Form G 45 Periodic General ExciseUse Tax Return, Rev 2023-2026

What is the Form G-45 Periodic General Excise/Use Tax Return

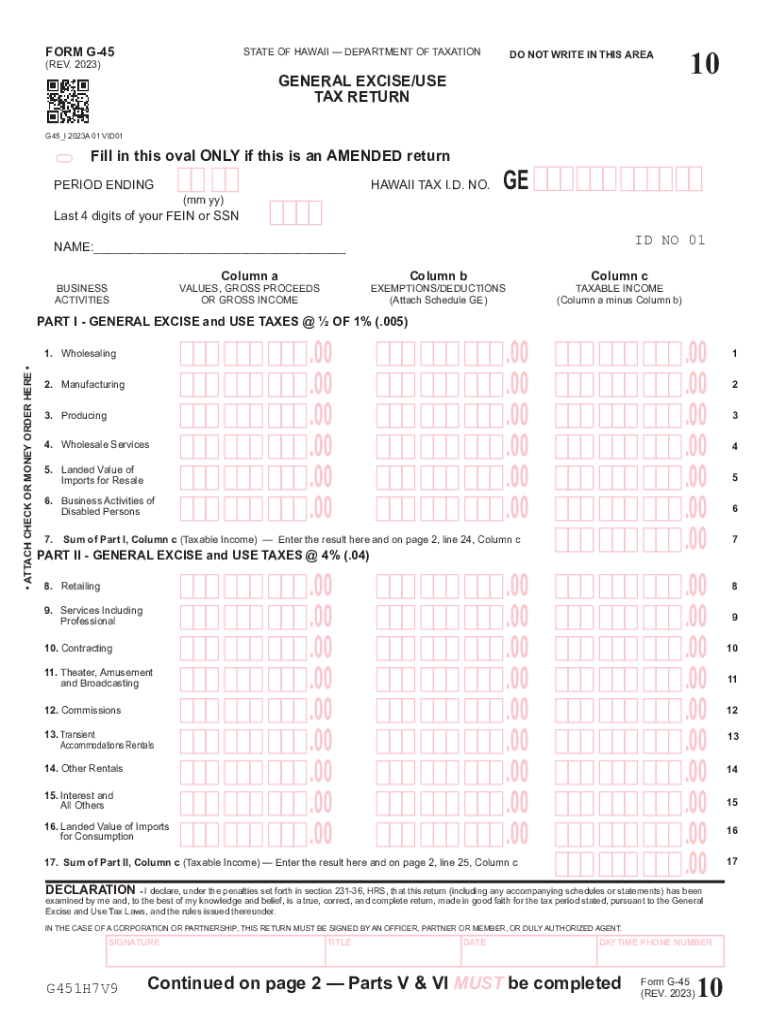

The Form G-45 is an essential document used by businesses in Hawaii to report and pay the General Excise Tax (GET) and Use Tax. This form is required for entities engaged in business activities within the state, including retail, service, and manufacturing sectors. It serves as a periodic return, typically filed quarterly or annually, depending on the taxpayer's specific circumstances. Understanding the purpose of this form is crucial for compliance with Hawaii state tax regulations.

How to Use the Form G-45 Periodic General Excise/Use Tax Return

Using the Form G-45 involves several steps to ensure accurate reporting of your business's gross income and applicable taxes. First, gather all necessary financial records, including sales receipts and expense reports. Next, complete the form by entering your total gross income, deductions, and the calculated tax amount owed. After filling out the form, it can be submitted either online or by mail, depending on your preference. Ensuring that all information is accurate and complete will help avoid penalties and interest charges.

Steps to Complete the Form G-45 Periodic General Excise/Use Tax Return

Completing the Form G-45 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and receipts.

- Enter your total gross income from all business activities.

- Apply any allowable deductions, such as returns and allowances.

- Calculate the total tax due based on the applicable rates.

- Review the form for accuracy before submission.

Once completed, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines for the Form G-45 to remain compliant with Hawaii tax laws. Generally, the form is due on the last day of the month following the end of the reporting period. For quarterly filers, this means the deadlines are April 20, July 20, October 20, and January 20. Annual filers must submit their forms by January 20 of the following year. Late submissions may incur penalties and interest, making timely filing crucial.

Form Submission Methods

The Form G-45 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Filing through the Hawaii Department of Taxation's online portal is a convenient option for many businesses.

- Mail: Completed forms can be mailed to the appropriate tax office address provided by the state.

- In-Person: Businesses may also choose to submit their forms in person at designated tax offices.

Choosing the right submission method can streamline the filing process and ensure timely compliance.

Penalties for Non-Compliance

Failure to file the Form G-45 on time or inaccurately reporting information can lead to significant penalties. The Hawaii Department of Taxation imposes fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount due. Understanding these penalties highlights the importance of accurate and timely filing to avoid unnecessary financial burdens.

Quick guide on how to complete form g 45 periodic general exciseuse tax return rev

Complete Form G 45 Periodic General ExciseUse Tax Return, Rev seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form G 45 Periodic General ExciseUse Tax Return, Rev on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form G 45 Periodic General ExciseUse Tax Return, Rev effortlessly

- Find Form G 45 Periodic General ExciseUse Tax Return, Rev and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Edit and eSign Form G 45 Periodic General ExciseUse Tax Return, Rev and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form g 45 periodic general exciseuse tax return rev

Create this form in 5 minutes!

How to create an eSignature for the form g 45 periodic general exciseuse tax return rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Hawaii state tax forms?

Hawaii state tax forms are official documents required by the state of Hawaii for individuals and businesses to report their income and calculate their tax obligations. These forms vary based on the type of tax being filed, such as income tax or general excise tax. Familiarizing yourself with these forms is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help with Hawaii state tax forms?

airSlate SignNow provides an efficient platform to easily send and eSign Hawaii state tax forms, making the submission process simpler and faster. The user-friendly interface allows you to fill out and sign documents electronically, streamlining your tax preparation. Save time and reduce stress when handling your Hawaii state tax forms with our solution.

-

Are there any costs associated with using airSlate SignNow for Hawaii state tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses and individuals. Our plans include features that allow you to manage, send, and eSign Hawaii state tax forms efficiently. Explore our pricing options to find the plan that works best for your tax and document management needs.

-

What features does airSlate SignNow offer for Hawaii state tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking specifically designed for Hawaii state tax forms. With these features, users can ensure their documents are compliant with state regulations and are prepared for submission. Easy document management allows you to focus on what matters most—your taxes.

-

Is airSlate SignNow secure for handling Hawaii state tax forms?

Absolutely! airSlate SignNow prioritizes security and utilizes advanced encryption protocols to protect your Hawaii state tax forms. Our platform complies with industry standards, ensuring your sensitive information is safe while being processed. You can confidently manage your documents without the risk of data bsignNowes or unauthorized access.

-

Can I integrate airSlate SignNow with other applications for handling Hawaii state tax forms?

Yes, airSlate SignNow supports integrations with a variety of applications to enhance your productivity. You can easily connect it with accounting software, CRMs, and other tools to manage your Hawaii state tax forms seamlessly. This integration saves you time and ensures that all your information is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for Hawaii state tax forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The ability to eSign documents electronically shortens the turnaround time for submissions, allowing you to meet your tax deadlines without hassle. Leverage our platform to elevate your overall tax experience.

Get more for Form G 45 Periodic General ExciseUse Tax Return, Rev

Find out other Form G 45 Periodic General ExciseUse Tax Return, Rev

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter