such as casinos or lottery organizations, are responsible for completing the form and submitting it to the IRS, ensuring that all relevant details are accurately reported.

Steps to Complete the Form W-2G

Completing the Form W-2G involves several key steps:

- Gather necessary information, including the date of the winnings, the type of gambling, and the amount won.

- Fill out the payer's information, including name, address, and taxpayer identification number (TIN).

- Provide the winner's details, including name, address, and TIN.

- Report the total winnings and any federal income tax withheld.

- Submit the completed form to the IRS and provide a copy to the winner.

Legal Use of the Form W-2G

The legal use of the Form W-2G is governed by IRS regulations. It is mandatory for payers to issue this form for gambling winnings that meet or exceed specified thresholds. Failure to provide the form can result in penalties for the payer. For recipients, it is crucial to report the income accurately on their tax returns to avoid issues with the IRS. Understanding the legal implications of the W-2G helps ensure compliance and proper reporting of gambling income.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-2G are critical for both payers and recipients. Payers must submit the form to the IRS by the end of January for the previous tax year. Recipients should receive their copies by the same deadline. It is important to be aware of these dates to ensure timely reporting and to avoid potential penalties for late submissions.

Who Issues the Form W-2G

The Form W-2G is issued by entities that pay out gambling winnings, such as casinos, racetracks, and lottery organizations. These payers are responsible for accurately completing the form and ensuring it is provided to both the IRS and the winner. Understanding who issues the form helps recipients know where to expect their tax documentation and ensures proper record-keeping for tax purposes.

Quick guide on how to complete form w 2g rev january internal revenue service

Effortlessly Prepare Form W 2G Rev January Internal Revenue Service on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-conscious substitute for traditional printed and signed paperwork, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form W 2G Rev January Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

How to Modify and Electronically Sign Form W 2G Rev January Internal Revenue Service with Ease

- Locate Form W 2G Rev January Internal Revenue Service and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools available from airSlate SignNow designed specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Alter and electronically sign Form W 2G Rev January Internal Revenue Service and ensure excellent communication throughout every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 2g rev january internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 2G Rev January Internal Revenue Service?

Form W 2G Rev January Internal Revenue Service is a tax form used to report gambling winnings and any federal income tax withheld on those winnings. It is essential for individuals who have received gambling winnings to accurately report this information to the IRS. Understanding this form is crucial for compliance with tax regulations.

-

How can airSlate SignNow help with Form W 2G Rev January Internal Revenue Service?

airSlate SignNow provides a seamless platform for businesses to send and eSign Form W 2G Rev January Internal Revenue Service electronically. This simplifies the process of managing tax documents, ensuring that they are completed accurately and submitted on time. Our solution enhances efficiency and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form W 2G Rev January Internal Revenue Service?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing Form W 2G Rev January Internal Revenue Service. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures you only pay for what you need.

-

What features does airSlate SignNow offer for managing Form W 2G Rev January Internal Revenue Service?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Form W 2G Rev January Internal Revenue Service. These tools streamline the document workflow, making it easier to manage tax forms efficiently. Additionally, our platform ensures compliance with legal standards.

-

Is airSlate SignNow secure for handling Form W 2G Rev January Internal Revenue Service?

Yes, airSlate SignNow prioritizes security and compliance when handling Form W 2G Rev January Internal Revenue Service. Our platform employs advanced encryption and security protocols to protect sensitive information. You can trust that your documents are safe and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for Form W 2G Rev January Internal Revenue Service?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow for Form W 2G Rev January Internal Revenue Service. This means you can connect with your existing tools, enhancing productivity and ensuring a smooth document management process.

-

What are the benefits of using airSlate SignNow for Form W 2G Rev January Internal Revenue Service?

Using airSlate SignNow for Form W 2G Rev January Internal Revenue Service offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, allowing you to focus on your core business activities while ensuring compliance with tax regulations. It's a smart choice for modern businesses.

Get more for Form W 2G Rev January Internal Revenue Service

- Exhibit sheet court form fill out and sign printable pdf

- Tf 240 witness list 11 10 trial court forms

- Tf 410 manual of transcript procedures 3 16 state of alaska form

- Fees due to my financial inability to pay form

- Cr 205 request for appointed attorney state of alaska form

- Tf 935 notice of change of judge state of alaska form

- Tf 940 affidavit 414 pdf fill in state of alaska form

- Attach it to the form it relates to at the time that form is filed

Find out other Form W 2G Rev January Internal Revenue Service

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online