Form 3586 Instructions for Form FTB 3586 Payment Voucher for Corporations Ans Exempt Organizations E Filed Returns 2016

Understanding Form 3586 and Its Purpose

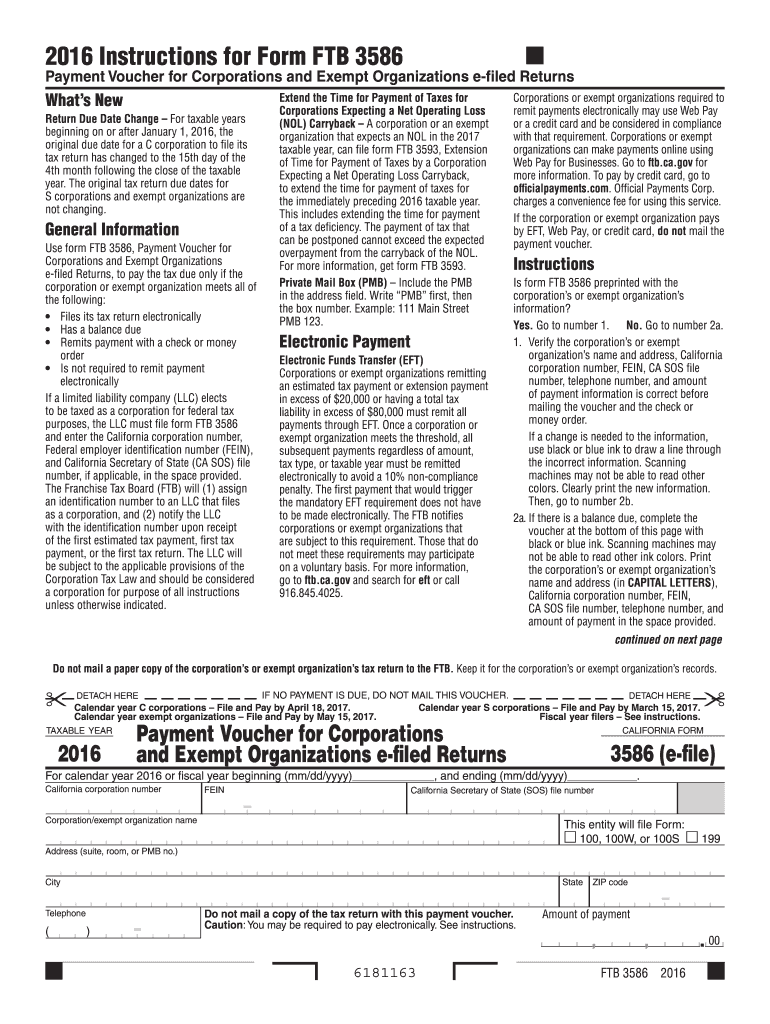

Form 3586, also known as the Payment Voucher for Corporations and Exempt Organizations E-filed Returns, is a crucial document for businesses and exempt organizations in the United States. This form is used to remit payments associated with corporate taxes or taxes owed by exempt organizations that file electronically. It ensures that the payment is correctly matched with the corresponding tax return, facilitating a smoother processing experience with the California Franchise Tax Board (FTB).

Steps to Complete Form 3586

Completing Form 3586 involves several important steps to ensure accuracy and compliance. Begin by gathering necessary information, including your entity's name, address, and tax identification number. Next, determine the amount owed, which should reflect the balance due from your e-filed return. Carefully fill out the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors before signing and dating it. Finally, submit the form along with your payment to the appropriate address indicated on the form.

Obtaining Form 3586

Form 3586 can be obtained directly from the California Franchise Tax Board's website or through authorized tax preparation software. It is essential to ensure that you are using the most current version of the form to comply with the latest tax regulations. If you prefer a physical copy, you may also request one from the FTB by contacting their office directly.

Legal Use of Form 3586

Form 3586 is legally binding when completed and submitted according to the guidelines set forth by the California Franchise Tax Board. It is important to ensure that the information provided is accurate and truthful, as any discrepancies could lead to penalties or delays in processing. The form serves as an official record of payment, which can be referenced in case of audits or inquiries regarding your tax filings.

Filing Deadlines and Important Dates

Timely submission of Form 3586 is critical to avoid penalties. The filing deadline typically aligns with the due date of your corporate tax return. It is advisable to check the California Franchise Tax Board's website for specific dates, as they may vary from year to year. Marking these deadlines on your calendar can help ensure that you submit your payment voucher on time.

Form Submission Methods

Form 3586 can be submitted through various methods, including online, by mail, or in person. When submitting electronically, ensure that you follow the instructions provided for e-filing to ensure proper processing. If mailing the form, use the address specified for payments on the form itself. In-person submissions can be made at designated FTB offices, but it is advisable to check for any specific requirements or office hours before visiting.

Quick guide on how to complete 2016 form 3586 2016 instructions for form ftb 3586 payment voucher for corporations ans exempt organizations e filed returns

Your assistance manual on how to prepare your Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns

If you’re interested in understanding how to generate and transmit your Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns, below are a few straightforward guidelines to simplify the tax submission process.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly intuitive and robust document solution that enables you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and go back to adjust responses as needed. Enhance your tax organization with advanced PDF editing, eSigning, and user-friendly sharing.

Execute the tasks below to finalize your Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns in a matter of minutes:

- Establish your account and begin working on PDFs in just a few moments.

- Utilize our directory to find any IRS tax form; examine various versions and schedules.

- Click Obtain form to access your Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns in our editor.

- Complete the essential fillable fields with your details (text, numbers, check marks).

- Utilize the Signing Tool to include your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Store changes, print your copy, send it to your intended recipient, and download it to your device.

Leverage this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing manually can increase the likelihood of errors and postpone refunds. Of course, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 3586 2016 instructions for form ftb 3586 payment voucher for corporations ans exempt organizations e filed returns

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 3586 2016 instructions for form ftb 3586 payment voucher for corporations ans exempt organizations e filed returns

How to create an eSignature for your 2016 Form 3586 2016 Instructions For Form Ftb 3586 Payment Voucher For Corporations Ans Exempt Organizations E Filed Returns online

How to generate an electronic signature for the 2016 Form 3586 2016 Instructions For Form Ftb 3586 Payment Voucher For Corporations Ans Exempt Organizations E Filed Returns in Google Chrome

How to generate an eSignature for signing the 2016 Form 3586 2016 Instructions For Form Ftb 3586 Payment Voucher For Corporations Ans Exempt Organizations E Filed Returns in Gmail

How to generate an electronic signature for the 2016 Form 3586 2016 Instructions For Form Ftb 3586 Payment Voucher For Corporations Ans Exempt Organizations E Filed Returns from your mobile device

How to generate an electronic signature for the 2016 Form 3586 2016 Instructions For Form Ftb 3586 Payment Voucher For Corporations Ans Exempt Organizations E Filed Returns on iOS devices

How to make an electronic signature for the 2016 Form 3586 2016 Instructions For Form Ftb 3586 Payment Voucher For Corporations Ans Exempt Organizations E Filed Returns on Android OS

People also ask

-

What is the Form 3586 and why is it important for corporations?

The Form 3586 is a payment voucher that corporations and exempt organizations use when filing electronically. Understanding the Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns is crucial to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with the Form 3586 process?

airSlate SignNow streamlines the submission process by allowing businesses to eSign and send documents efficiently. Our solution is designed to simplify the compliance with the Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns, ensuring accuracy and timeliness.

-

What features does airSlate SignNow offer for managing Form 3586 submissions?

airSlate SignNow offers a range of features including document templates, eSignature capabilities, and tracking options. These tools make it easier to adhere to the Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns while minimizing errors.

-

Is there a cost associated with using airSlate SignNow for Form 3586?

Yes, airSlate SignNow provides various pricing plans that cater to different business sizes and needs. Investing in our services ensures that you have the necessary tools to follow the Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns effectively.

-

Can airSlate SignNow integrate with other software for managing Form 3586?

Absolutely! airSlate SignNow seamlessly integrates with multiple platforms such as CRMs and accounting software. This compatibility enhances your ability to manage Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns with ease.

-

What are the benefits of e-filing Form 3586 through airSlate SignNow?

E-filing Form 3586 through airSlate SignNow saves time and resources. By following the Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns electronically, you can streamline approvals and reduce the risk of lost documents.

-

How user-friendly is airSlate SignNow for new users handling Form 3586?

airSlate SignNow is designed with simplicity in mind, making it easy for new users to navigate. Our platform provides clear guidance on following the Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns, so you can quickly learn how to eSign and manage your documents.

Get more for Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns

- Dlad form

- Asthma action planmedication authorization form cms k12 nc

- New mexico office of the state engineer meter reading email form

- Practical math for veterinary technicians form

- Firearm statement of ownership texas form

- Carroll county maryland department of human services form

- Hcps partnership form henrico county public schools

- Miami dade corrections and rehabilitation department annual form

Find out other Form 3586 Instructions For Form FTB 3586 Payment Voucher For Corporations Ans Exempt Organizations E filed Returns

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template