Rut 7 2017-2026

What is the Rut 7

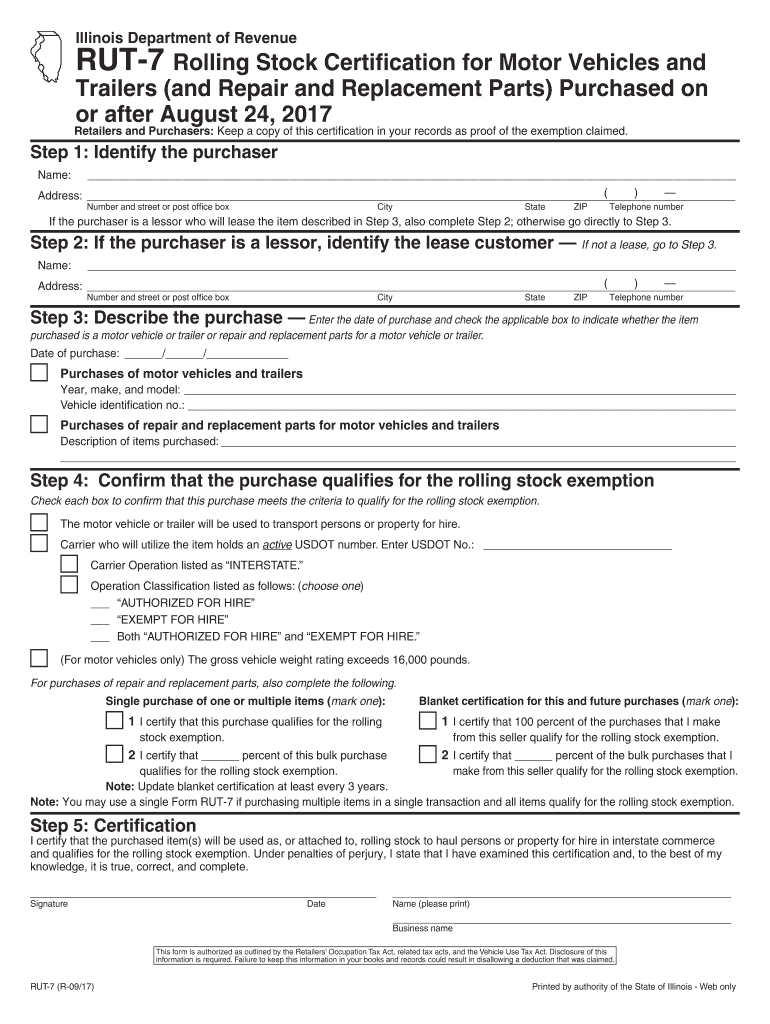

The Rut 7 form is a tax document used in Illinois, specifically designed for the certification of rolling stock exemption. This form is essential for businesses that own or operate rolling stock, such as trucks and railcars, which are utilized for transportation purposes. By completing the Rut 7 form, businesses can claim exemptions from certain taxes, thereby reducing their overall tax liability. The form is crucial for ensuring compliance with state tax regulations while maximizing potential savings.

Steps to Complete the Rut 7

Completing the Rut 7 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information related to your rolling stock, including details about the vehicles, their usage, and ownership. Next, access the Rut 7 form, which can be filled out digitally or printed for manual completion. Carefully enter the required information in the designated fields, ensuring all data is accurate and up to date. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the completed Rut 7 form to the appropriate state agency, either online or via mail, depending on your preference and the submission guidelines.

Legal Use of the Rut 7

The Rut 7 form is legally recognized under Illinois tax law, allowing businesses to certify their eligibility for rolling stock exemptions. To ensure legal compliance, it is important to adhere to all instructions provided with the form and to submit it within the required timeframes. Misuse or incorrect submission of the Rut 7 can lead to penalties or denial of tax exemptions. Therefore, understanding the legal implications and requirements associated with the Rut 7 form is essential for businesses seeking to benefit from tax savings.

Who Issues the Form

The Rut 7 form is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides guidelines and resources to assist businesses in completing the Rut 7 form accurately. By following the instructions from the Illinois Department of Revenue, businesses can ensure they are properly utilizing the Rut 7 form to claim their rolling stock exemptions.

Form Submission Methods

Businesses have multiple options for submitting the Rut 7 form. The form can be completed and submitted online through the Illinois Department of Revenue's website, offering a convenient and efficient way to file. Alternatively, businesses may choose to print the completed form and submit it via mail. In-person submissions may also be possible at designated state offices, depending on local regulations. It is important to select the submission method that best fits your needs while ensuring compliance with all deadlines.

Required Documents

To successfully complete and submit the Rut 7 form, certain documents may be required. These typically include proof of ownership for the rolling stock, such as titles or registration documents, and any additional documentation that supports the claim for exemption. It is advisable to review the specific requirements outlined by the Illinois Department of Revenue to ensure that all necessary documents are included with the Rut 7 submission. This helps to avoid delays or complications in processing the form.

Quick guide on how to complete rut 7 rolling stock certification 2017 2019 form

Your assistance manual for preparing your Rut 7

If you’re curious about how to finalize and submit your Rut 7, here are some quick tips on how to simplify tax processing.

To begin, simply register your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an intuitive and robust document solution that enables you to edit, create, and complete your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify information when necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your Rut 7 in just a few minutes:

- Establish your account and start editing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Obtain form to access your Rut 7 in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print a copy, dispatch it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper submissions can raise return errors and postpone refunds. Obviously, before electronically filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct rut 7 rolling stock certification 2017 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

Create this form in 5 minutes!

How to create an eSignature for the rut 7 rolling stock certification 2017 2019 form

How to make an eSignature for your Rut 7 Rolling Stock Certification 2017 2019 Form in the online mode

How to generate an electronic signature for your Rut 7 Rolling Stock Certification 2017 2019 Form in Google Chrome

How to make an electronic signature for signing the Rut 7 Rolling Stock Certification 2017 2019 Form in Gmail

How to make an electronic signature for the Rut 7 Rolling Stock Certification 2017 2019 Form right from your mobile device

How to create an electronic signature for the Rut 7 Rolling Stock Certification 2017 2019 Form on iOS devices

How to generate an electronic signature for the Rut 7 Rolling Stock Certification 2017 2019 Form on Android devices

People also ask

-

What is rut 7 and how does airSlate SignNow utilize it?

Rut 7 refers to the streamlined process of document signing that airSlate SignNow offers. Our platform utilizes rut 7 to ensure quick and efficient electronic signatures for various documents, enhancing workflow productivity and efficiency.

-

How much does airSlate SignNow cost compared to other services in rut 7?

AirSlate SignNow provides a cost-effective solution within the rut 7 niche, offering competitive pricing plans. Compared to other eSignature solutions, our pricing structure delivers outstanding value, especially for businesses seeking affordability without sacrificing quality.

-

What features make airSlate SignNow stand out in the context of rut 7?

AirSlate SignNow features an intuitive user interface, robust security measures, and customizable templates, all aligned with the rut 7 approach to document management. These features empower users to efficiently manage their signing processes, making it a top choice for businesses.

-

Can I integrate airSlate SignNow with other applications relevant to rut 7?

Yes, airSlate SignNow offers seamless integrations with various applications that are pivotal to the rut 7 workflow. By integrating with tools like CRM systems, cloud storage, and management software, we enhance your document signing experience and streamline operations.

-

What benefits does airSlate SignNow provide for businesses focusing on rut 7?

Businesses leveraging rut 7 with airSlate SignNow enjoy benefits such as faster transaction times, reduced paper use, and improved compliance. Our solution not only speeds up the signing process but also contributes to signNow cost savings and operational efficiency.

-

Is airSlate SignNow suitable for small businesses and startups within rut 7?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, making it ideal for small businesses and startups looking to adopt rut 7 capabilities. Our pricing and features are tailored to empower growing companies to streamline their document signing processes.

-

How secure is the signing process with airSlate SignNow in the rut 7 framework?

Security is paramount at airSlate SignNow, especially within the rut 7 framework. We utilize advanced encryption and comply with industry standards to ensure that all documents are signed securely, providing peace of mind for our users.

Get more for Rut 7

Find out other Rut 7

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement