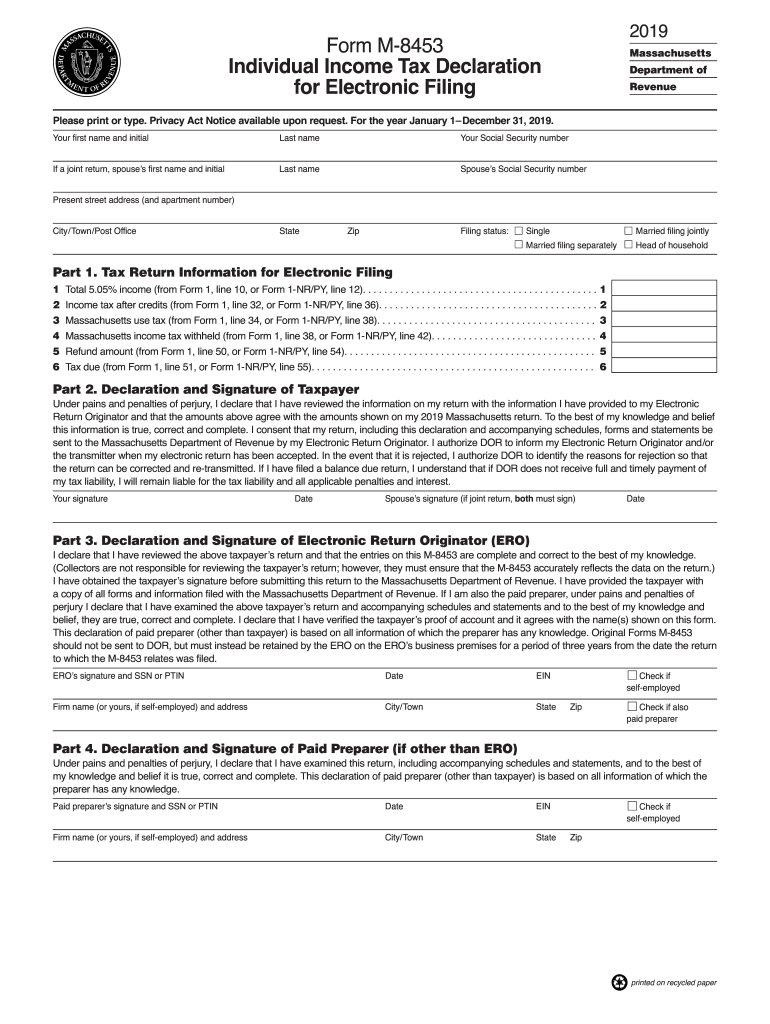

05% Income from Form 1, Line 10, or Form 1 NRPY, Line 12 2019

Understanding the 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12

The 05% income refers to a specific income threshold reported on Massachusetts tax forms, particularly on Form 1, Line 10, or Form 1 NRPY, Line 12. This income is crucial for determining eligibility for certain tax credits and deductions. It typically includes income from various sources, such as wages, interest, dividends, and other taxable income. Understanding this figure is essential for accurate tax reporting and compliance with state regulations.

Steps to Complete the 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12

Completing the 05% income section on the Massachusetts tax forms involves several key steps:

- Gather all relevant income documents, including W-2s, 1099s, and any other income statements.

- Calculate your total income from all sources, ensuring to include only taxable income.

- Locate Line 10 on Form 1 or Line 12 on Form 1 NRPY and enter the calculated amount.

- Review your entries for accuracy to avoid discrepancies that could lead to penalties.

Legal Use of the 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12

The legal use of the 05% income reported on these lines is primarily for tax calculation purposes. It ensures that taxpayers comply with Massachusetts tax laws and accurately report their income. Failure to report this income correctly can result in legal consequences, including fines or audits by the Massachusetts Department of Revenue. Therefore, it is vital to ensure that all income is reported in accordance with state guidelines.

Filing Deadlines for the 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12

Filing deadlines for the Massachusetts tax forms are typically aligned with the federal tax deadlines. For most individual taxpayers, the deadline to file Form 1 or Form 1 NRPY is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about these dates to avoid late filing penalties.

Required Documents for Reporting the 05% Income

When reporting the 05% income on Form 1 or Form 1 NRPY, several documents are necessary:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Bank statements showing interest income.

- Any other documentation supporting reported income sources.

IRS Guidelines Related to the 05% Income

While the 05% income is specific to Massachusetts, it is essential to understand how it aligns with IRS guidelines. The IRS requires all taxpayers to report their total income accurately, which includes any amounts reported on state forms. Familiarizing oneself with IRS regulations can help ensure compliance and avoid issues during tax season.

Quick guide on how to complete 05 income from form 1 line 10 or form 1 nrpy line 12

Complete 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12 with ease

- Find 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 05 income from form 1 line 10 or form 1 nrpy line 12

Create this form in 5 minutes!

How to create an eSignature for the 05 income from form 1 line 10 or form 1 nrpy line 12

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the m8453 form and why is it important?

The m8453 form is a crucial document used for electronic tax filings. It serves as a declaration allowing taxpayers to electronically submit forms to the IRS while ensuring security and compliance. Understanding the m8453 form is important for streamlined tax processes.

-

How does airSlate SignNow facilitate the signing of the m8453 form?

airSlate SignNow provides an intuitive platform for businesses to send and eSign the m8453 form seamlessly. Users can easily upload their documents, add signers, and track the signing process in real-time. This ensures a fast and efficient workflow for handling essential tax documents.

-

What pricing plans are available for using airSlate SignNow for the m8453 form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, starting from affordable options for small teams. These plans include features specifically designed for managing documents like the m8453 form. Check the website for the latest pricing details and promotions.

-

Can I integrate airSlate SignNow with other tools for managing the m8453 form?

Yes, airSlate SignNow seamlessly integrates with various business applications like Google Drive, Salesforce, and Zapier. This allows you to automate workflows and easily manage the m8453 form alongside your existing systems. This flexibility enhances productivity and collaboration.

-

What features does airSlate SignNow offer specifically for the m8453 form?

Key features of airSlate SignNow for the m8453 form include customizable templates, secure cloud storage, and advanced tracking options. These features ensure that all parties can easily access, sign, and manage the document securely. Additionally, audit trails provide peace of mind by documenting every action.

-

Is it safe to use airSlate SignNow for signing the m8453 form?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and compliance with legal standards, to protect your data. When signing the m8453 form, users can trust that their sensitive information is kept secure throughout the process.

-

How long does it take to process the m8453 form with airSlate SignNow?

Processing the m8453 form with airSlate SignNow is quick and efficient, often taking just minutes to complete. Once the document is prepared, it can be eSigned and sent to the IRS almost instantly, dramatically speeding up what traditionally was a lengthy paper-based process.

Get more for 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12

- Wa odometer 497429179 form

- Promissory note in connection with sale of vehicle or automobile washington form

- Bill of sale for watercraft or boat washington form

- Bill of sale of automobile and odometer statement for as is sale washington form

- Construction contract cost plus or fixed fee washington form

- Painting contract for contractor washington form

- Trim carpenter contract for contractor washington form

- Fencing contract for contractor washington form

Find out other 05% Income from Form 1, Line 10, Or Form 1 NRPY, Line 12

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement