Form 3586 2018

What is the Form 3586

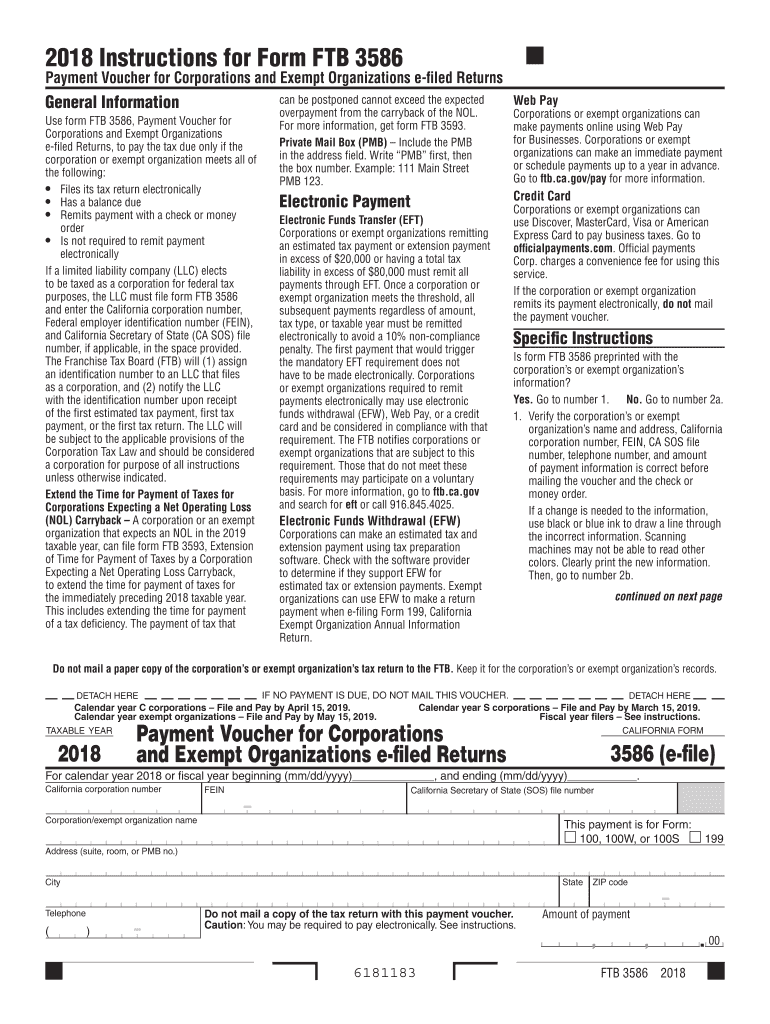

The CA Form 3586, also known as the California Payment Voucher, is a tax form used by individuals and businesses to submit payments to the California Franchise Tax Board (FTB). This form is essential for reporting and paying taxes owed to the state, ensuring compliance with California tax regulations. It is particularly relevant for taxpayers who need to make estimated tax payments or pay any balance due when filing their tax returns.

How to use the Form 3586

Using the Form 3586 involves several straightforward steps. First, you will need to gather your financial information, including your total income and any deductions. Next, complete the form by entering your name, address, and taxpayer identification number. You will also need to specify the amount you are paying and the tax year for which the payment is being made. After filling out the form, review it for accuracy before submitting it along with your payment to the FTB.

Steps to complete the Form 3586

Completing the CA Form 3586 requires careful attention to detail. Begin by downloading the form from the official FTB website or using a reliable eSignature solution like signNow. Follow these steps:

- Enter your personal information, including your full name and address.

- Provide your taxpayer identification number, which can be your Social Security number or Employer Identification Number.

- Indicate the tax year for which you are making the payment.

- Specify the amount you are submitting with the voucher.

- Check all entries for accuracy before signing the form.

Once completed, you can submit the form either electronically or via mail, depending on your preference.

Legal use of the Form 3586

The legal use of the CA Form 3586 is governed by California tax laws. This form must be accurately completed and submitted to ensure that your payments are properly credited to your tax account. Using the form correctly helps avoid penalties for late payments or underpayment of taxes. The FTB allows for electronic submissions, which are legally binding and compliant with the ESIGN Act, ensuring that your digital signature holds the same validity as a handwritten one.

Filing Deadlines / Important Dates

Filing deadlines for the CA Form 3586 are crucial for taxpayers to observe. Generally, estimated tax payments are due quarterly, with specific deadlines falling on April 15, June 15, September 15, and January 15 of the following year. It is important to stay informed about any changes to these dates, as timely submissions help avoid interest and penalties. Additionally, if you are filing for a specific tax year, ensure that you are aware of the deadlines relevant to that year.

Form Submission Methods (Online / Mail / In-Person)

The CA Form 3586 can be submitted through various methods, providing flexibility for taxpayers. You can file the form online using a secure eSignature solution, which streamlines the process and ensures immediate confirmation of receipt. Alternatively, you can mail the completed form to the FTB at the designated address or submit it in person at a local FTB office. Each method has its own advantages, so choose the one that best fits your needs.

Quick guide on how to complete 2018 form 3586 e file payment voucher for franchise tax

Your assistance manual on how to prepare your Form 3586

If you’re curious about how to generate and submit your Form 3586, here are a few brief guidelines on how to simplify tax processing.

To begin, you merely need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify answers as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form 3586 in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore versions and schedules.

- Click Get form to load your Form 3586 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to mistakes and delays in reimbursements. Importantly, prior to e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 3586 e file payment voucher for franchise tax

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

What ITR form should one fill to file his income tax returns in India for AY 2018-19 if he is a salaried employee and he also owns a sole proprietorship firm?

ITR 3 or 4 will be applicable.Accounting for the firm should be properly done and financial statements should be adequately prepared for the purpose of recording it in the ITR. Any TDS deducted on the incomes should also be properly captured in the ITR.Best regards,Aditiaditi.bhardwaj@outlook.com

-

I made a wrong payment to IRS from their website for taxes before sending tax forms, but later I e-filed and made correct payment. How can I contact them for a refund of my wrong payment?

I'm not sure what you did here - you paid online an estimated tax, and then e-filed paying a different amount of tax without claiming your estimated tax already paid? In that case you need to file a 1040X to correct your estimated tax payments made. You will then show an overpayment and should get back a refund eventually.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 3586 e file payment voucher for franchise tax

How to make an eSignature for your 2018 Form 3586 E File Payment Voucher For Franchise Tax online

How to make an eSignature for your 2018 Form 3586 E File Payment Voucher For Franchise Tax in Google Chrome

How to create an eSignature for signing the 2018 Form 3586 E File Payment Voucher For Franchise Tax in Gmail

How to generate an eSignature for the 2018 Form 3586 E File Payment Voucher For Franchise Tax from your mobile device

How to create an electronic signature for the 2018 Form 3586 E File Payment Voucher For Franchise Tax on iOS devices

How to make an electronic signature for the 2018 Form 3586 E File Payment Voucher For Franchise Tax on Android devices

People also ask

-

What is the CA Form 3586 for 2018, and how can I use it?

The CA Form 3586 for 2018 is a document used for specific tax reporting in California. With airSlate SignNow, you can easily prepare and eSign this form online, ensuring your submissions are accurate and timely. Our platform streamlines the process, helping you focus on your business instead of paperwork.

-

How can airSlate SignNow help me complete the CA Form 3586 for 2018?

airSlate SignNow provides templates and tools to fill out the CA Form 3586 for 2018 efficiently. Our user-friendly interface guides you through the required fields, and you can add your signature with just a click. This simplifies compliance and boosts productivity for your business.

-

Is there a cost associated with using airSlate SignNow for the CA Form 3586 for 2018?

Yes, there is a pricing model for using airSlate SignNow, which includes various plans tailored to your needs. Our cost-effective solution is designed to provide you value while ensuring you can complete essential documents like the CA Form 3586 for 2018 seamlessly. Browse our pricing page for details on the best plan for you.

-

What features does airSlate SignNow offer for processing the CA Form 3586 for 2018?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking specifically for forms such as the CA Form 3586 for 2018. These features maximize your efficiency, ensuring you can manage important documents without hassle. Additionally, the platform is built for collaboration, allowing multiple users to work on a document simultaneously.

-

Can I integrate airSlate SignNow with other software to manage the CA Form 3586 for 2018?

Absolutely! airSlate SignNow integrates with various platforms, including CRM and accounting software, to help streamline your workflow when handling the CA Form 3586 for 2018. This connectivity allows you to automatically sync data and minimize manual entry, enhancing your overall efficiency.

-

What are the benefits of using airSlate SignNow for the CA Form 3586 for 2018 compared to traditional methods?

Using airSlate SignNow for the CA Form 3586 for 2018 offers numerous benefits over traditional methods, including speed, accuracy, and cost savings. You can complete and sign forms from anywhere, at any time, signNowly reducing delays in processing. Additionally, our platform reduces the chances of errors, ensuring your submissions are correct.

-

How secure is my information when using airSlate SignNow for the CA Form 3586 for 2018?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the CA Form 3586 for 2018. Our platform utilizes advanced encryption protocols to protect your information. You can trust that your data remains confidential and secure while using our eSigning services.

Get more for Form 3586

Find out other Form 3586

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy