Form MA M 8453 Fill Online, Printable, Fillable 2020

What is the m 8453 form?

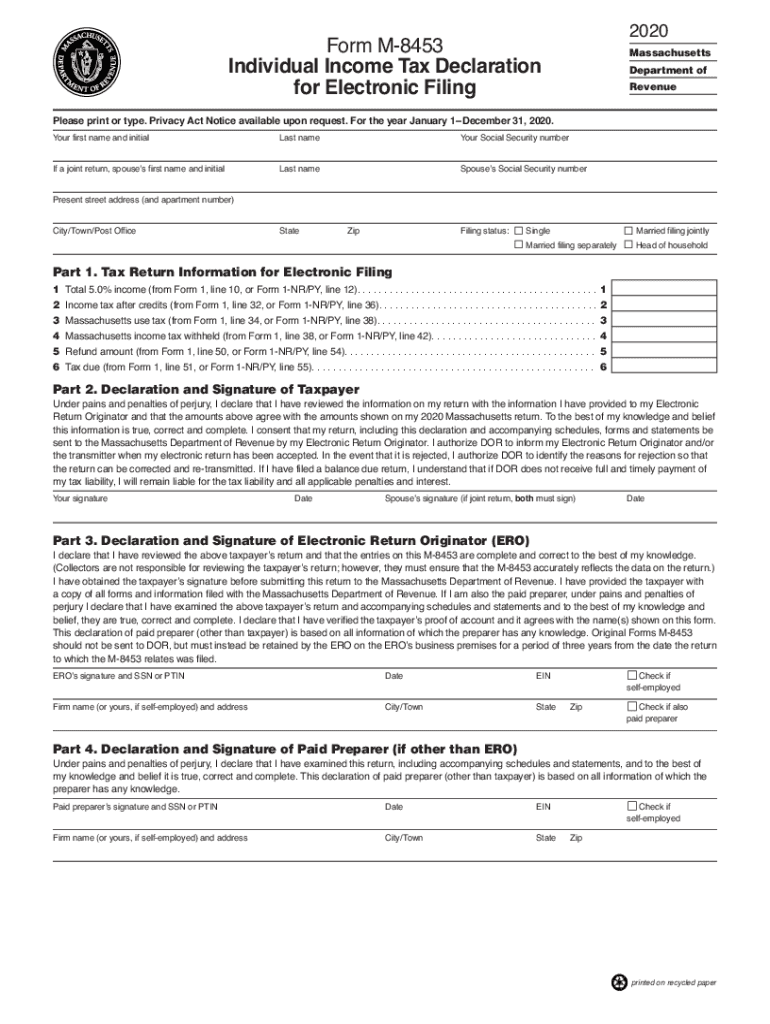

The m 8453 form, also known as the Massachusetts Declaration of Electronic Filing, is a crucial document for individuals who file their tax returns electronically in Massachusetts. This form serves as a declaration that the taxpayer has authorized the electronic submission of their tax return and affirms the accuracy of the information provided. It is essential for ensuring compliance with state regulations regarding electronic filing.

How to complete the m 8453 form online

Completing the m 8453 form online involves several straightforward steps. First, access the form through a reliable electronic filing platform. Fill in your personal information, including your name, address, and Social Security number. Ensure that all details match the information on your tax return. After entering the required data, review the form for accuracy before submitting it electronically. Using an electronic signature feature can enhance the process, ensuring that your submission is legally binding.

Legal use of the m 8453 form

The m 8453 form is legally recognized when filled out and signed according to Massachusetts state laws. It complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures, making the m 8453 form a legitimate document for electronic tax filing. Proper execution of this form guarantees that your electronic submission is accepted by the Massachusetts Department of Revenue.

Key elements of the m 8453 form

Understanding the key elements of the m 8453 form is vital for accurate completion. The form typically includes sections for personal identification, the tax year, and a declaration statement. It also requires the taxpayer's signature, which can be provided electronically. Additionally, the form may request information about the tax preparer, if applicable. Each element must be filled out carefully to avoid delays or issues with your tax filing.

Filing deadlines for the m 8453 form

Filing deadlines for the m 8453 form align with the general tax return deadlines set by the Massachusetts Department of Revenue. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to submit the m 8453 form along with your electronic tax return by this deadline to ensure compliance and avoid penalties.

Form submission methods for the m 8453 form

The m 8453 form can be submitted electronically through approved e-filing platforms. This method is preferred for its efficiency and security. Alternatively, if you choose to file a paper tax return, you may need to print the m 8453 form and submit it by mail. Ensure that you follow the specific instructions provided by the Massachusetts Department of Revenue regarding submission methods to avoid complications.

Quick guide on how to complete 2018 2020 form ma m 8453 fill online printable fillable

Easily Prepare Form MA M 8453 Fill Online, Printable, Fillable on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Form MA M 8453 Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Form MA M 8453 Fill Online, Printable, Fillable with Ease

- Find Form MA M 8453 Fill Online, Printable, Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and has the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow covers all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form MA M 8453 Fill Online, Printable, Fillable and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 2020 form ma m 8453 fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2018 2020 form ma m 8453 fill online printable fillable

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the m 8453 form and why is it important?

The m 8453 form is a crucial document used to verify the identity of taxpayers when filing electronic tax returns. Understanding its significance can help ensure your eTax submissions are processed quickly and accurately.

-

How does airSlate SignNow handle the m 8453 form?

airSlate SignNow offers an efficient platform to send and eSign the m 8453 form securely. Our solution simplifies the process, enabling users to comply with IRS requirements while saving time and minimizing errors.

-

Is there a cost associated with using airSlate SignNow for the m 8453 form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Our cost-effective solution for managing the m 8453 form is designed to enhance productivity without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the m 8453 form?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, allowing you to streamline processes while managing the m 8453 form. These integrations enhance user experience and efficiency signNowly.

-

What security measures does airSlate SignNow implement for the m 8453 form?

Security is our top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to protect your information when working with the m 8453 form, ensuring that your sensitive data remains safe.

-

How does airSlate SignNow improve the efficiency of processing the m 8453 form?

With airSlate SignNow, users can eSign and send the m 8453 form digitally, eliminating the need for physical paperwork. This digital approach enhances efficiency, reduces turnaround time, and simplifies tracking and management of documents.

-

Are there any support resources available for users of the m 8453 form at airSlate SignNow?

Yes, airSlate SignNow offers comprehensive support resources, including tutorials, FAQs, and customer service, specifically tailored for users managing the m 8453 form. Our team is dedicated to ensuring a smooth user experience.

Get more for Form MA M 8453 Fill Online, Printable, Fillable

Find out other Form MA M 8453 Fill Online, Printable, Fillable

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document