State of Hawaii Tax Form G 45 2017

What is the State Of Hawaii Tax Form G-45

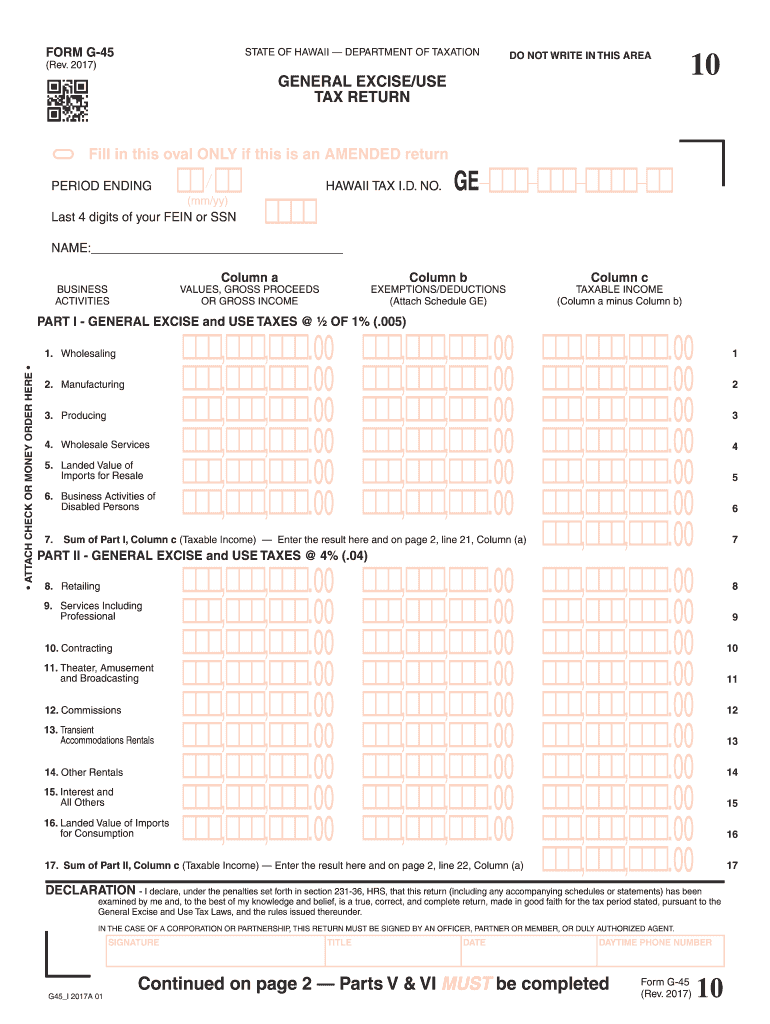

The State Of Hawaii Tax Form G-45 is used by taxpayers to report and pay their general excise tax. This form is essential for individuals and businesses operating in Hawaii, as it helps ensure compliance with state tax regulations. The G-45 form allows taxpayers to calculate their gross income and determine the amount of tax owed based on their business activities. It is important to understand the specific requirements and instructions associated with this form to avoid potential penalties.

How to use the State Of Hawaii Tax Form G-45

Using the State Of Hawaii Tax Form G-45 involves several steps. First, gather all necessary financial information, including gross income from business activities. Next, accurately complete the form by entering the required figures in the designated fields. It is crucial to double-check all calculations to ensure accuracy. After completing the form, taxpayers can submit it either online, by mail, or in person, depending on their preference and the options available. Understanding how to properly fill out and submit this form is vital for maintaining compliance with state tax laws.

Steps to complete the State Of Hawaii Tax Form G-45

Completing the State Of Hawaii Tax Form G-45 requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including sales records and expense reports.

- Access the G-45 form, either online or through a physical copy.

- Fill in your gross income, deductions, and any applicable credits in the appropriate sections of the form.

- Calculate the total tax owed based on the provided instructions.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, ensuring that you retain a copy for your records.

Key elements of the State Of Hawaii Tax Form G-45

The State Of Hawaii Tax Form G-45 includes several key elements that are essential for accurate tax reporting. These elements typically consist of:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Gross Income: Taxpayers must report their total gross income from all business activities.

- Deductions: Any allowable deductions should be clearly documented to reduce taxable income.

- Tax Calculation: This section outlines how to calculate the general excise tax owed based on reported income.

- Signature: A signature is required to verify the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The State Of Hawaii Tax Form G-45 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Hawaii Department of Taxation's online portal.

- Mail Submission: Completed forms can be printed and mailed to the appropriate state tax office address.

- In-Person Submission: Taxpayers may also choose to deliver the form directly to their local tax office for processing.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Hawaii Tax Form G-45 are crucial to avoid penalties. Typically, the form is due on the last day of the month following the end of the reporting period. For example, if a taxpayer is reporting for the month of January, the form must be filed by the end of February. It is essential for taxpayers to stay informed about specific deadlines and any changes to the filing schedule to ensure timely submissions.

Quick guide on how to complete state of hawaii tax form g 45 2017 2019

Your assistance manual on how to prepare your State Of Hawaii Tax Form G 45

If you’re interested in learning how to produce and transmit your State Of Hawaii Tax Form G 45, here are some brief guidelines on how to simplify your tax reporting.

First, you merely need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to complete your State Of Hawaii Tax Form G 45 in just minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your State Of Hawaii Tax Form G 45 in our editor.

- Populate the required fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to mistakes in returns and delay refunds. As a reminder, before e-filing your taxes, visit the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct state of hawaii tax form g 45 2017 2019

FAQs

-

CA Reply to Franchise Tax Board Form re Tax Yr 2011: What income is stated in question 2 of section G? CA income only? Or out of state income?

The question asks for your gross income from all sources. If you had been a California resident in 2011, you would have filled out Schedule CA, and the amount that appears on line 22 in Column C is the amount that California considers to be your gross income, your total Federal income adjusted for differences between California law and Federal law. That number - the one you compute by filling out Part I of Schedule CA as though you had been a resident of California - is what you put on the Request for Tax Return. That includes all of the income you earned outside of California as well as any that you earned inside of California. If you want to simplify the process you can just put the amount from line 22 of your 1040 on the form, reduced by any taxable state tax refund on line 10 that you received from California in 2011, any unemployment compensation on line 19, and any taxable social security benefits on line 20(b). Those are the most common adjustments to California income. If you had a small business or earned capital gains, you might have to do a little more detailed computation, and at that point you're probably best served by consulting a professional.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

For 2017, I do not owe any tax to the state of California. How should I file my taxes, online or by sending hard copies of forms? Also, do I need an ITIN for this?

In theory if your income does not arise in CA or is not sufficient to be taxed, you do not have to file a return. In practice it may be safer to do so, demonstrating to the Franchise Tax Board that you do not owe them anything. They have a couple of times tried to tax me - an expat who never resided in CA - because one of the financial/insurance firms we represent sent me a 1099-Misc from a CA address. It took a month to sort them out.For your tax returns to any state or to the IRS, you need a TIN. For Americans this is the social security number, for non-US nationals the ITIN. Have you applied for it? If not, and if you owe US tax, you should immediately apply. You cannot e-file a return without a TIN, so you will need to file on paper with a copy of your ITIN application.

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

Create this form in 5 minutes!

How to create an eSignature for the state of hawaii tax form g 45 2017 2019

How to generate an eSignature for your State Of Hawaii Tax Form G 45 2017 2019 online

How to generate an eSignature for the State Of Hawaii Tax Form G 45 2017 2019 in Chrome

How to make an electronic signature for putting it on the State Of Hawaii Tax Form G 45 2017 2019 in Gmail

How to create an eSignature for the State Of Hawaii Tax Form G 45 2017 2019 from your smartphone

How to generate an eSignature for the State Of Hawaii Tax Form G 45 2017 2019 on iOS devices

How to make an eSignature for the State Of Hawaii Tax Form G 45 2017 2019 on Android devices

People also ask

-

What is the State Of Hawaii Tax Form G 45?

The State Of Hawaii Tax Form G 45 is a general excise tax return that businesses must file to report and pay their general excise tax. This form is essential for ensuring compliance with Hawaii's tax regulations and is typically required on a quarterly basis. Using airSlate SignNow simplifies the process of completing and submitting the State Of Hawaii Tax Form G 45 electronically.

-

How can airSlate SignNow help with filing the State Of Hawaii Tax Form G 45?

airSlate SignNow streamlines the filing of the State Of Hawaii Tax Form G 45 by providing an easy-to-use platform for eSigning and submitting documents securely. Businesses can create, edit, and send the form directly through the platform, ensuring that all necessary fields are accurately filled out. This saves time and reduces the risk of errors in tax submissions.

-

What are the pricing options for using airSlate SignNow to handle the State Of Hawaii Tax Form G 45?

airSlate SignNow offers a variety of pricing plans tailored to businesses of different sizes. Each plan includes features that facilitate the management of documents, including the State Of Hawaii Tax Form G 45, at a competitive price. You can choose a plan based on your needs, whether you're a small business or a large enterprise.

-

Is airSlate SignNow compliant with Hawaii tax regulations for the State Of Hawaii Tax Form G 45?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the State Of Hawaii Tax Form G 45. The platform ensures that your electronic signatures and submissions meet legal standards, providing peace of mind that your tax filings are valid and secure.

-

Can I integrate airSlate SignNow with other accounting software for the State Of Hawaii Tax Form G 45?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software. This allows you to easily import data needed for the State Of Hawaii Tax Form G 45, streamlining your workflow and ensuring that your tax information is accurate and up-to-date.

-

What features does airSlate SignNow offer for managing the State Of Hawaii Tax Form G 45?

airSlate SignNow provides features such as customizable templates, automated reminders, and real-time tracking for documents like the State Of Hawaii Tax Form G 45. These features help ensure that you never miss a filing deadline and that your documents are organized and easily accessible.

-

How secure is airSlate SignNow for submitting the State Of Hawaii Tax Form G 45?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your data when submitting the State Of Hawaii Tax Form G 45. This means your sensitive tax information remains confidential and secure throughout the filing process.

Get more for State Of Hawaii Tax Form G 45

- Printable certificate of ordination printable certificate of ordination form

- Administrative settlement agreement amp order on consent for rifs signed v w 07 c 861 docid epa form

- Abl 901 2015 2019 form

- 144 tc no 17 united states tax court jeffrey t ustaxcourt form

- Dbpr cilb 12 change of status inactive to active and qualify a business form

- Irp schedule c form

- Company registration form vpa 0212 b 8 19 2010 docx

- Instructions for rev 1510 schedule g inter vivos transfers ampamp misc non probate property formspublications

Find out other State Of Hawaii Tax Form G 45

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template