G45 Form 2019

What is the G45 Form

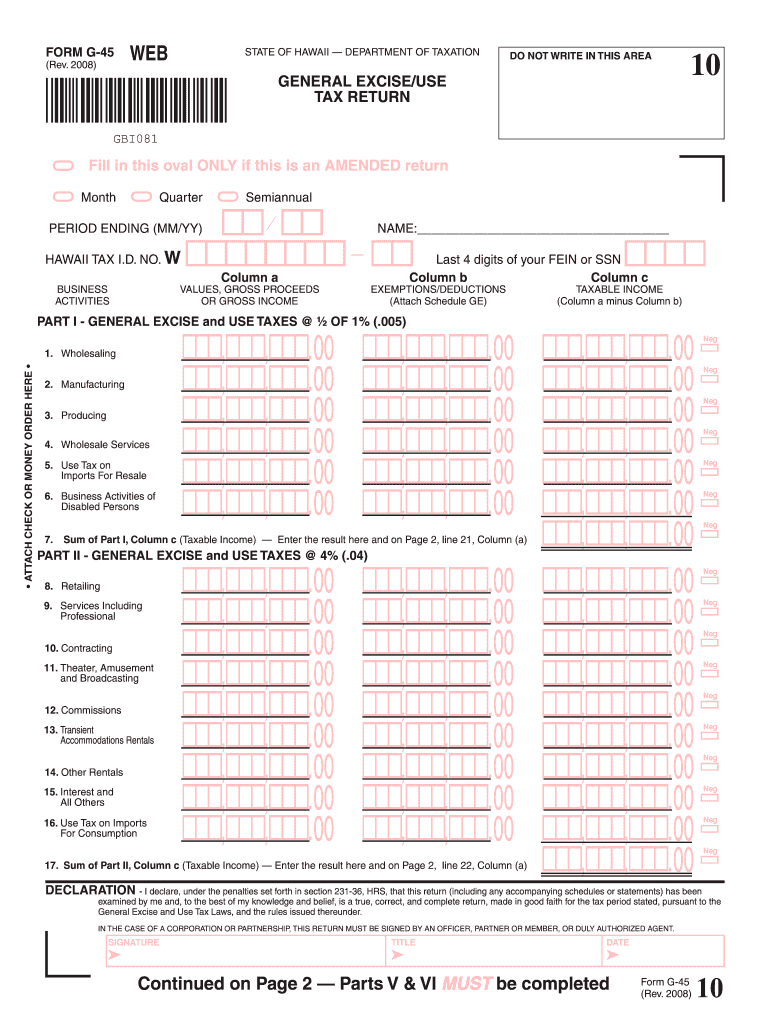

The G45 form, officially known as the General Excise Tax Return, is a crucial document used in Hawaii for reporting and paying general excise taxes. This form is essential for businesses operating in the state, as it ensures compliance with Hawaii's tax regulations. The G45 form covers various types of income, including sales, services, and rental income. It is important for both individuals and businesses to understand the implications of this form to avoid penalties and ensure accurate reporting.

How to Use the G45 Form

Using the G45 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including sales receipts, invoices, and any other relevant documentation. Next, fill out the form with accurate figures reflecting your gross income. It is vital to categorize income correctly, as different rates may apply. After completing the form, review it for accuracy before submitting it to the appropriate state tax office. Utilizing digital tools can streamline this process, making it easier to manage and submit your G45 form efficiently.

Steps to Complete the G45 Form

Completing the G45 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including sales records and invoices.

- Determine the total gross income for the reporting period.

- Fill in the form, ensuring to categorize income types accurately.

- Calculate the total tax due based on the applicable rates.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail to the appropriate tax authority.

Legal Use of the G45 Form

The G45 form serves as a legal document for reporting general excise taxes in Hawaii. Proper use of this form is essential for compliance with state tax laws. Businesses must file the G45 form accurately and on time to avoid penalties. The information provided on the form is used by the state to assess tax liabilities and ensure that businesses contribute their fair share to public services. Failure to comply with the legal requirements associated with the G45 form can result in fines and other legal consequences.

Filing Deadlines / Important Dates

Timeliness is crucial when it comes to filing the G45 form. The filing deadlines are typically quarterly, with specific dates set by the state of Hawaii. Businesses should mark their calendars for these important dates to avoid late fees. For example, the deadlines for the first quarter usually fall in April, while subsequent quarters have their respective deadlines. Staying informed about these dates helps ensure compliance and smooth tax management.

Form Submission Methods

The G45 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses choose to file electronically through the state tax website, which can expedite processing.

- Mail: The form can be printed and mailed to the appropriate tax office, ensuring it is sent well before the deadline.

- In-Person: Some businesses may opt to deliver the form in person, allowing for immediate confirmation of receipt.

Quick guide on how to complete 2008 g45 form

Complete G45 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage G45 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign G45 Form without hassle

- Locate G45 Form and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to store your adjustments.

- Choose how you prefer to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign G45 Form and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 g45 form

Create this form in 5 minutes!

How to create an eSignature for the 2008 g45 form

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the Form G 45 PDF and why is it important?

The Form G 45 PDF is a crucial document used for reporting tax information and ensuring compliance with regulatory requirements. Businesses are often required to fill out and submit this form to avoid penalties. By using airSlate SignNow, you can easily create, sign, and store your Form G 45 PDF securely, streamlining your document management process.

-

How does airSlate SignNow simplify the completion of Form G 45 PDF?

airSlate SignNow offers user-friendly features that make completing the Form G 45 PDF straightforward. With options to fill out, edit, and sign documents electronically, users can signNowly reduce the time spent on paperwork. Additionally, you can save templates for future use, ensuring efficiency in managing taxes.

-

Is there a cost associated with using airSlate SignNow for Form G 45 PDF?

Yes, airSlate SignNow offers various pricing plans based on your business needs. Each plan provides access to features specifically designed to facilitate the signing and management of important documents like the Form G 45 PDF. To find a plan that suits you, visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other applications for handling Form G 45 PDF?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Salesforce. This means you can easily manage your Form G 45 PDF alongside other important business documents, enhancing your overall workflow and productivity.

-

What benefits does airSlate SignNow provide for managing Form G 45 PDF?

Using airSlate SignNow provides several benefits for managing your Form G 45 PDF. It offers electronic signatures, which are legally binding and secure, eliminating the need for physical papers. Additionally, the platform provides tracking features, allowing you to see when your form has been signed and accessed.

-

Is it safe to sign and store my Form G 45 PDF with airSlate SignNow?

Yes, it is very safe to sign and store your Form G 45 PDF with airSlate SignNow. The platform uses advanced encryption methods to protect your documents and personal information. Compliance with major security standards ensures that your data remains confidential and secure at all times.

-

Can I access my Form G 45 PDF anytime after creating it?

Yes, once you've created your Form G 45 PDF using airSlate SignNow, you can access it anytime from any device. The cloud-based platform ensures that your documents are always available, making it easy to retrieve, edit, or share your Form G 45 PDF whenever needed.

Get more for G45 Form

Find out other G45 Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free