State of Hawaii Tax Form G 45 2016

What is the State Of Hawaii Tax Form G-45

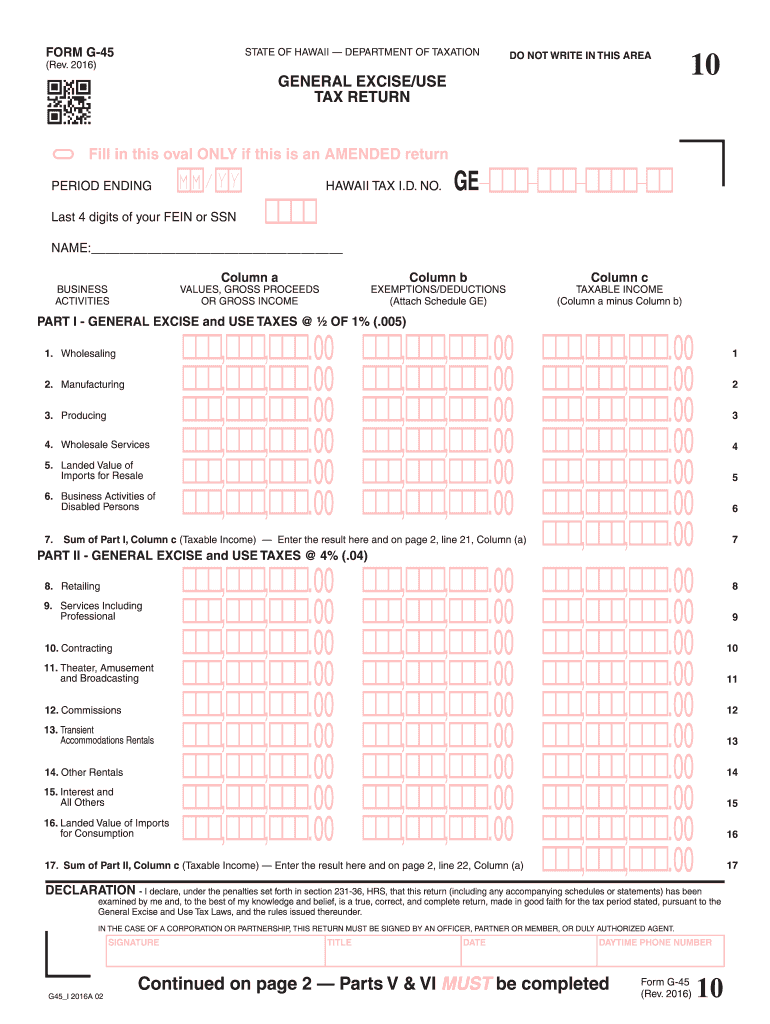

The State Of Hawaii Tax Form G-45 is a tax form specifically designed for taxpayers in Hawaii to report their general excise tax (GET) and use tax liabilities. This form is essential for businesses and individuals who engage in taxable activities within the state. It allows taxpayers to calculate the amount of tax owed based on their gross income from business activities. Understanding this form is crucial for compliance with Hawaii tax laws and for avoiding potential penalties.

How to use the State Of Hawaii Tax Form G-45

Using the State Of Hawaii Tax Form G-45 involves several steps to ensure accurate reporting of your tax obligations. First, gather all necessary financial records, including sales receipts and invoices. Next, fill out the form by entering your gross income and any applicable deductions. It is important to review the instructions provided with the form to ensure all sections are completed correctly. Once filled out, the form can be submitted online or via mail, depending on your preference.

Steps to complete the State Of Hawaii Tax Form G-45

Completing the State Of Hawaii Tax Form G-45 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, such as sales records and expense receipts.

- Download the G-45 form from the official Hawaii Department of Taxation website or access it through a trusted platform.

- Fill in your business information, including your name, address, and taxpayer identification number.

- Report your gross income and any deductions applicable to your business activities.

- Calculate the total tax owed based on the provided tax rates.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or by mail to the appropriate tax office.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Hawaii Tax Form G-45 are crucial to ensure compliance and avoid penalties. Generally, the form must be filed quarterly, with deadlines typically falling on the last day of the month following the end of each quarter. For example, the due dates for the first quarter are April 30, for the second quarter are July 31, for the third quarter are October 31, and for the fourth quarter are January 31 of the following year. It is important to check for any updates or changes to these deadlines each tax year.

Legal use of the State Of Hawaii Tax Form G-45

The legal use of the State Of Hawaii Tax Form G-45 is governed by the Hawaii Revised Statutes and regulations set forth by the Department of Taxation. This form must be used by all individuals and businesses that are subject to the general excise tax. Filing this form accurately and on time is a legal requirement, and failure to do so can result in penalties, interest on unpaid taxes, and potential legal action. It is essential to ensure that all information provided on the form is truthful and complete to comply with state law.

Key elements of the State Of Hawaii Tax Form G-45

The State Of Hawaii Tax Form G-45 includes several key elements that taxpayers must understand to complete it correctly. These elements typically include:

- Taxpayer identification information, including name and address.

- Gross income from business activities.

- Applicable deductions and exemptions.

- Calculation of the total tax owed based on reported income.

- Signature and date to certify the accuracy of the information provided.

Quick guide on how to complete state of hawaii tax form g 45 2016

Your assistance manual on how to prepare your State Of Hawaii Tax Form G 45

If you’re curious about how to finalize and submit your State Of Hawaii Tax Form G 45, here are a few concise tips on making tax processing smoother.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to amend details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Adhere to the instructions below to complete your State Of Hawaii Tax Form G 45 in just a few minutes:

- Create your account and start working with PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Select Get form to access your State Of Hawaii Tax Form G 45 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if needed).

- Inspect your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting on paper can lead to increased return errors and delays in reimbursements. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct state of hawaii tax form g 45 2016

FAQs

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

What percent of people don't have the intelligence to fill out tax forms?

Recent statistics that I've seen indicate that about 66% of electronically filed returns are filed by paid preparers. This doesn't necessarily mean that these filers don't have the intelligence but it does indicate that they have a level of discomfort and anxiety and prefer the solace of having a paid preparer fill out and transmit the forms. It all depends on the level of complexity of the form. For the young wage earner living at home with his or her parents, who is able to operate a computer and can operate simple tax return software, I would think that 80% should be intelligent enough to fill out tax forms. Especially because the software is designed to prompt and assist (and check the arithmetic).One of America's most respected jurists, Judge Learned Hand, offers a more thoughtful observation on the law of taxation: ‘In my own case the words of such an act as the Income Tax ... merely dance before my eyes in a meaningless procession; cross-reference to cross-reference, exception upon exception—couched in abstract terms that offer no handle to seize hold of—leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegal [sic]: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness.’ Ruth Realty Co. v. Horn, 222 Or. 290, 353 P.2d 524, 526 n. 2 (Or. 1960) (citing 57 Yale L.J. 167, 169 (1947)), overruled on other grounds by Parr v. DOR, 276 Or. 113, 553 P.2d 1051 (Or. 1976). The Humorist Dave Barry had this observation "The IRS is working hard to develop a tax form so scary that merely reading it will cause the ordinary taxpayer's brain to explode.” His candidate for the best effort so far is Schedule J Form 1118 "Separate Limitation Loss Allocations and Other Adjustments Necessary to Determine Numerators of Limitations fraction, Year end Recharacterization Balance and Overall Foreign Loss Account Balances"And don’t forget this observation from Albert Einstein “The hardest thing to understand in the world is the income tax. “ So if Al had trouble understanding taxes, I don't see how a mere mortal has any chance.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

Create this form in 5 minutes!

How to create an eSignature for the state of hawaii tax form g 45 2016

How to generate an electronic signature for the State Of Hawaii Tax Form G 45 2016 online

How to make an eSignature for your State Of Hawaii Tax Form G 45 2016 in Google Chrome

How to generate an electronic signature for putting it on the State Of Hawaii Tax Form G 45 2016 in Gmail

How to generate an eSignature for the State Of Hawaii Tax Form G 45 2016 from your smart phone

How to generate an electronic signature for the State Of Hawaii Tax Form G 45 2016 on iOS

How to create an eSignature for the State Of Hawaii Tax Form G 45 2016 on Android

People also ask

-

What is the State Of Hawaii Tax Form G 45?

The State Of Hawaii Tax Form G 45 is a tax form used for reporting and paying the general excise tax in Hawaii. It is specifically designed for businesses that sell goods or provide services in the state. Filling out this form accurately is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help me with the State Of Hawaii Tax Form G 45?

airSlate SignNow provides an efficient platform for businesses to digitally complete and eSign the State Of Hawaii Tax Form G 45. With our user-friendly interface, you can streamline the process, reduce errors, and ensure timely submissions. Our solution is designed to save you time and hassle.

-

Are there any costs associated with submitting the State Of Hawaii Tax Form G 45 through airSlate SignNow?

While submitting the State Of Hawaii Tax Form G 45 is free through the state website, airSlate SignNow offers a subscription model with plans tailored to business needs. This investment provides added benefits like document tracking, secure storage, and advanced eSigning features, enhancing the overall compliance process.

-

What features does airSlate SignNow offer for managing the State Of Hawaii Tax Form G 45?

airSlate SignNow includes several powerful features for managing the State Of Hawaii Tax Form G 45, such as customizable templates, automated workflows, and secure eSigning options. You can also collaborate with your team in real time to ensure accuracy and compliance. These features make it easier and faster to manage your tax documentation.

-

Can I integrate airSlate SignNow with other tools for the State Of Hawaii Tax Form G 45?

Yes, airSlate SignNow offers integrations with a variety of tools, including cloud storage services and accounting software, which can assist you in managing your State Of Hawaii Tax Form G 45 efficiently. With these integrations, you can automate your workflows and ensure all relevant documents are easily accessible.

-

Is there customer support available for issues related to the State Of Hawaii Tax Form G 45?

Absolutely! airSlate SignNow provides customer support to assist users with any questions or issues regarding the State Of Hawaii Tax Form G 45. Our knowledgeable support team is dedicated to helping you navigate the eSigning process and make the most of our platform.

-

What benefits can businesses expect by using airSlate SignNow for the State Of Hawaii Tax Form G 45?

By using airSlate SignNow for the State Of Hawaii Tax Form G 45, businesses can enjoy increased efficiency through streamlined document management and quicker turnaround times for eSignatures. Additionally, the platform enhances compliance and reduces the likelihood of errors, contributing to a more organized tax filing process.

Get more for State Of Hawaii Tax Form G 45

- Lic frim no 32515122 form

- Wg 005 editable and saveable california judicial council forms

- Ad 616 fillable form

- Change request form grundy worldwide

- Loss of enjoymentduties under duress summary form

- Itrhfm hall of fame nomination form class of

- Loan contract template form

- Loan of money contract template form

Find out other State Of Hawaii Tax Form G 45

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile