3586 2022-2025 Form

Understanding the California Form 3586 E-file Payment Voucher

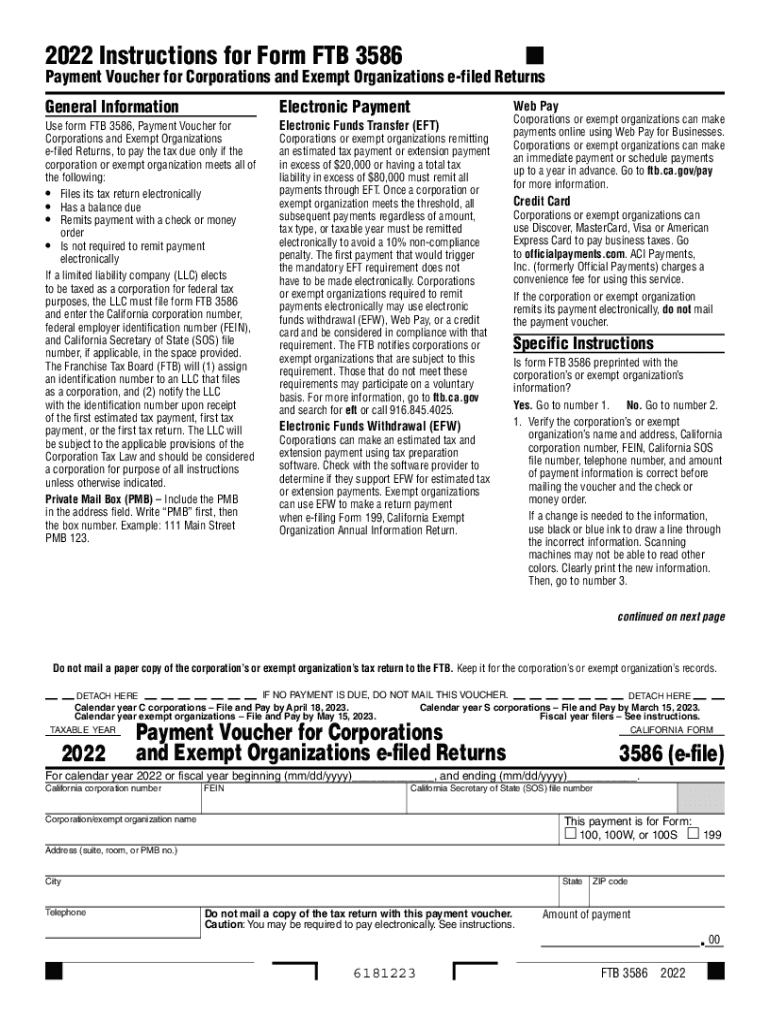

The California Form 3586 is a payment voucher specifically designed for corporations and exempt organizations that file their returns electronically. This form serves as a means to submit payments associated with e-filed returns, ensuring compliance with California tax regulations. It is crucial for businesses to understand the purpose of this form, as it simplifies the payment process and helps maintain accurate records with the California Franchise Tax Board (FTB).

Steps to Complete the California Form 3586

Completing the California Form 3586 involves several key steps:

- Gather necessary information, including your corporation's name, address, and identification number.

- Calculate the total payment amount due based on your e-filed return.

- Fill out the form accurately, ensuring all details are correct.

- Review the form for any errors before submission.

- Submit the completed form along with your payment to the appropriate address or electronically, depending on your preference.

Legal Use of the California Form 3586

The California Form 3586 is legally recognized as a valid payment method for corporations and exempt organizations. When completed correctly and submitted on time, it ensures that the associated e-filed returns are processed without complications. Compliance with state regulations is essential, as failure to submit this form can lead to penalties or interest on unpaid taxes.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the California Form 3586. Typically, the form must be submitted by the due date of the e-filed return to avoid penalties. Keeping track of these dates ensures timely payments and compliance with California tax laws.

Required Documents for Form 3586 Submission

Before submitting the California Form 3586, ensure you have all required documents ready. This includes:

- Your e-filed return, which provides the basis for the payment amount.

- Any supporting documentation that may be necessary for your specific tax situation.

- Identification details of your corporation or exempt organization.

Examples of Using the California Form 3586

For corporations and exempt organizations, the California Form 3586 can be utilized in various scenarios, such as:

- Submitting payments for annual franchise taxes.

- Paying estimated tax payments based on projected income.

- Making adjustments for prior year payments if necessary.

Quick guide on how to complete form 3586 payment

Complete form 3586 payment effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage form 3586 on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The optimal method to modify and eSign 3586 form with ease

- Locate 3586 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign ca form 3586 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3586 2024

Related searches to ftb 3586

Create this form in 5 minutes!

People also ask california form 3586

-

What is a form 3586 and how can it be used in airSlate SignNow?

Form 3586 is a specific document template that can be utilized for various purposes within airSlate SignNow. It allows businesses to customize their workflows, ensuring compliance and efficiency in signing processes. By using form 3586, you can streamline your document handling, making it easier to collect signatures electronically.

-

How does airSlate SignNow facilitate the completion of form 3586?

airSlate SignNow simplifies the completion of form 3586 by providing an intuitive interface for users. You can easily fill out, sign, and send the form with just a few clicks, reducing time and errors often associated with manual processing. This ensures that your document management is efficient and user-friendly.

-

What are the pricing options for using airSlate SignNow for form 3586?

airSlate SignNow offers several pricing tiers to suit different business needs when using form 3586. You can choose from individual plans for startups to comprehensive packages for larger enterprises. Each plan is designed to provide cost-effective solutions, maximizing value while minimizing overhead costs.

-

What features of airSlate SignNow are particularly beneficial for managing form 3586?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking that are particularly beneficial for managing form 3586. These tools enhance your document management process, allowing for quicker and easier collaboration among multiple users. Additionally, built-in security ensures that confidential information remains protected.

-

Can form 3586 be integrated with other applications?

Yes, form 3586 can be easily integrated with a variety of applications through airSlate SignNow's API. This functionality allows seamless sharing of data between different platforms, enhancing your workflow efficiency. You can connect with popular tools like CRM systems to keep your operations streamlined.

-

What are the benefits of using airSlate SignNow for form 3586 compared to traditional methods?

Using airSlate SignNow for form 3586 provides numerous benefits over traditional methods, including faster turnaround times and reduced paperwork. It supports electronic signatures, which can signNowly speed up the approval process. Additionally, the platform helps minimize errors and enhances security in document management.

-

How does the electronic signature process work for form 3586 in airSlate SignNow?

The electronic signature process for form 3586 in airSlate SignNow is straightforward. After preparing the document, you can send it for signature via email. Signers can review and sign the form digitally, making the entire process efficient and ensuring compliance with legal standards for electronic signatures.

Get more for 3582 e file

- Haccp plan restaurant form

- Visa application to poland form

- Arizona department of economic security sign insign out record 1 2 form

- Ymca canandaigua form

- Dd form 1351 2 100257637

- Usmle step 2 cs core cases pdf form

- Di 9 state of utah investigating officers report of traffic crash di 9 form

- Desoto county schools proof of residency form

Find out other form 3586 filed

- eSign Nevada Plumbing Purchase Order Template Online

- eSign Nebraska Plumbing Lease Agreement Template Fast

- eSign Nebraska Plumbing Lease Agreement Template Simple

- eSign Nevada Plumbing Purchase Order Template Computer

- eSign Nevada Plumbing Work Order Online

- eSign Nevada Plumbing Purchase Order Template Mobile

- eSign Nevada Plumbing Purchase Order Template Now

- eSign Nevada Plumbing Purchase Order Template Later

- eSign Nebraska Plumbing Lease Agreement Template Easy

- eSign Nevada Plumbing Purchase Order Template Myself

- eSign Nevada Plumbing Purchase Order Template Free

- eSign Nebraska Plumbing Lease Agreement Template Safe

- eSign Nevada Plumbing Work Order Computer

- eSign Nevada Plumbing Purchase Order Template Fast

- eSign Nevada Plumbing Purchase Order Template Secure

- eSign Nevada Plumbing Purchase Order Template Simple

- eSign Nevada Plumbing Work Order Mobile

- eSign Nevada Plumbing Purchase Order Template Easy

- How To eSign Nevada Plumbing Work Order

- eSign Nevada Plumbing Work Order Now