Council on State Taxation COST 2019

What is the CA Form 3586 for 2018?

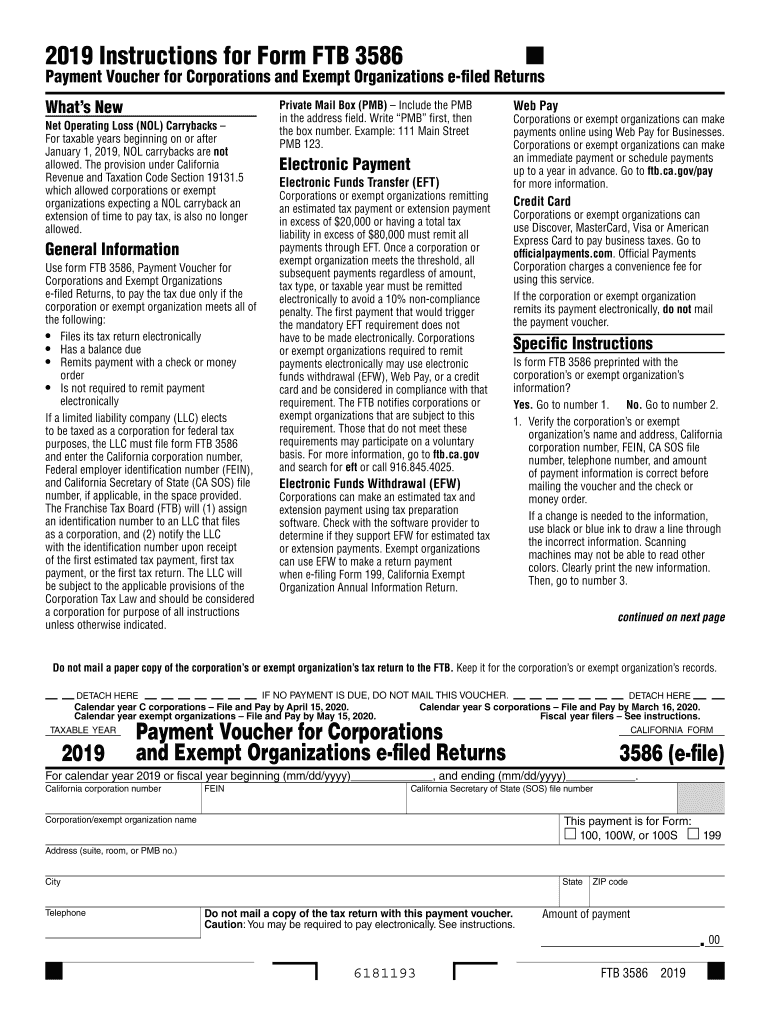

The CA Form 3586, also known as the California Franchise Tax Board (FTB) Form 3586, is a tax form used by individuals and businesses in California to report and pay their state taxes. Specifically, this form is associated with the payment of the California income tax and is essential for ensuring compliance with state tax obligations. The 2018 version of this form is tailored to reflect the tax regulations and requirements applicable for that tax year.

Steps to Complete the CA Form 3586 for 2018

Completing the CA Form 3586 for 2018 involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out personal identification information, such as your name, address, and Social Security number.

- Report your total income and calculate your tax liability based on the applicable tax rates for 2018.

- Include any deductions or credits you may qualify for to reduce your taxable income.

- Review the form for accuracy before submission to avoid penalties.

Form Submission Methods for CA Form 3586

The CA Form 3586 can be submitted through various methods to accommodate different preferences:

- Online Submission: You can complete and submit the form electronically through the California Franchise Tax Board's website, ensuring a quicker processing time.

- Mail: If you prefer a paper submission, print the completed form and send it to the designated FTB address for processing.

- In-Person: You may also choose to deliver the form directly to a local FTB office, which can provide immediate confirmation of receipt.

Penalties for Non-Compliance with CA Form 3586

Failing to file the CA Form 3586 for 2018 or submitting it late can result in significant penalties. These may include:

- Late Filing Penalties: A percentage of the unpaid tax amount may be charged for each month the form is late.

- Interest Charges: Interest will accrue on any unpaid taxes from the due date until the tax is paid in full.

- Potential Legal Action: Continued non-compliance may lead to further legal consequences, including liens or levies on property.

Eligibility Criteria for CA Form 3586

To be eligible to file the CA Form 3586 for 2018, you must meet certain criteria, including:

- Being a resident of California or having income sourced from California.

- Meeting the income thresholds established by the California Franchise Tax Board for the 2018 tax year.

- Having tax liabilities that necessitate the use of this specific form for reporting and payment.

Legal Use of CA Form 3586

The CA Form 3586 is legally binding when completed and submitted according to California tax laws. It is crucial to ensure that all information provided is accurate and truthful, as discrepancies may lead to audits or legal repercussions. Utilizing a trusted digital platform for e-signatures can enhance the legal standing of the form, ensuring compliance with electronic signature laws.

Quick guide on how to complete council on state taxation cost

Effortlessly finalize Council On State Taxation COST on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any holdups. Manage Council On State Taxation COST on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and electronically sign Council On State Taxation COST without stress

- Find Council On State Taxation COST and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Council On State Taxation COST to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct council on state taxation cost

Create this form in 5 minutes!

How to create an eSignature for the council on state taxation cost

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the CA Form 3586 for 2018?

The CA Form 3586 for 2018 is a tax-related document required by the State of California for specific reporting. It plays a crucial role in certain financial transactions and ensures compliance when submitting tax documents. Understanding how to fill out and submit the CA Form 3586 for 2018 is essential for businesses operating within the state.

-

How can airSlate SignNow help with the CA Form 3586 for 2018?

airSlate SignNow allows you to easily upload, fill, and eSign the CA Form 3586 for 2018. Our platform streamlines the signing process, ensuring that your document is signed quickly and securely. This efficiency helps businesses meet their deadlines while maintaining compliance with state regulations.

-

What are the pricing options for airSlate SignNow related to CA Form 3586 for 2018?

airSlate SignNow offers competitive pricing plans to accommodate various business needs when dealing with documents like the CA Form 3586 for 2018. Our plans include features that suit individual users and large teams alike. You can compare the pricing on our website to find the best fit for your requirements.

-

Are there any special features in airSlate SignNow for handling CA Form 3586 for 2018?

Yes, airSlate SignNow includes features tailored for managing the CA Form 3586 for 2018 effectively. These features include customizable templates, advanced security options, and workflow automation to help you manage your documents efficiently. This ensures that your eSigning experience is both productive and secure.

-

Can airSlate SignNow integrate with my existing systems when handling CA Form 3586 for 2018?

Absolutely! airSlate SignNow offers a range of integrations with popular business applications. This allows you to seamlessly manage and send the CA Form 3586 for 2018 without disrupting your existing workflows or systems.

-

What benefits does using airSlate SignNow provide for the CA Form 3586 for 2018?

Using airSlate SignNow for the CA Form 3586 for 2018 enhances productivity by reducing document turnaround time. It provides a secure environment for eSigning, which helps prevent unauthorized access and ensures compliance. This trust and reliability can give your business a competitive edge.

-

Is airSlate SignNow user-friendly for completing CA Form 3586 for 2018?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it simple to complete the CA Form 3586 for 2018. The intuitive interface allows users of all technical skill levels to navigate and execute document workflows with ease. You'll be able to manage your documents efficiently without extensive training.

Get more for Council On State Taxation COST

Find out other Council On State Taxation COST

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF