HBP Request to Withdraw Funds from an RRSP Canada Ca 2024

What is the HBP Request To Withdraw Funds From An RRSP?

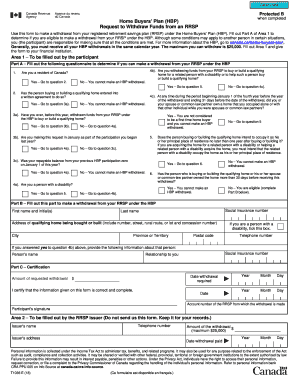

The HBP Request To Withdraw Funds From An RRSP is a formal document used in Canada that allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) under the Home Buyers' Plan (HBP). This program enables first-time homebuyers to access their retirement savings to assist with purchasing a home. The amount withdrawn must be repaid to the RRSP within a specified timeframe to avoid tax implications. Understanding this form is crucial for those looking to utilize their RRSP funds for home buying purposes.

How to Use the HBP Request To Withdraw Funds From An RRSP

Using the HBP Request To Withdraw Funds From An RRSP involves several steps. First, ensure you meet the eligibility criteria for the Home Buyers' Plan. Next, complete the form accurately, providing all required personal and financial information. This includes details about the RRSP account and the amount you wish to withdraw. After completing the form, submit it to your financial institution, which will process the request. It's important to keep a copy of the submitted form for your records.

Steps to Complete the HBP Request To Withdraw Funds From An RRSP

Completing the HBP Request To Withdraw Funds From An RRSP involves the following steps:

- Gather necessary personal identification and RRSP details.

- Fill out the form with accurate information, including the amount you wish to withdraw.

- Review the form for any errors or omissions.

- Submit the completed form to your financial institution for processing.

- Retain a copy of the submitted form for your records.

Key Elements of the HBP Request To Withdraw Funds From An RRSP

Key elements of the HBP Request To Withdraw Funds From An RRSP include:

- Personal Information: Name, address, and Social Security number.

- RRSP Account Details: Account number and financial institution information.

- Withdrawal Amount: The specific amount you wish to withdraw under the HBP.

- Signature: Your signature to authorize the withdrawal.

Eligibility Criteria

To qualify for the HBP Request To Withdraw Funds From An RRSP, individuals must meet specific eligibility criteria. These include being a first-time homebuyer, having a written agreement to buy or build a qualifying home, and intending to occupy the home as your principal residence within one year of the purchase. Additionally, the funds must be repaid to the RRSP within a designated period to avoid tax penalties.

Required Documents

When submitting the HBP Request To Withdraw Funds From An RRSP, certain documents are required. These typically include:

- A completed HBP Request form.

- Proof of eligibility, such as a purchase agreement for the home.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

The HBP Request To Withdraw Funds From An RRSP can be submitted through various methods, depending on the financial institution's policies. Common submission methods include:

- Online Submission: Many institutions allow electronic submission through their secure portals.

- Mail: You can send the completed form via postal service to your financial institution.

- In-Person: Submitting the form directly at a branch may also be an option.

Quick guide on how to complete hbp request to withdraw funds from an rrsp canada ca

Effortlessly Manage HBP Request To Withdraw Funds From An RRSP Canada ca on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle HBP Request To Withdraw Funds From An RRSP Canada ca on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to modify and electronically sign HBP Request To Withdraw Funds From An RRSP Canada ca with ease

- Obtain HBP Request To Withdraw Funds From An RRSP Canada ca and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal weight as a physical signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign HBP Request To Withdraw Funds From An RRSP Canada ca and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hbp request to withdraw funds from an rrsp canada ca

Create this form in 5 minutes!

How to create an eSignature for the hbp request to withdraw funds from an rrsp canada ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HBP Request To Withdraw Funds From An RRSP Canada ca?

The HBP Request To Withdraw Funds From An RRSP Canada ca allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to purchase their first home. This program is designed to help first-time homebuyers access their savings without incurring immediate tax penalties. Understanding this process is crucial for anyone looking to take advantage of the Home Buyers' Plan.

-

How can airSlate SignNow assist with the HBP Request To Withdraw Funds From An RRSP Canada ca?

airSlate SignNow streamlines the process of submitting your HBP Request To Withdraw Funds From An RRSP Canada ca by allowing you to eSign and send documents securely. Our platform ensures that all necessary forms are completed accurately and submitted on time, reducing the risk of delays. This makes it easier for you to access your funds quickly.

-

What are the costs associated with using airSlate SignNow for HBP requests?

Using airSlate SignNow for your HBP Request To Withdraw Funds From An RRSP Canada ca is cost-effective, with various pricing plans to suit different needs. Our plans are designed to provide value while ensuring you have access to all necessary features for document management and eSigning. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for HBP requests?

airSlate SignNow offers a range of features that enhance the HBP Request To Withdraw Funds From An RRSP Canada ca process, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are handled efficiently and securely, making the entire process smoother. Additionally, our user-friendly interface simplifies document management.

-

Are there any benefits to using airSlate SignNow for my HBP request?

Yes, using airSlate SignNow for your HBP Request To Withdraw Funds From An RRSP Canada ca provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to manage your documents digitally, saving time and minimizing errors. Furthermore, the ability to eSign documents remotely means you can complete your request from anywhere.

-

Can I integrate airSlate SignNow with other tools for my HBP request?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can enhance your HBP Request To Withdraw Funds From An RRSP Canada ca experience. Whether you need to connect with CRM systems or other document management tools, our integrations ensure a seamless workflow. This flexibility allows you to tailor the process to your specific needs.

-

Is airSlate SignNow secure for handling my HBP request documents?

Yes, airSlate SignNow prioritizes security for all documents, including those related to your HBP Request To Withdraw Funds From An RRSP Canada ca. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure throughout the entire process.

Get more for HBP Request To Withdraw Funds From An RRSP Canada ca

- Doh 5064 form

- I partnership or llc nyc form

- F 00107 form

- Wisconsin dmv official government site motor vehicle form

- Renewal application of body damage estimator license form

- How to complete the application form university of notre dame

- Www springgardentwp org wp content uploadsnotice to bidders residential garbage and recycling form

- Requestforusmfmservicesformsept10 med unc

Find out other HBP Request To Withdraw Funds From An RRSP Canada ca

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form