Wa Combined Excise Tax Return Form 2016

What is the Wa Combined Excise Tax Return Form

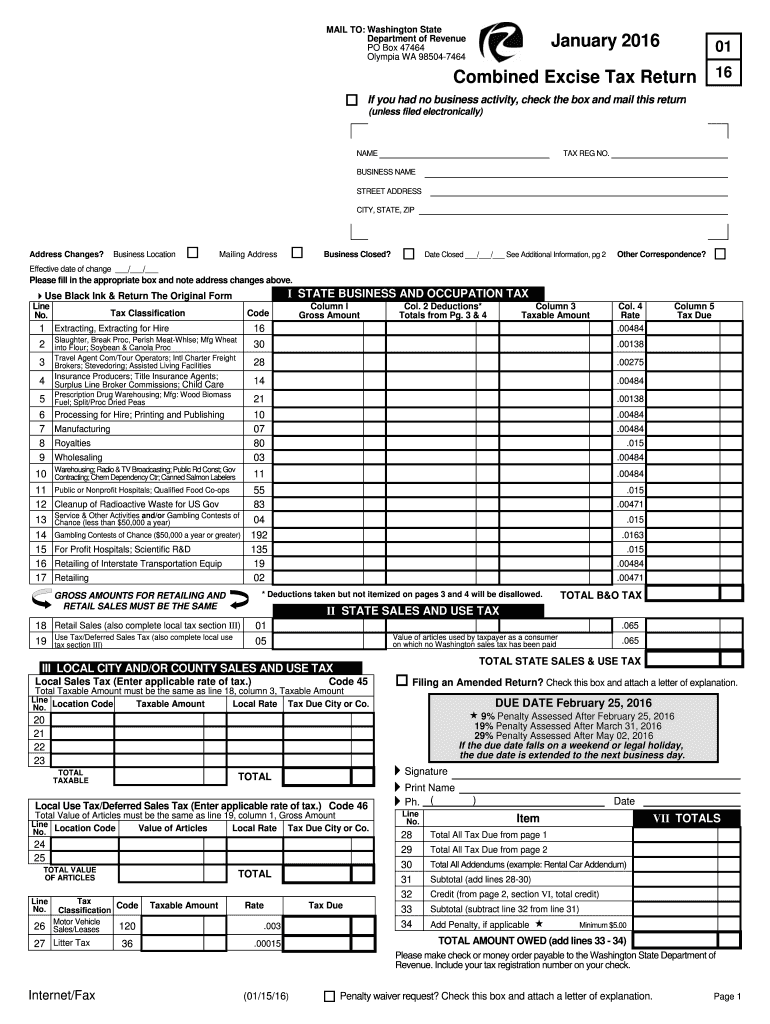

The Wa Combined Excise Tax Return Form is a crucial document used by businesses in Washington State to report and pay various excise taxes. This form consolidates multiple tax obligations, including the business and occupation (B&O) tax, public utility tax, and sales and use tax. By using this form, businesses can streamline their tax reporting process, ensuring compliance with state regulations while minimizing the administrative burden of filing separate returns for each tax type.

How to use the Wa Combined Excise Tax Return Form

To effectively use the Wa Combined Excise Tax Return Form, businesses should first gather all necessary financial information, including gross income, deductions, and any applicable tax credits. Once the form is obtained, it can be filled out online or printed for manual completion. Each section of the form corresponds to specific taxes, requiring accurate reporting of income and tax calculations. After completing the form, it must be submitted by the designated deadline to avoid penalties.

Steps to complete the Wa Combined Excise Tax Return Form

Completing the Wa Combined Excise Tax Return Form involves several important steps:

- Obtain the form from the Washington State Department of Revenue website or a trusted source.

- Gather all relevant financial documents, including sales records and expense receipts.

- Fill out the form, ensuring all sections are completed accurately, including income, deductions, and tax calculations.

- Review the completed form for any errors or omissions.

- Submit the form online or via mail by the specified deadline.

Legal use of the Wa Combined Excise Tax Return Form

The Wa Combined Excise Tax Return Form is legally mandated for businesses operating in Washington State that meet certain revenue thresholds. Filing this form ensures compliance with state tax laws and helps avoid potential legal issues related to tax evasion or misreporting. It is essential for businesses to understand their obligations under Washington law to maintain good standing and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Wa Combined Excise Tax Return Form vary based on the business's reporting frequency. Most businesses are required to file either monthly or quarterly. Monthly filers must submit their forms by the last day of the month following the reporting period, while quarterly filers typically have until the last day of the month following the end of each quarter. It is crucial for businesses to keep track of these deadlines to ensure timely submissions and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Wa Combined Excise Tax Return Form can be submitted through various methods to accommodate different preferences. Businesses can file online through the Washington State Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, the form can be printed and mailed to the appropriate address or delivered in person to a local Department of Revenue office. Each submission method has its advantages, and businesses should choose the one that best fits their needs.

Quick guide on how to complete wa combined excise tax return 2016 form

Your assistance manual on how to prepare your Wa Combined Excise Tax Return Form

If you’re interested in discovering how to generate and dispatch your Wa Combined Excise Tax Return Form, below are a few brief instructions on how to simplify tax processing.

First, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to alter, draft, and finalize your income tax forms with ease. Utilizing its editor, you can transition between text, checkboxes, and electronic signatures, and revert to modify details as needed. Optimize your tax organization with sophisticated PDF editing, eSigning, and easy sharing features.

Follow these steps to finalize your Wa Combined Excise Tax Return Form in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; sift through various versions and schedules.

- Click Get form to access your Wa Combined Excise Tax Return Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Store your changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically using airSlate SignNow. Keep in mind that paper submissions can increase errors and prolong refund processes. Additionally, before e-filing your taxes, consult the IRS website for filing requirements specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct wa combined excise tax return 2016 form

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the wa combined excise tax return 2016 form

How to generate an eSignature for your Wa Combined Excise Tax Return 2016 Form in the online mode

How to make an eSignature for the Wa Combined Excise Tax Return 2016 Form in Google Chrome

How to generate an electronic signature for putting it on the Wa Combined Excise Tax Return 2016 Form in Gmail

How to create an electronic signature for the Wa Combined Excise Tax Return 2016 Form from your smartphone

How to make an eSignature for the Wa Combined Excise Tax Return 2016 Form on iOS

How to generate an eSignature for the Wa Combined Excise Tax Return 2016 Form on Android devices

People also ask

-

What is the WA Combined Excise Tax Return Form?

The WA Combined Excise Tax Return Form is a document used by businesses in Washington State to report and pay various taxes, including retail sales tax, use tax, and business and occupation tax. Understanding how to complete this form accurately is essential for compliance with state regulations.

-

How can airSlate SignNow help with the WA Combined Excise Tax Return Form?

airSlate SignNow streamlines the process of filling out and eSigning the WA Combined Excise Tax Return Form, making it easier for businesses to manage their tax obligations. With its user-friendly interface, you can quickly prepare, sign, and send your tax return electronically.

-

Is there a cost associated with using airSlate SignNow for the WA Combined Excise Tax Return Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your WA Combined Excise Tax Return Form. Pricing is competitive and varies based on the features you choose, ensuring businesses of all sizes can access the tools they need without breaking the bank.

-

What features does airSlate SignNow provide for the WA Combined Excise Tax Return Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the WA Combined Excise Tax Return Form. These tools enhance efficiency and ensure that your tax return is completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with my accounting software for the WA Combined Excise Tax Return Form?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for smooth data transfer when preparing your WA Combined Excise Tax Return Form. This integration helps streamline your workflow and reduces the risk of errors in your tax submissions.

-

What are the benefits of using airSlate SignNow for eSigning my WA Combined Excise Tax Return Form?

Using airSlate SignNow for eSigning your WA Combined Excise Tax Return Form offers several benefits, including time savings, enhanced security, and reduced paperwork. The platform ensures that your documents are signed quickly and securely, allowing you to focus on your business operations.

-

Is airSlate SignNow user-friendly for completing the WA Combined Excise Tax Return Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the WA Combined Excise Tax Return Form without prior experience. The intuitive interface guides you through each step, ensuring that you can manage your taxes efficiently.

Get more for Wa Combined Excise Tax Return Form

- State form 46021 r97 09

- Antenatal booking form

- New york state athletic commission form

- Www eyemedvisioncare com railroad form

- Elpac practice test 11 12 form

- Brothers grimm spectaculathon one act pdf form

- State of virginia residential application form

- Service level for software development agreement template form

Find out other Wa Combined Excise Tax Return Form

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement