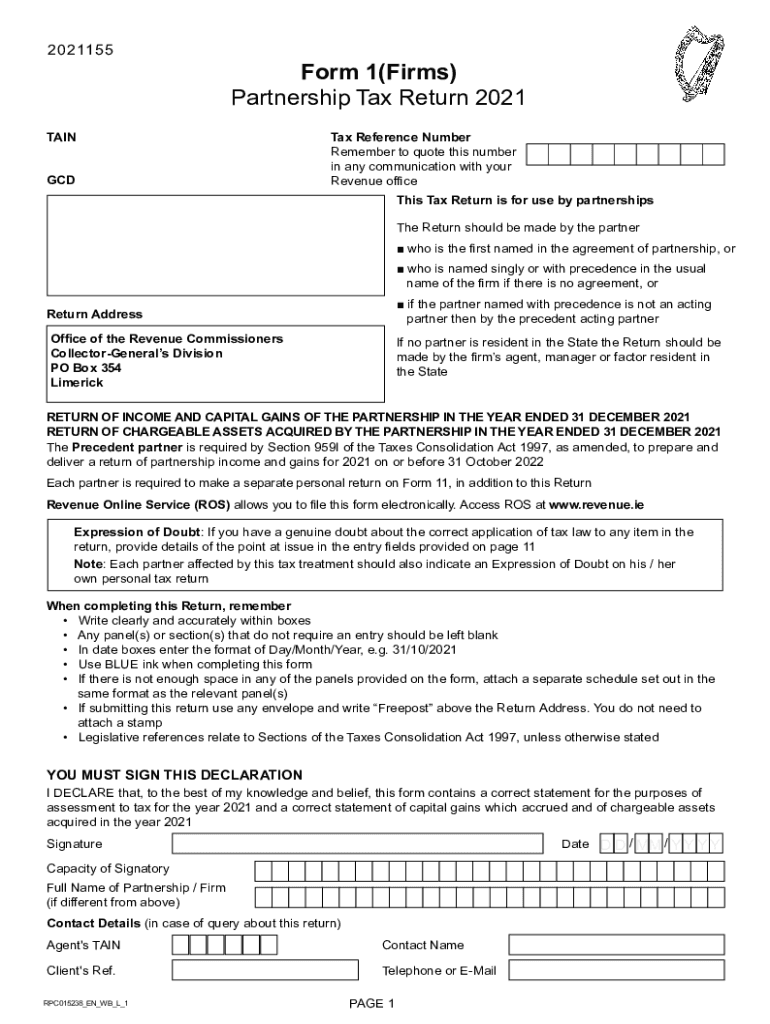

Form 1 Firms 2021-2026

What is the Form 1 Firms

The Form 1 Firms is a specific tax return document used by partnerships in the United States to report income, deductions, gains, and losses. This form is essential for partnerships to comply with federal tax obligations. It provides a comprehensive overview of the partnership's financial activities and is a critical component in the overall tax filing process for businesses operating as partnerships.

How to use the Form 1 Firms

Using the Form 1 Firms involves several steps. First, gather all necessary financial information, including income statements, expense reports, and any relevant documentation that supports the figures reported. Next, accurately fill out the form, ensuring that all sections are completed based on the partnership's financial data. Once completed, the form must be submitted to the appropriate tax authority by the designated deadline. It is important to keep a copy of the submitted form for your records.

Steps to complete the Form 1 Firms

Completing the Form 1 Firms involves a systematic approach:

- Collect financial records: Gather all income and expense documents related to the partnership.

- Fill out the form: Input accurate figures in the designated fields, ensuring compliance with IRS guidelines.

- Review the form: Check for accuracy and completeness to avoid errors that could lead to penalties.

- Submit the form: File the completed form with the IRS or state tax authority by the specified deadline.

Required Documents

To successfully complete the Form 1 Firms, several documents are required:

- Income statements detailing revenue generated by the partnership.

- Expense reports outlining all costs incurred during the tax year.

- Supporting documentation for deductions claimed, such as receipts and invoices.

- Previous year’s tax returns for reference and consistency.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1 Firms are crucial to avoid penalties. Typically, partnerships must file their tax returns by March 15 for the previous tax year. If additional time is needed, partnerships can file for an extension, which may extend the deadline by six months. It is important to stay informed about any changes to these deadlines that may occur due to legislative updates or IRS announcements.

Penalties for Non-Compliance

Failing to file the Form 1 Firms on time or submitting inaccurate information can result in significant penalties. The IRS may impose fines based on the length of the delay and the amount of tax owed. Additionally, partnerships may face interest charges on any unpaid taxes. It is essential for partnerships to ensure timely and accurate filing to avoid these financial repercussions.

Quick guide on how to complete form 1 firms

Effortlessly Prepare Form 1 Firms on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage Form 1 Firms on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Form 1 Firms with Ease

- Obtain Form 1 Firms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to retain your modifications.

- Select your preferred method to share your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1 Firms and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 firms

Create this form in 5 minutes!

How to create an eSignature for the form 1 firms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are form 1 firms and how can airSlate SignNow benefit them?

Form 1 firms are businesses that require efficient document management and eSigning solutions. airSlate SignNow provides these firms with an easy-to-use platform that streamlines the signing process, reduces paperwork, and enhances productivity. By utilizing our solution, form 1 firms can save time and resources while ensuring compliance and security.

-

What pricing plans does airSlate SignNow offer for form 1 firms?

airSlate SignNow offers flexible pricing plans tailored to the needs of form 1 firms. Our plans range from basic to advanced features, allowing businesses to choose the option that best fits their budget and requirements. Additionally, we provide a free trial, enabling form 1 firms to explore our features before committing.

-

What features does airSlate SignNow provide for form 1 firms?

airSlate SignNow offers a variety of features designed specifically for form 1 firms, including customizable templates, automated workflows, and secure eSigning. These features help streamline document processes, reduce errors, and improve overall efficiency. Form 1 firms can also benefit from real-time tracking and notifications to stay updated on document status.

-

How does airSlate SignNow ensure the security of documents for form 1 firms?

Security is a top priority for airSlate SignNow, especially for form 1 firms handling sensitive documents. We utilize advanced encryption methods, secure cloud storage, and compliance with industry standards to protect your data. Our platform also includes audit trails and user authentication to ensure that only authorized personnel can access documents.

-

Can airSlate SignNow integrate with other tools used by form 1 firms?

Yes, airSlate SignNow offers seamless integrations with various tools commonly used by form 1 firms, such as CRM systems, project management software, and cloud storage services. This allows businesses to streamline their workflows and enhance productivity by connecting their existing tools with our eSigning solution. Form 1 firms can easily manage documents without switching between multiple platforms.

-

What are the benefits of using airSlate SignNow for form 1 firms?

Using airSlate SignNow provides numerous benefits for form 1 firms, including increased efficiency, reduced turnaround times, and improved document accuracy. Our platform simplifies the signing process, allowing businesses to focus on their core operations. Additionally, form 1 firms can enhance customer satisfaction by providing a quick and convenient way to sign documents.

-

Is airSlate SignNow suitable for small form 1 firms?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small form 1 firms. Our user-friendly interface and affordable pricing make it an ideal solution for smaller organizations looking to optimize their document management processes without breaking the bank.

Get more for Form 1 Firms

- Audition registration forms pdf peninsula youth theatre pytnet

- Divorce forms indiana

- Prospective tenant form

- Illinois support form

- Form nfp 1051010520 rev dec 2003 cyberdrive illinois cyberdriveillinois

- Form nfp 1041520 rev aug 2014 cyberdrive illinois cyberdriveillinois

- Temporary guardianship packet cherokee county government form

- Status conference report form

Find out other Form 1 Firms

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form