Montana Form Clt 4s Instructions 2018

Understanding the Montana Form CIT Instructions

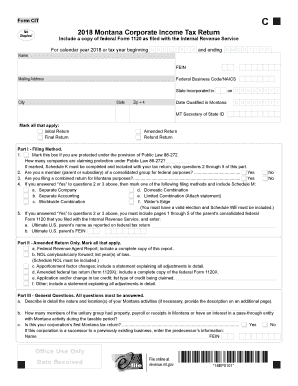

The Montana Form CIT, or Corporate Income Tax Form, is essential for corporations operating within the state. This form is used to report income, calculate tax liability, and ensure compliance with state tax laws. Understanding the instructions associated with the form is crucial for accurate reporting and avoiding potential penalties. The instructions detail how to fill out the form correctly, including sections on income reporting, deductions, and credits applicable to Montana corporations. Familiarity with these guidelines can help streamline the filing process and ensure that all necessary information is included.

Steps to Complete the Montana Form CIT Instructions

Completing the Montana Form CIT involves several key steps. First, gather all relevant financial documents, including income statements and expense reports. Next, carefully read through the instructions provided with the form to understand each section's requirements. Fill out the form systematically, ensuring that all figures are accurate and correspond to the supporting documentation. After completing the form, review it for any errors or omissions before submission. Finally, sign and date the form, as required, to validate your submission.

Legal Use of the Montana Form CIT Instructions

The Montana Form CIT instructions are legally binding and must be adhered to when filing your corporate taxes. These instructions are designed to ensure compliance with Montana tax laws and IRS regulations. Failure to follow these guidelines can result in penalties, including fines or interest on unpaid taxes. It is important to stay updated on any changes to the form or instructions, as state tax laws can evolve. By using the form as intended and following the provided instructions, corporations can maintain good standing with the state tax authority.

Filing Deadlines for the Montana Form CIT

Filing deadlines for the Montana Form CIT are critical for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form is due by April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations should also be aware of any extensions available for filing, which may require additional forms to be submitted.

Form Submission Methods for the Montana Form CIT

Corporations have several options for submitting the Montana Form CIT. The form can be filed electronically through the Montana Department of Revenue's online portal, which is often the fastest method. Alternatively, corporations can mail a paper copy of the completed form to the appropriate address provided in the instructions. In-person submission is also an option at designated tax offices. Each method has its own processing times, so it is advisable to choose the one that best fits the corporation's needs.

Required Documents for the Montana Form CIT

When preparing to file the Montana Form CIT, certain documents are required to support the information reported on the form. These typically include financial statements, such as profit and loss statements, balance sheets, and any relevant tax documents from the previous year. Additionally, corporations should have documentation for any deductions or credits claimed, as well as records of estimated tax payments made throughout the year. Having these documents organized and readily available can facilitate a smoother filing process.

Quick guide on how to complete montana clt 4 instructions 2014 2018 2019 form

Your assistance manual on how to prepare your Montana Form Clt 4s Instructions

If you’re looking to understand how to generate and dispatch your Montana Form Clt 4s Instructions, here are a few concise guidelines to simplify tax filing.

Initially, you just need to establish your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an extremely intuitive and potent document solution that enables you to modify, draft, and finalize your income tax papers effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and return to edit details as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to finalize your Montana Form Clt 4s Instructions in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Montana Form Clt 4s Instructions in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-binding electronic signature (if applicable).

- Examine your document and fix any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes using airSlate SignNow. Keep in mind that filing by paper can lead to return discrepancies and postpone refunds. It’s important to check the IRS website for submission guidelines specific to your state prior to e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct montana clt 4 instructions 2014 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the montana clt 4 instructions 2014 2018 2019 form

How to make an eSignature for your Montana Clt 4 Instructions 2014 2018 2019 Form in the online mode

How to make an eSignature for the Montana Clt 4 Instructions 2014 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the Montana Clt 4 Instructions 2014 2018 2019 Form in Gmail

How to make an eSignature for the Montana Clt 4 Instructions 2014 2018 2019 Form straight from your mobile device

How to create an eSignature for the Montana Clt 4 Instructions 2014 2018 2019 Form on iOS devices

How to make an electronic signature for the Montana Clt 4 Instructions 2014 2018 2019 Form on Android OS

People also ask

-

What is the 2018 Montana Form CIT and who needs it?

The 2018 Montana Form CIT is used for corporate income tax reporting in Montana. Businesses operating in Montana need to complete this form to report their unitary and non-unitary income to the state. It's essential for compliance with state tax regulations.

-

How can airSlate SignNow help me with the 2018 Montana Form CIT?

airSlate SignNow streamlines the process of completing and submitting the 2018 Montana Form CIT by allowing users to electronically fill out, sign, and send the form securely. This simplifies tax reporting and reduces the risk of errors during submission.

-

What features does airSlate SignNow offer for signing the 2018 Montana Form CIT?

With airSlate SignNow, you can easily eSign the 2018 Montana Form CIT with just a few clicks. The platform offers customizable templates and a user-friendly interface, allowing for seamless completion and security features to protect sensitive information.

-

Are there any costs associated with using airSlate SignNow for the 2018 Montana Form CIT?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for occasional users and teams. Costs are competitive and are designed to provide excellent value for businesses needing to manage the 2018 Montana Form CIT and other documents.

-

Can I integrate airSlate SignNow with other systems for handling the 2018 Montana Form CIT?

Yes, airSlate SignNow supports integrations with various third-party applications, streamlining document workflows for the 2018 Montana Form CIT and other related documents. This ensures that you can efficiently manage your tax forms alongside your existing software solutions.

-

How secure is airSlate SignNow for handling the 2018 Montana Form CIT?

airSlate SignNow prioritizes security, ensuring that all documents, including the 2018 Montana Form CIT, are protected through encryption and secure storage. Compliance with industry standards provides peace of mind for businesses handling sensitive tax information.

-

What are the benefits of using airSlate SignNow for my 2018 Montana Form CIT submissions?

Using airSlate SignNow for your 2018 Montana Form CIT submissions can save time and reduce paperwork. The easy-to-use platform increases efficiency, decreases error rates, and ensures your forms are submitted on time without hassle.

Get more for Montana Form Clt 4s Instructions

- Summer camp permission slip template 100559049 form

- Colour past tense form

- Vat1615a form

- Ing proof of death claimant statement form

- C 420 petition template any place doc form

- Www pdffiller com461638717 ancillary providerfillable online ancillary provider id request form blue cross

- Eltamd order form 8 5w 88 1033 12 19 hr

- Grazing lease agreements grazing lease is made and form

Find out other Montana Form Clt 4s Instructions

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF